Government Seizes and Sells Man’s $900,000 Home Over Unpaid Water Bill He Didn’t Even Know About: Report

A Brooklyn homeowner has lost his $900,000 property after New York City sold it over an unpaid $5,000 water bill.

The home was foreclosed, auctioned off and sold to investors without 65 year-old Filmore Brown’s knowledge, reports ABC 7 New York.

The 2019 bill, worth less than 1% of the home’s value, was sold to a trust. It vanished from city statements, and Brown received no notices.

The city says foreclosure papers were served in 2020, but Brown denies receiving them. He says he learned of the sale when strangers drilled his locks at night.

Brown’s attorney Alice Nicholson is now suing the city, alleging improper warnings.

Meanwhile, the Department of Finance claims reforms have already provided more outreach and payment options.

Brown paid off the mortgage for the three-unit home in 2019 by working seven days a week. He lives on the top floor and rents the lower two.

Councilmember Chris Banks calls the sale a “grave injustice” and has proposed legislation to enhance notifications and bar water bill sales to trusts. State bills on the issue failed last year.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

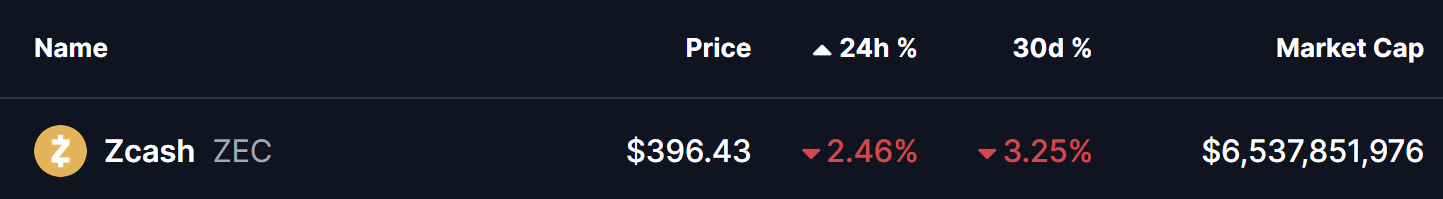

Is Zcash (ZEC) In Bears Control? This Emerging Bearish Pattern Formation Suggest So!

South Korea to negotiate with the US for favourable chip tariff terms, official says

Weekly Highlights Propel Cryptocurrency Trends