Aerodrome, Velodrome merge to unified Aero network and expand to Ethereum and Circle’s Arc

Dromos Labs, the team behind Aerodrome on Base and Velodrome on Optimism, has announced a new unified exchange called Aero.

- Dromos merges Aerodrome and Velodrome into a single DEX called Aero.

- Unified AERO token replaces AERO and VELO with no new minting or dilution.

- MetaDEX 03 system aims to boost efficiency and expand across Ethereum and Arc.

The platform will bring together both protocols under one system, designed to consolidate liquidity, improve scalability, and expand across multiple Ethereum networks, including Circle’s Arc blockchain.

The announcement was made at Dromos Labs’ “New Horizon” event on Nov. 11, where the team described Aero as a “central liquidity hub” designed to connect every network and power applications through a shared system.

A unified token and new DEX architecture

A key part of the transition involves merging the Aerodrome ( AERO ) and Velodrome ( VELO ) tokens into a single AERO token. No new tokens will be created.

The new token will be distributed to existing holders according to each protocol’s size and revenue share, with VELO holders receiving 5.5% and AERO holders receiving roughly 94.5%. To ensure that holders maintain their stake without any dilution, AERO token will represent a portion of Aero’s overall revenue and growth.

In addition, Dromos is launching MetaDEX 03, a new exchange operating system designed to enhance efficiency and reward structures. AER and REV, the system’s two new engines, will internalize liquidity revenue and lower operating costs. According to the team, the upgrade could raise protocol earnings by 40% while cutting expenses by around $34 million.

The protocol will also feature “Metaswaps” for cross-chain trading, verified pools for compliant institutions, and improved integrations across ethereum-virtual machine networks. Aero hopes to rank among DeFi’s most adaptable and scalable DEX infrastructures with these enhancements.

Expanding across Ethereum and institutional networks

Beyond the merger, Dromos plans to position Aero as the liquidity base layer for the onchain economy. The new hub will integrate with major Ethereum networks and institutional channels through Circle’s Arc blockchain . It will also serve as the foundation for new developer tools and yield programs designed to attract enterprise users and builders.

Aerodrome currently leads all DEXs on Base, earning over $14.7 million in monthly fees and capturing most of the network’s liquidity. Combined with Velodrome, the merged platform controls more than $480 million in total value locked.

Analysts say Aero’s launch could mark a turning point for DEX infrastructure, creating a unified, scalable model capable of supporting $2 billion or more in monthly trading volume across multiple chains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Prepare Your Portfolio: The 3 Most Significant Token Unlocks of January 2026

Trump Is Prevailing in the Battle Over Offshore Wind Even After Court Defeats

With a $100M War Chest, Experts Think ZKP Could Eclipse Solana & Sui – A True 5000x Growth Opportunity!

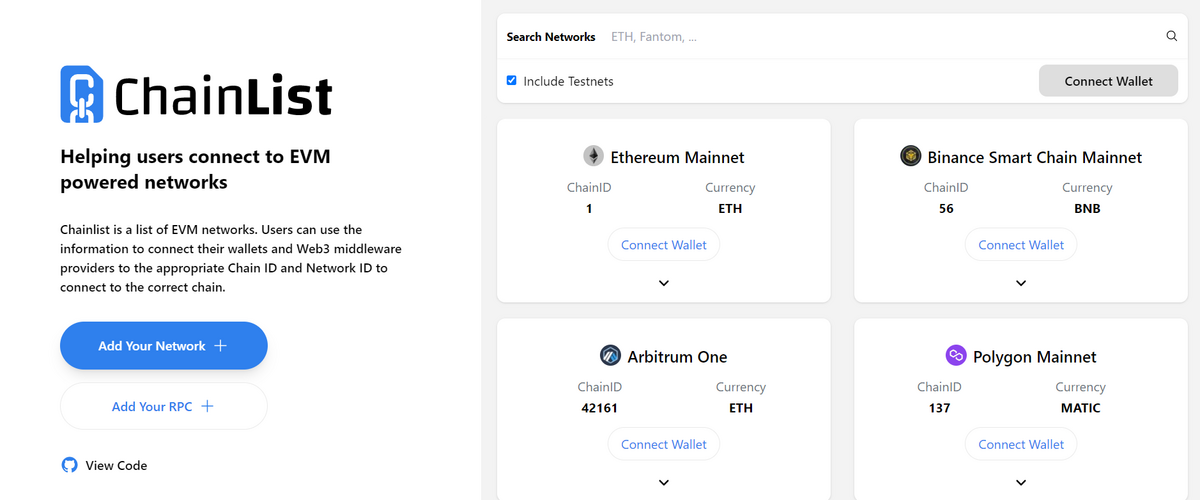

Testnets in Crypto: How To Use Test Networks to Earn Cryptocurrency