Date: Wed, Oct 29, 2025 | 08:20 AM GMT

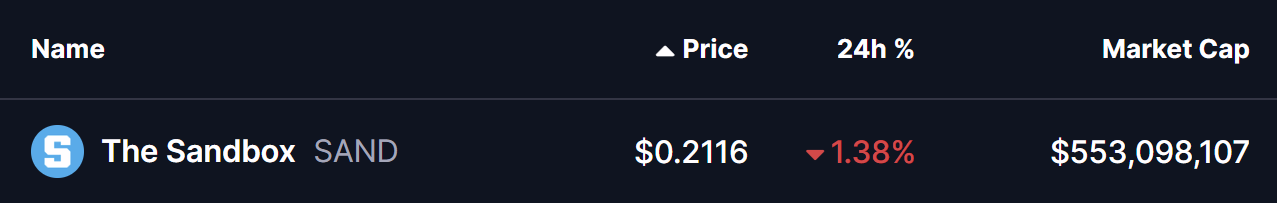

The broader cryptocurrency market is showing a cautious tone head of today’s the Federal Reserve’s policy meeting, where a potential interest rate cut remains a key focus. Both Bitcoin (BTC) and Ethereum (ETH) are slightly in the red, extending mild weakness across major altcoins — including The Sandbox (SAND).

While SAND is seeing a modest dip today, the latest chart formation suggests that the token might be preparing for a larger directional move, provided it continues to hold its crucial support level.

Source: Coinmarketcap

Source: Coinmarketcap

Holds Symmetrical Triangle Support

On the 4-hour chart, SAND has been consolidating within a symmetrical triangle pattern — a neutral yet often powerful technical setup that typically precedes a volatility breakout.

After facing an 8% rejection from the triangle’s upper resistance zone, SAND pulled back to retest its ascending support trendline near $0.2057. Buyers once again stepped in around this level, defending the structure and helping price rebound to about $0.2112, showing early resilience.

The Sandbox (SAND) 4H Chart/Coinsprobe (Source: Tradingview)

The Sandbox (SAND) 4H Chart/Coinsprobe (Source: Tradingview)

This ascending support trendline has consistently acted as a dynamic demand zone since the October 10 crash, cushioning each pullback and reinforcing the base of the current pattern.

What’s Next for SAND?

If bulls can defend the ascending support trendline, SAND may soon attempt a retest of the triangle’s upper boundary near $0.2180. A decisive breakout and retest above this resistance zone could open the door for a trend expansion, with an upside target near $0.2653 — a level that aligns with the measured move projection from the triangle formation and previous swing highs.

Conversely, if price fails to sustain above support, SAND could experience renewed selling pressure, potentially sliding toward the lower triangle boundary before any renewed breakout attempt.

For now, the technical structure remains intact, suggesting that the next few sessions could be pivotal in determining whether SAND breaks upward or remains trapped in consolidation mode.