Finloop and 1exchange Unite to Build Regulated RWA Tokenization Network for Crypto-Linked Assets

Quick Breakdown

- Finloop partnered with 1exchange to develop a compliant RWA liquidity ecosystem.

- The alliance integrates tokenization technology with regulated secondary market trading.

- The collaboration aims to expand access to tokenized assets across Hong Kong and Singapore.

Finloop Finance Technology Holding Limited has entered a strategic partnership with 1exchange to create a regulated liquidity ecosystem for Real-World Asset (RWA) tokenization — a growing sector bridging traditional finance and blockchain-based digital markets.

The collaboration combines Finloop’s blockchain and tokenization technology with 1exchange’s regulated trading infrastructure to enable compliant issuance, listing, and secondary trading of RWA-backed tokens such as equities, funds, and bonds. The initiative aims to accelerate the integration of tokenized real-world assets into the crypto economy while maintaining institutional-grade compliance and transparency.

💡 Where Tokenization Meets Regulated Liquidity

We’re partnering @FinloopHK to advance the secure, compliant, and efficient #issuance , #listing , and #trading of #RWA (Real-World Asset) security tokens.

By combining our expertise in regulated listings and secondary-market… pic.twitter.com/9Attr4sp6e

— 1exchange (@1Xexchange) November 13, 2025

Expanding institutional access to tokenized assets

Under the partnership, Finloop will use its on-chain protocol and smart contract capabilities to tokenize a diverse range of financial instruments, while 1exchange — licensed by the Monetary Authority of Singapore (MAS) — will provide a regulated venue for listing and trading these assets. Together, the firms aim to simplify the end-to-end lifecycle of RWA issuance and improve liquidity through blockchain settlement.

Finloop CEO Cai Hua said the collaboration

“bridges Hong Kong’s blockchain leadership with Singapore’s compliance framework,ensuring that institutional and retail investors can engage in tokenized asset markets with greater trust and efficiency.”

1exchange CEO Sheena Lim added that the partnership “expands access to compliant tokenized asset trading,” highlighting its role in building an integrated market for RWA-backed tokens across Asia.

Strengthening the RWA-crypto bridge

As the demand for tokenized assets grows, the Finloop–1exchange alliance is positioned to standardize how real-world assets enter the blockchain ecosystem. By embedding compliance, risk management, and smart contract automation, the partnership reinforces the link between traditional financial instruments and crypto-native liquidity pools.

This move strengthens Asia’s position as a global hub for regulated tokenization — where blockchain technology transforms how real-world assets are issued, traded, and settled across decentralized and institutional finance.

As part of its broader expansion, 1exchange also announced a new partnership with Dinari, a U.S.-based provider of tokenized public equities and ETFs, to enhance cross-border trading of regulated tokenized securities.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

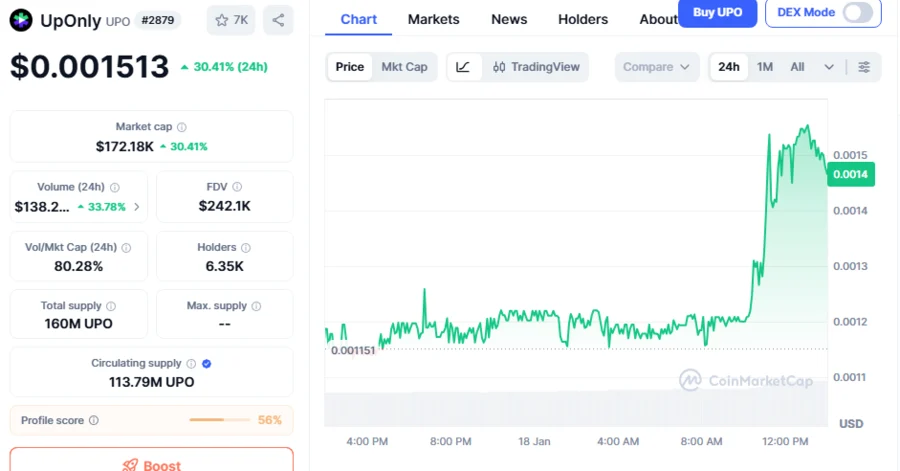

UPO Climbs Above $0.001500, Sets to Explode Amid Incoming Mega Pump, Whale Accumulation: Analyst

Ethereum staking just hit a $118B record at 30% of all coins, but one whale might be skewing the signal

Bullish Analyst Tom Lee Says, ‘Ethereum Will Outperform Bitcoin,’ Explains His Expectations