Date: Mon, Nov 10, 2025 | 04:55 PM GMT

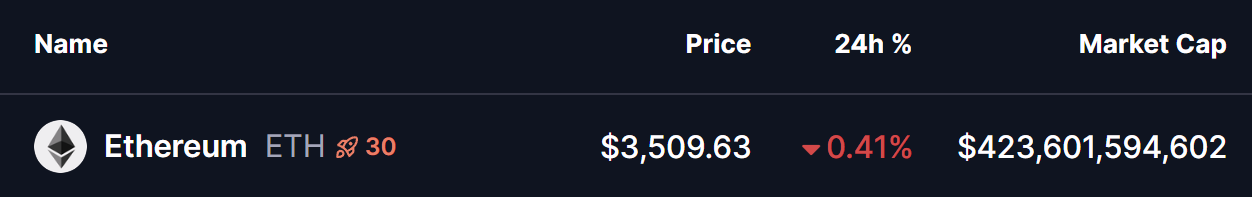

Earlier today, the price of Ethereum (ETH) jumped over 4% following a key breakout. However, it’s now trading in the red as the breakout is being retested, which could determine its next move.

Source: Coinmarketcap

Source: Coinmarketcap

Retesting Descending Broadening Wedge

As shown in the 4H chart, ETH had been consolidating within a descending broadening wedge — a bullish reversal structure that often forms during prolonged downtrends and signals increased volatility before a trend shift.

Earlier today, ETH broke above the wedge’s descending resistance line near $3,550, confirming a technical breakout and pushing the price toward a local high of $3,657. However, strong profit-taking at that level cooled momentum, causing Ethereum to slide back toward its breakout region for a retest.

Ethereum (ETH) 4H Chart/Coinsprobe (Source: Tradingview)

Ethereum (ETH) 4H Chart/Coinsprobe (Source: Tradingview)

ETH is now retesting breakout around $3,507, holding just above the 50 moving average at $3,482. This zone is a major confluence of support and could play a defining role in preserving the bullish structure.

What’s Next for ETH?

If ETH successfully holds above the breakout trendline and maintains support at the 50 MA, the bullish outlook remains intact. A rebound from this level could lead the price back to $3,657, and a move above the 100 MA at $3,723 would strengthen buyer confidence. In that scenario, ETH may head toward the measured move target at $4,750, representing roughly a 35 percent upside from the current price.

If ETH fails to hold this support cluster and closes back below the breakout level, the wedge pattern may be invalidated. That would push the token back into its previous downtrend, delaying any meaningful recovery attempt.

For now, ETH’s retest zone is critical. How the price reacts here will likely shape the market’s direction through the rest of November, making this one of the most important technical moments for Ethereum in recent weeks.