BCH Drops 0.26% as Short-Term Price Fluctuations Approach Six-Month Minimums

- Bitcoin Cash (BCH) fell 0.26% in 24 hours but gained 15.58% over one year, showing mixed short- and long-term performance. - Technical indicators suggest consolidation, with a 200-day moving average above price and RSI at neutral 54, signaling no major trend reversal. - Reduced volatility has challenged backtesting models, forcing analysts to recalibrate event thresholds due to lack of extreme price swings since 2022.

As of November 10, 2025, BCH declined by 0.26% over the past day, settling at $502.2. Over the previous week, it gained 2.68%, but lost 6.15% in the last month. Over the past year, however, BCH has increased by 15.58%.

In recent weeks, BCH’s price has shown limited movement, with volatility indicators pointing to a temporary slowdown in speculative trading. The coin has dropped 6.15% in the last month, yet long-term investors remain well-positioned, as the 365-day return stands at a 15.58% increase. This contrast between short-term losses and long-term gains underscores the market’s growing maturity, with those holding for longer periods less impacted by short-term price changes.

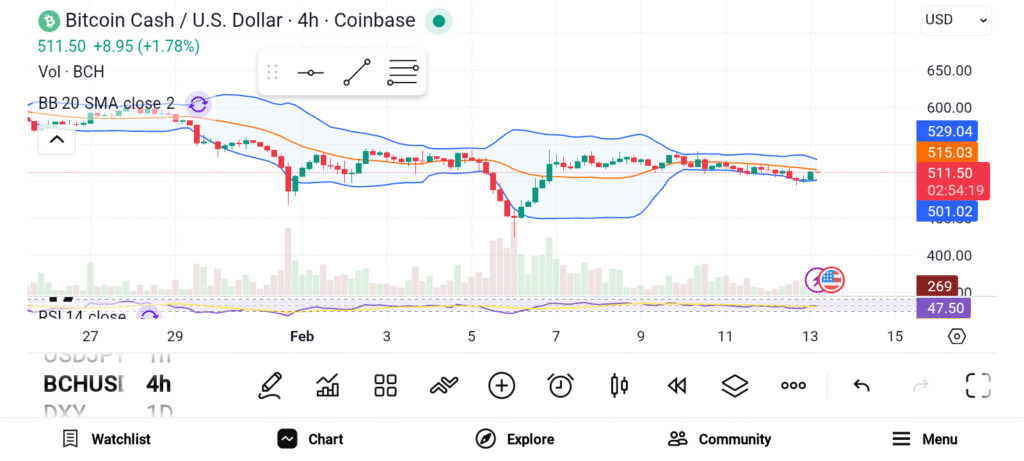

Technical analysis presents a mixed outlook. The 200-day moving average is still above the current price, which supports the ongoing bullish trend. The RSI is at a neutral 54, suggesting neither overbought nor oversold conditions. Meanwhile, the MACD line has leveled off, indicating a pause in momentum. These signals point to a consolidation phase rather than a reversal, as traders appear to be waiting for new developments before taking positions.

With few sharp price movements in recent months, strategy testing has also been affected. Analysts who use historical volatility to model BCH’s behavior have found fewer relevant data points for event-driven backtesting, prompting a need to adjust their frameworks—especially for strategies that rely on significant daily price changes.

Backtest Hypothesis

Recent backtesting has faced challenges due to the lack of major price surges in BCH’s historical data. From January 1, 2022, to November 10, 2025, BCH did not experience a single day with a price jump of 15% or more. This absence of extreme moves caused an internal error in the event-backtest engine, as it requires at least one qualifying event to generate post-event statistics.

This period of relative calm suggests BCH has been more stable than some other cryptocurrencies. For analysts and quantitative researchers, this means they may need to lower the threshold for what counts as a “significant” event—perhaps to 10% or 8%—or use different criteria, such as intraday highs or weekly returns. It also raises questions about the suitability of event-driven models for BCH unless volatility picks up again.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar Flatlines, Solana Sinks, But BlockDAG’s Live TGE and 200× Potential Tell a Different Story

3 Promising Altcoins to Accumulate in 2026 — DOGE, ADA, and BCH

As Soon As Bitcoin Hits $70,000, a Billion-Dollar Chinese Whale Steps In and Makes a Massive Sale – What’s Going On?