3 Altcoins To Watch This Weekend | November 8 – 9

As Bitcoin wavers near $100,000, altcoins like ICP, MOVE, and AXS are drawing investor focus this weekend, with network upgrades and token unlocks poised to drive volatility.

The coming weekend is crucial for the crypto market as the fear of Bitcoin’s price falling below $100,000 is intensifying. This makes altcoins dependent not on broader market cues but on their own network developments.

BeInCrypto has analysed three such altcoins that the investors should watch this weekend.

Internet Computer (ICP)

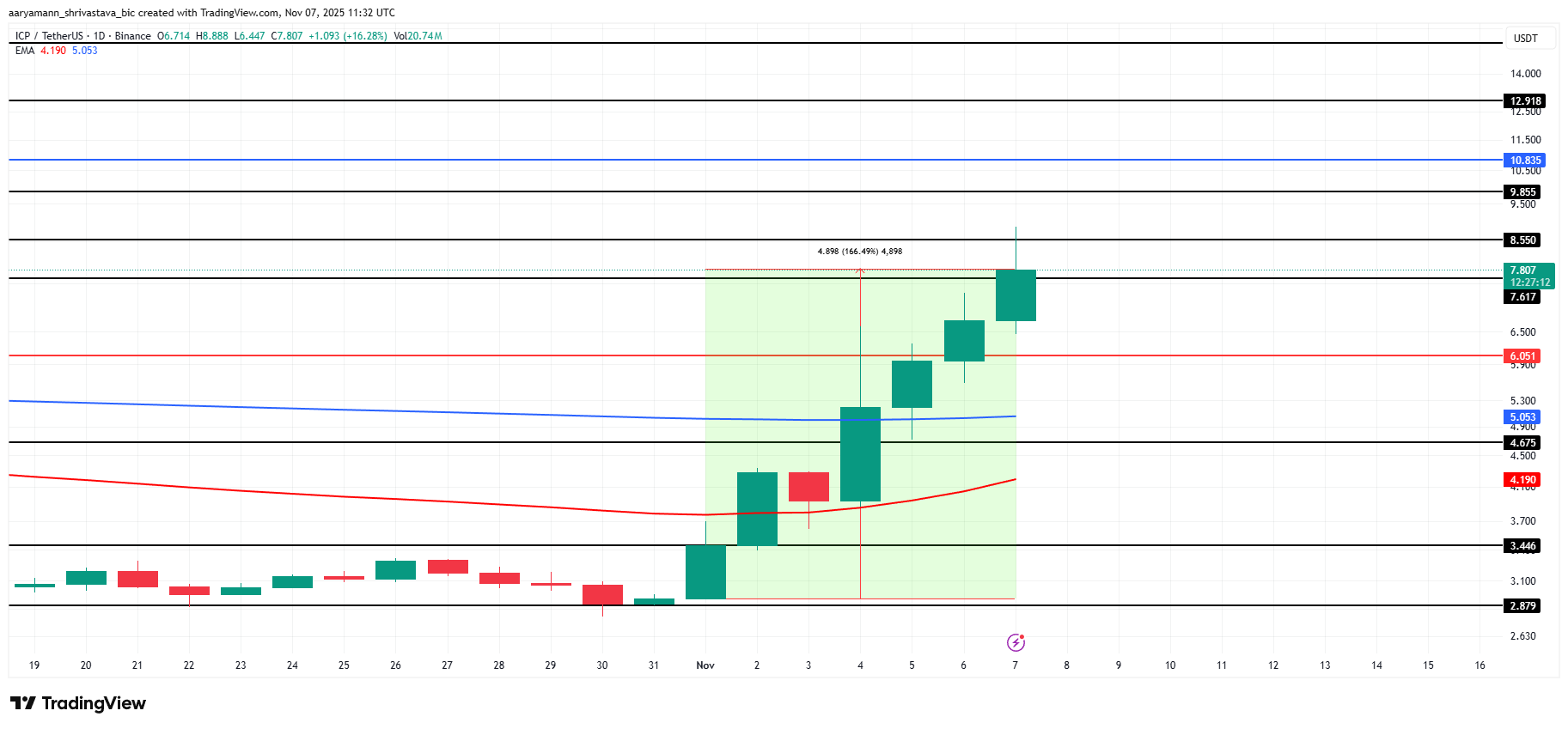

ICP has emerged as one of the top-performing altcoins this week after the launch of Dfinity’s new AI tool, Caffeine. The no-language, AI-powered upgrade doubled the project’s subnet capacity to 2 TiB, enhancing performance for HIPAA-compliant decentralized applications and driving stronger investor interest in the network’s expanding AI ecosystem.

This surge in innovation fueled rapid demand, sending ICP’s price soaring 166% within a week. Currently trading at $7.80, the altcoin has broken past the $7.61 resistance, reaching a 10-month high. If bullish sentiment holds, ICP could rally further toward the $10.83 mark, extending its strong upward trajectory into the weekend.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

ICP Price Analysis. Source:

TradingView

ICP Price Analysis. Source:

TradingView

However, if investors begin taking profits after the steep rally, selling pressure may intensify. This could cause ICP’s price to decline to $6.05 or even lower to $4.67. A fall below these levels would invalidate the bullish outlook and erase much of the recent weekly gains.

Movement (MOVE)

Movement is preparing for a significant token unlock event in the next two days, with 50 million MOVE tokens worth over $2.90 million entering circulation. The sudden increase in supply amid subdued demand could amplify selling pressure.

The altcoin has been in a steady downtrend for the past month, and its strong 0.86 correlation with Bitcoin adds to market uncertainty. If MOVE follows Bitcoin’s bearish trajectory, its price could drop below the $0.0525 support and potentially slip under $0.0461, extending recent losses and weakening investor sentiment.

MOVE Price Analysis. Source:

TradingView

MOVE Price Analysis. Source:

TradingView

However, renewed investor support could help reverse the trend. If buying pressure strengthens, MOVE could break the ongoing downtrend, pushing past the $0.0669 resistance and the $0.0741 barrier. A successful breach of these levels would invalidate the bearish thesis.

Axie Infinity (AXS)

Another one of the altcoins to watch this weekend is AXS, which is preparing for a token unlock similar to MOVE, though on a smaller scale. The upcoming unlock, valued at just $854,780, is unlikely to significantly affect the altcoin’s price. The limited supply inflow reduces the risk of heavy selling pressure, helping maintain short-term price stability.

Despite this, AXS has been stuck in a month-long downtrend that it could soon break. The MACD indicator is nearing a bullish crossover, signaling potential momentum reversal. If market sentiment improves, AXS could rise above the downtrend, surpassing $1.39 resistance and reaching $1.51 or higher in the coming sessions.

AXS Price Analysis. Source:

TradingView

AXS Price Analysis. Source:

TradingView

However, if bearish conditions persist, AXS could face renewed selling pressure. A decline below the $1.18 support may send the altcoin under $1.15, with a possible retest of $1.00. Such a move would invalidate the bullish thesis and extend losses for Axie Infinity investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports