Date: Mon, Nov 10, 2025 | 05:20 AM GMT

The cryptocurrency market continues to show strong performance as Ethereum (ETH) climbs more than 7 percent today. This market strength is helping several altcoins push higher, including Pump.fun (PUMP).

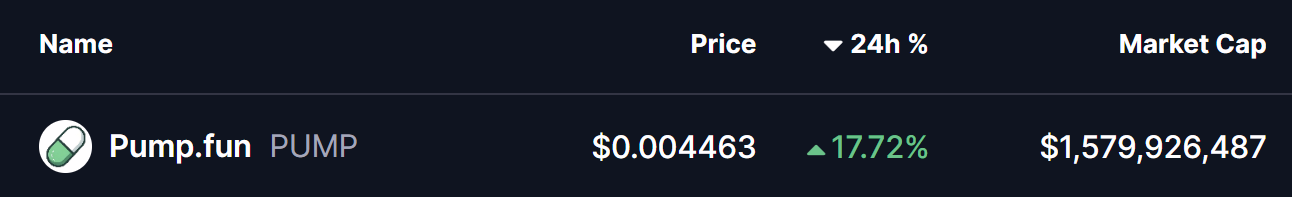

PUMP has jumped by an impressive 17 percent in the last 24 hours, and more importantly, its technical structure is beginning to show signs of a potential bullish reversal. The latest chart reveals a pattern that could set the stage for a breakout in the sessions ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Descending Channel in Play

On the daily chart, PUMP remains inside a classic descending channel, moving between two parallel downward-sloping trendlines. This structure has guided the token through a steady corrective phase for several weeks.

During the recent decline, PUMP retested the lower boundary of the channel near $0.0032. This level has repeatedly acted as a strong support area, and once again, buyers stepped in aggressively. The resulting bounce has pushed the token back to around $0.00448, bringing it close to the upper boundary of the channel.

PUMP Daily Chart/Coinsprobe (Source: Tradingview)

PUMP Daily Chart/Coinsprobe (Source: Tradingview)

This tightening price action at the top end of the structure suggests that momentum is building and pressure is increasing for a possible breakout.

What’s Next for PUMP?

If buyers manage to push PUMP above the channel’s upper trendline and reclaim the 50-day moving average at $0.004829, it would confirm a breakout. In that scenario, the next significant technical target sits near $0.01032, which implies roughly a 130 percent upside from current levels.

Failure to break through the upper boundary would likely keep the token consolidating inside the channel a while longer. In that case, the $0.0034 zone remains the key support area to keep an eye on.

For now, PUMP’s structure appears constructive. The descending channel remains intact, buyers are defending support, and a move above the 50-day MA could be the signal needed for a broader bullish continuation.