- RESOLV rose 49% to $0.0684, showing strong accumulation and steady bullish momentum.

- MAVIA gained 34.32%, peaking at $0.12 with sustained investor buying interest.

- SHRAP jumped 27.69% to $0.00257, driven by heavy trading and short-term volatility.

The crypto market is showing signs of a healthy rebound as several altcoins surge sharply. Among the biggest gainers in the last 24 hours are RESOLV, MAVIA, and SHRAP. These tokens recorded double-digit gains, signaling renewed investor confidence. Strong buying pressure, short-term volatility, and sustained accumulation have pushed their prices higher, pointing to growing optimism in the broader market recovery.

Resolv (RESOLV)

Source: Trading View

Source: Trading View

At press time, Resolv had experienced a strong rally over the past 24 hours. The price climbed from around $0.044 to $0.066, marking a gain of nearly 49%. The chart revealed an early surge when the token briefly touched $0.07 before pulling back slightly. Despite the fluctuations, the trend stayed upward. Resolv’s trading activity reflected heavy accumulation from investors.

After hitting the day’s peak, the price steadied and moved within a tighter range. Later in the session, bullish pressure returned, driving the token to $0.0684. The steady rise signals consistent buying momentum and positive sentiment from traders. Even with small corrections, Resolv continues to hold a firm upward pattern, suggesting the uptrend may extend if market confidence remains.

Heroes of Mavia (MAVIA)

Source: Trading View

Source: Trading View

Heroes of Mavia also enjoyed a sharp increase in value, jumping 34.32% in a single day. The session began with sideways movement before strong buying activity lifted the price to $0.12. That mid-session surge reflected strong investor interest and confidence in the project’s growth potential. Following the high, the chart showed active trading with minor dips and quick rebounds.

This pattern suggested traders were taking profits while new buyers entered the market. The overall trend stayed bullish as MAVIA maintained a higher trading range compared to earlier levels. The steady buying volume points to continued enthusiasm around the token and strengthens the case for further upside.

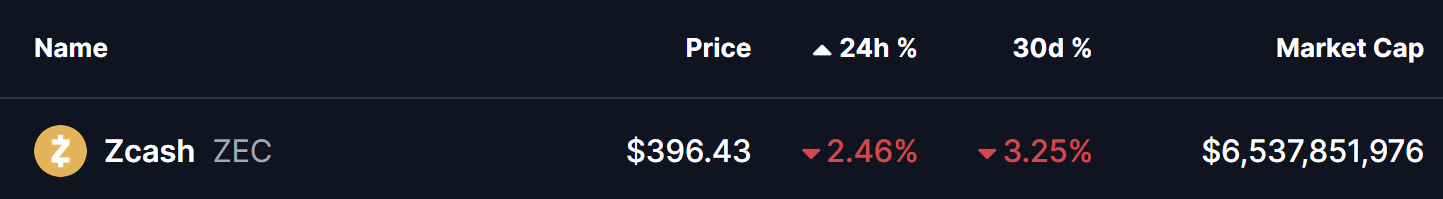

Shrapnel (SHRAP)

Source: Trading View

Source: Trading View

Shrapnel recorded a 27.69% jump, showing one of the day’s most dynamic movements. The token traded steadily at first before entering a volatile phase. Two strong spikes occurred, with the top reaching $0.00257. That move likely came from large-scale buying activity or news-driven momentum.

After touching the peak, the price eased slightly but stayed well above previous levels. A short consolidation period followed, signaling the market’s attempt to stabilize after heavy trading. The current setup indicates that bullish momentum remains strong. Investors appear to be accumulating, expecting more gains as sentiment improves across the crypto space.

RESOLV, MAVIA, AND SHRAP each posted impressive 24-hour gains. Their price action reflects growing market optimism and fresh buying interest. Volatility remains present, but the overall trend leans bullish. As the market recovery continues, these tokens stand out as strong short-term performers in the altcoin space.