Privacy, Reimagined

Imagine trying to run a major investment fund from an office made of glass. Every client, every balance, and every single move is visible to the entire world, in real-time. Would you do it? Would you show your most sensitive strategies to your competitors?

This is the reality of public blockchains today: while a public ledger excels at auditing, its "transparency problem" renders it unsuitable for practical, real-world applications over sensitive data.

But what is the alternative? Total secrecy? A hidden system that aids illicit activity and alarms regulators? For years, the industry has been stuck between these two unworkable alternatives. How do you build a digital world that is both private and trustworthy?

Secrecy vs. Transparency

For years, the conversation around onchain privacy has been a constant conflict.

On one side, some groups demand absolute anonymity, often seen as a tool for secrecy. On the other hand, regulators and institutions demand compliance, requiring transparency to prevent illegal activity. This clash created a "compliance-fear", where privacy is seen as an enemy of regulation.

This conflict led to flawed, old-world solutions. The most common example is the "mandated backdoor": a special key for regulators to access private data. History has repeatedly shown that backdoors are a severe security risk as they can be misused, abused, and exploited, ultimately destroying trust in the system.

This old narrative is a dead end. It forces a choice between two poor options: a fully anonymous system that institutions will never use, or a compromised, centralized system that defeats the purpose (and ethos) of Web3.

In the real world, interactions are neither 100% public nor 100% secret. They are "selectively private". You have a right to privacy, but an auditor can still verify your accounts, and a court can still request records. At Horizen, we are building the onchain equivalent : an ecosystem where users, applications, and institutions can protect their sensitive data by default, while retaining the ability to prove their integrity to an auditor or regulator without making the data public.

Privacy with Auditability: The New Balance of Power

Instead of insecure backdoors, Horizen fosters an ecosystem based on auditable privacy. This means revealing just enough information to satisfy regulatory requirements without compromising overall privacy. For example, an onchain action could prove it is compliant with a set of rules (like AML/KYC for finance, or verifying your identity credentials for a service) without ever revealing the underlying data to the public.

As conversations around data privacy evolve, selective disclosure sounds like a breakthrough—privacy with accountability.

It sounds ideal, but it raises a critical question: selected by whom?

If a single company or person controls the "declassification" keys, we haven’t advanced at all; we’ve simply rebranded centralization.

Horizen’s goal is different. It aims to create a decentralized, fair, and user-centric ecosystem where no single entity holds power, users have full transparency and consent, and accountability is shared across all participants. The technology is designed to adapt to future needs while keeping sensitive data protected at its core.

What Next?

The path to better onchain privacy has many challenges, but also many opportunities. Horizen is redefining privacy, aiming to create a system that respects privacy while enabling real-world compliance: the old conflict between privacy and compliance is over.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

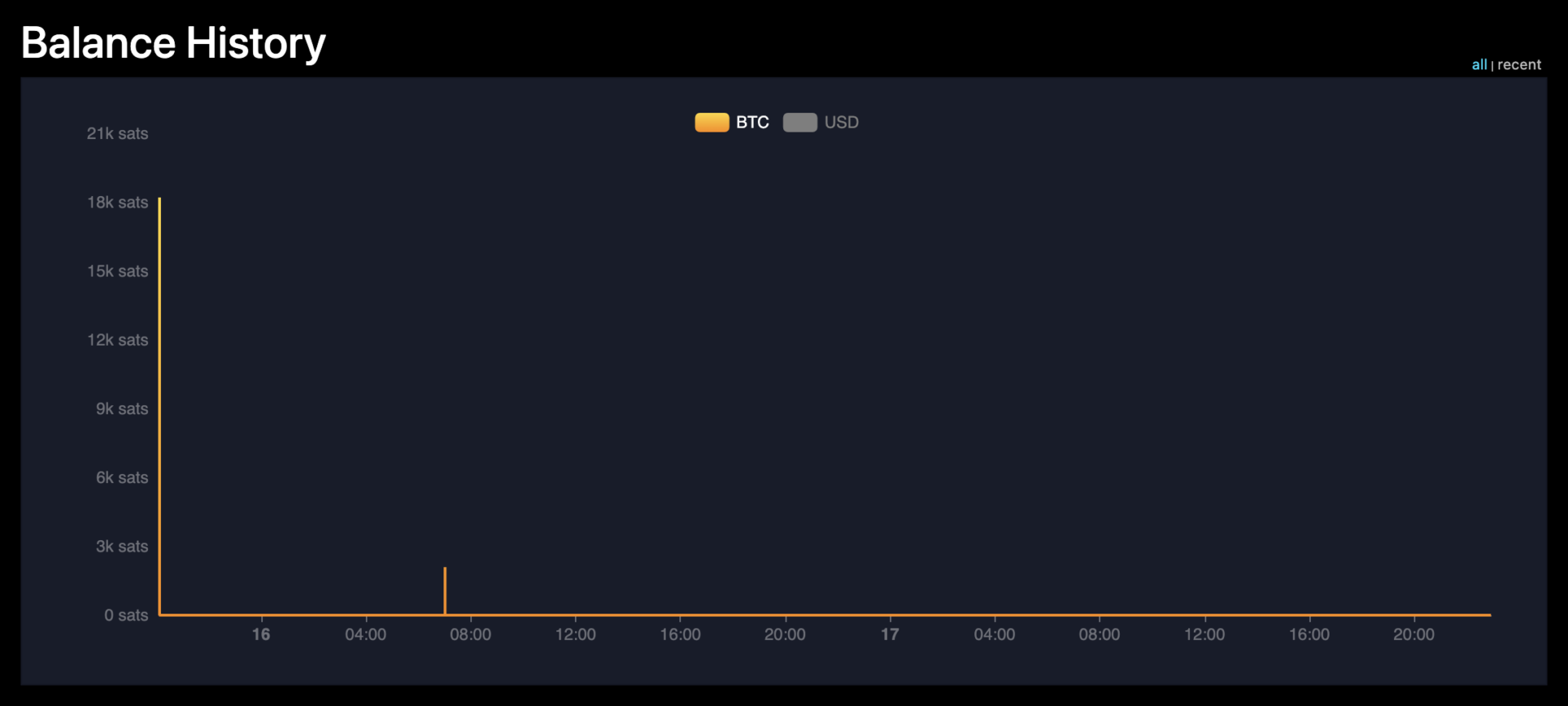

Bitcoin bots drain compromised wallet in RBF fee war

Cardano Rockets 10,654% in Derivatives Market Volume, Hidden Price Signal?