FUTURE Holdings Raises CHF 28 Million to Cement Switzerland’s Role in Institutional Bitcoin Finance

Quick Breakdown

- FUTURE secures CHF 28M from Fulgur Ventures, Nakamoto, and TOBAM.

- The firm builds institutional Bitcoin treasury and infrastructure platforms.

- Switzerland is positioned as Europe’s hub for Bitcoin finance innovation.

Switzerland-based Bitcoin treasury platform FUTURE Holdings AG has raised CHF 28 million in a strategic funding round led by Fulgur Ventures, Nakamoto, and TOBAM, reinforcing the country’s position as a hub for institutional Bitcoin finance.

Switzerland enters the Bitcoin treasury era.

FUTURE secures CHF 28 M (~$35 M) to bridge Bitcoin with legacy finance – powered by @FulgurVentures , @nakamoto , and TOBAM.

Led by CEO Sebastien Hess @sebastien_hess1 , Chairman Richard Byworth @richardbyworth .

Supported by… pic.twitter.com/MgarycTI0v

— Future (@future_hodlings) November 5, 2025

The raise marks one of the largest treasury-focused Bitcoin funding rounds in Europe this year, with participation from leading investors bridging traditional finance and crypto. FUTURE aims to serve as Europe’s premier Bitcoin Treasury Company, connecting global capital markets with Bitcoin through transparent governance and disciplined financial management.

Institutional gateway for Bitcoin finance

Founded by a team of veterans from finance and crypto, FUTURE’s leadership includes Chairman Richard Byworth (Syz Capital), CEO Sebastien Hess, and co-founders Marc Syz, Julian Liniger (Relai), and Adam Back, the inventor of Hashcash and CEO of Blockstream. The company plans to expand its institutional platform, offering services that integrate treasury operations, custody, and infrastructure for corporate and financial clients seeking exposure to Bitcoin.

According to CEO Sebastien Hess, the funding round validates FUTURE’s vision to “build Europe’s premier Bitcoin treasury company — a trusted institutional gateway connecting Bitcoin with global capital.” Chairman Richard Byworth added that Switzerland’s favourable financial environment and stable regulatory framework make it an ideal base for institutional Bitcoin innovation.

Building a balance-sheet-driven Bitcoin platform

FUTURE’s business model is centred on a Bitcoin-denominated balance sheet that underpins all operations. The firm will provide treasury management, research and analytics, and advisory services tailored to institutional investors. Additionally, FUTURE will host the Future Bitcoin Forum 2026 in Switzerland to advance collaboration and education in institutional Bitcoin adoption.

The funding underscores growing confidence in Switzerland’s role as a bridge between traditional finance and digital assets , positioning FUTURE to become a leading player in Bitcoin-based corporate treasury solutions.

This significant raise by FUTURE comes as institutional adoption accelerates, evidenced by a parallel development where Jiuzi Holdings, Inc. announced a $1 billion Bitcoin treasury initiative in partnership with the SOLV Foundation, marking a landmark moment in the convergence of traditional finance ( TradFi ) and DeFi.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump Is Prevailing in the Battle Over Offshore Wind Even After Court Defeats

With a $100M War Chest, Experts Think ZKP Could Eclipse Solana & Sui – A True 5000x Growth Opportunity!

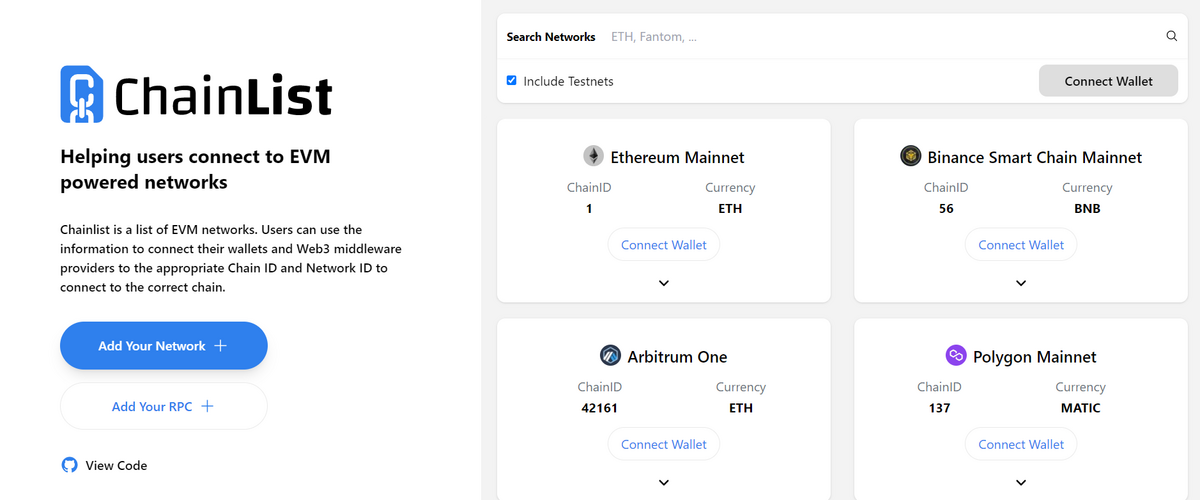

Testnets in Crypto: How To Use Test Networks to Earn Cryptocurrency

Bureaucracy Halts US National Bitcoin Stockpile Initiative