Date: Sun, Nov 09, 2025 | 11:42 AM GMT

The cryptocurrency market continues to highlight strong performance among Dino altcoins. Internet Computer (ICP) has already surged more than 200 percent in just one week, and now attention is shifting toward several other tokens showing similar early-stage setups — including Algorand (ALGO).

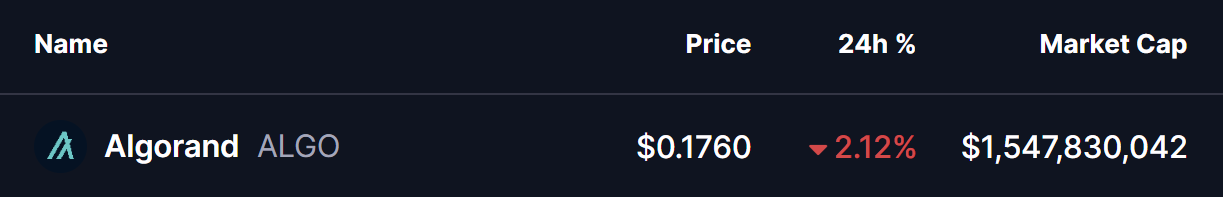

Even though ALGO is trading slightly in the red today, its chart is beginning to flash the same bullish fractal that previously triggered a strong breakout rally.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Hints at a Bullish Breakout

The daily chart of ALGO is showing early signs of a repeated bullish structure built around three core elements: a long accumulation zone, a falling wedge pattern, and the potential reclaim of the 50 and 200 day moving averages.

Earlier this year in July, ALGO corrected inside a falling wedge, where price found strong support near the $0.15 accumulation area. After months of compression, the token broke out of the wedge and reclaimed both the 50 and 200 MAs, setting off an 85 percent rally straight toward the ascending resistance trendline.

Algorand (ALGO) Daily Chart/Coinsprobe (Source: Tradingview)

Algorand (ALGO) Daily Chart/Coinsprobe (Source: Tradingview)

Now ALGO appears to be repeating that same behavior.

Price has once again bounced from the multi-month accumulation zone around $0.15 and is now pressing against the upper boundary of the current wedge near $0.1760, while also trading just below the 50 day MA at $0.1951. The positioning mirrors the earlier breakout setup and suggests that bullish momentum is quietly building beneath the surface.

What’s Next for ALGO?

For this fractal setup to stay valid, ALGO needs to break above the wedge resistance and reclaim both the 50 and 200 day moving averages. If buyers succeed, the next key technical target sits near $0.3752, representing an upside potential of roughly 110 percent from current levels.

Beyond that, the long-term ascending resistance trendline opens the door for even greater expansion later in the cycle, similar to what occurred during the previous fractal.

For now, confirmation is everything. ALGO must reclaim the 50 day MA to signal that the bullish structure is fully active and that a breakout continuation is underway.