Dow opens 250 points up as US-China trade talks buoy stocks

US stocks edged higher on Monday, with the Dow Jones Industrial Average gaining 250 points in early trading as Wall Street cheered a potential US-China trade deal.

- Dow Jones gained more than 250 points as stocks opened higher.

- US-China trade deal anticipation is driving optimism across Wall Street.

- This week will also welcome earnings results from some Big Tech giants.

As risk-on sentiment creeped back into the markets, the Dow Jones Industrial Average signalled fresh gains with +200 points. Meanwhile, the S&P 500 jumped 0.8% and Nasdaq Composite added 1.4%.

Dow gains 250 points: Why are US stocks up today?

Sentiment across Wall Street is bullish, continuing a trend that has persisted since the summer. In the months that followed a dip in April, stocks marched to new record high after new record high. Last week, Wall Street saw the major US gauges tap new all-time highs after the release of the US consumer price index inflation.

Currently, the upbeat mood is down to what investors see as a notably big week for markets.

Interest rates

The Federal Reserve is expected to cut its interest rate this October, with the Fed’s decision set to come at the end of its FOMC meeting on Oct. 29. The CPI report helped cement bets on a cut.

Dow up on US-China trade deal progress

Ahead of this, a sense of bullish maneuvering has taken over after US and Chinese officials announced a framework for a trade deal.

US Treasury Secretary Scott Bessent revealed this on Sunday, Oct. 26, and an uptick across stocks in reaction saw Asian markets bounce. Cryptocurrencies also gained.

Presidents Donald Trump and Xi Jinping meeting on Thursday is an event likely to command significant upside momentum for stocks. On Monday, Trump said he expects a deal when the two world leaders meet.

Big Tech earnings

US stocks have recently swung higher amid key quarterly earnings reports, and this week has the “Magnificent Seven”lined up.

Alphabet (GOOG), Microsoft (MSFT), and Meta (META) will report on Wednesday, while Apple (AAPL) and Amazon (AMZN) release theirs on Thursday.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Genius Terminal Hits Record $650M Single-Day Volume as EVM Chains Drive Surge

SUI Weathers Extended Shutdown with Minimal Price Impact

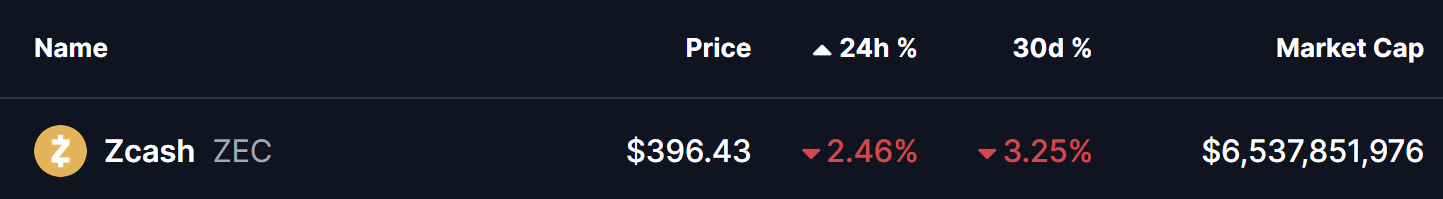

Is Zcash (ZEC) In Bears Control? This Emerging Bearish Pattern Formation Suggest So!