Bitcoin Latest Updates: Heightened Fear, Conflicting Indicators: Bitcoin's $94,000 Challenge Determines Outcome

- Bitcoin跌破关键支撑位,跌破50周均线,引发市场对深度修正的担忧。 - 短期持有者亏损12.79%,ETF单日流出8.7亿美元,恐惧与贪婪指数跌至15。 - Santiment指出散户抛售进入"投降阶段",链上NUP指标0.476暗示短期底部可能。 - 机构谨慎观望中,矿企盈利与特朗普称"暴跌是买入机会"提供局部乐观信号。 - 市场聚焦94,000美元支撑位,突破将加剧抛压,监管变化或成关键转折点。

Bitcoin traders are raising concerns as the cryptocurrency’s two-year upward trend faces its toughest challenge yet, with major technical signals and sentiment indicators pointing to a possible capitulation phase. The value of

The decline has been worsened by significant pressure on short-term investors, who are now facing losses of 12.79%, and by former support price bands turning into resistance.

Market sentiment has turned deeply negative, with the Fear and Greed Index plunging to 15—a level not seen since February 2025, just before a 25% price correction.

Yet, not every indicator is entirely negative. CryptoQuant’s Bull Score Index has dropped from 80 to 20 since October, but the firm highlights a possible support zone near $94,000, which aligns with the average cost of 6–12-month holders. A rebound from this area could help steady the market, though falling below it could trigger sharper declines

Institutional hesitancy has also contributed to volatility, with Bitcoin’s volatility index (BVIV) breaking above a key trendline, indicating increased price swings.

The outlook remains uncertain. While blockchain data shows long-term holders are accumulating and a potential regulatory shift could follow the U.S. government shutdown, immediate attention is on whether Bitcoin can reclaim the $100,000 mark to prevent further losses.

Currently, the market is in a fragile state. With ongoing outflows from Bitcoin ETFs and the Fear and Greed Index stuck in “extreme fear,” the coming weeks will reveal whether this is just a temporary pause or the start of a more severe bear market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Latest Updates: While Cryptocurrencies Decline, Major Institutions Reinforce Their Commitment to Long-Term Prospects

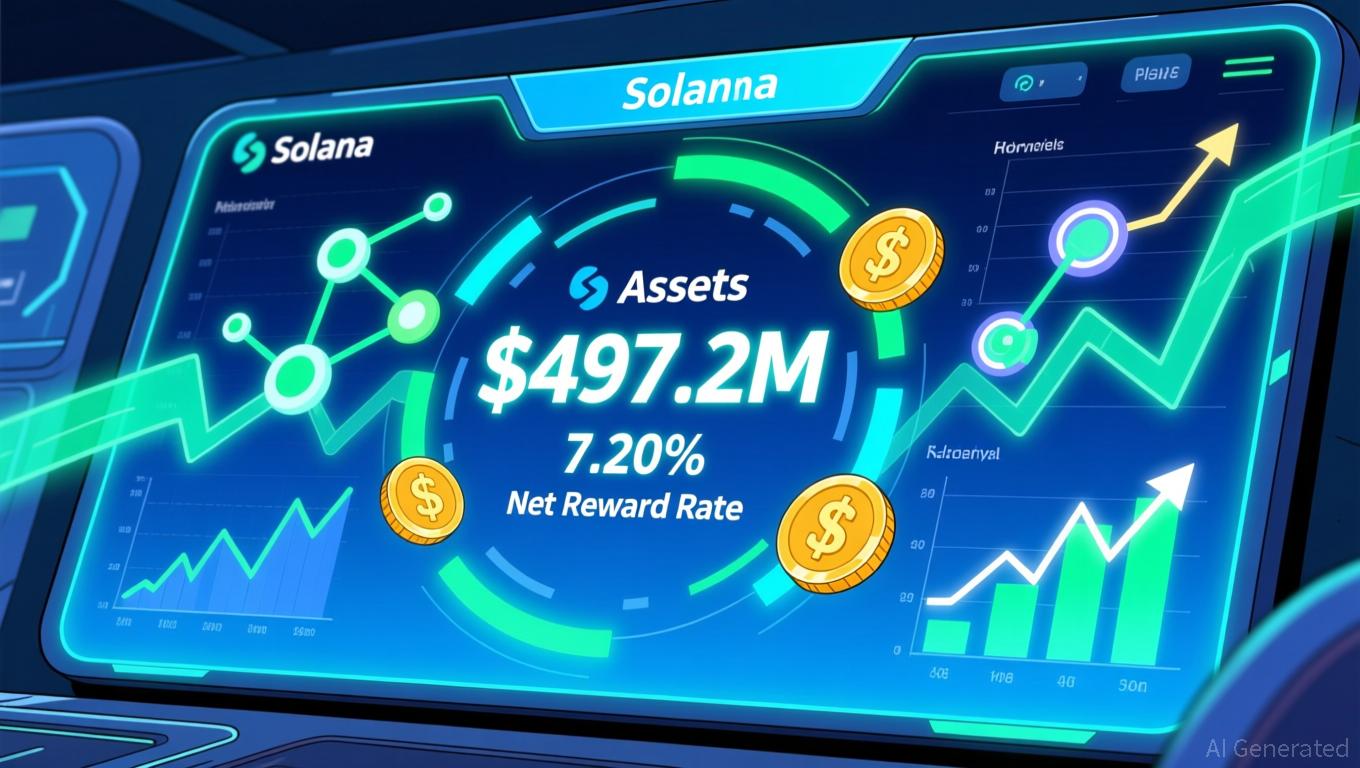

- Bitwise CEO Hunter Horsley asserts crypto's long-term fundamentals remain strong despite recent market selloffs, citing ETF growth and regulatory progress. - Bitwise's $497M Solana Staking ETF (BSOL) dominates 98% of Solana ETF flows, offering 7.20% staking rewards and options trading since November. - U.S. regulators advance crypto-friendly measures including leveraged spot trading plans, while institutions like BlackRock expand digital asset offerings. - Despite Bitcoin's $95k dip and bearish technical

LUNA Rises 9.00% in a Day Following Debut of Namibian High-End Resort and Expansion of Mining Drilling Operations

- LUNA surged 9% in 24 hours but fell 79.24% annually amid mixed technical indicators. - Gondwana Collection Namibia launched the Luna Namib Collection, a luxury desert retreat opening July 2026 with private stargazing and tailored experiences. - NGEx Minerals began Phase 4 drilling at Lunahuasi, targeting 25,000 meters of high-grade copper, gold , and silver deposits with C$175M funding. - The "Luna" name gained cross-sector relevance in tourism and mining, prompting backtesting strategies to analyze pric

COAI's Latest Price Decline: An Overreaction by the Market and a Chance for Undervalued Investment

- COAI Index plunged 88% YTD in Nov 2025 amid AI/crypto AI sector selloff, driven by C3.ai's leadership turmoil, $116.8M losses, and regulatory ambiguity. - C3.ai's Q1 2025 revenue rose 21% to $87.2M, with 84% recurring subscription income, highlighting resilient business fundamentals despite unprofitability. - AI infrastructure stocks like Celestica (CLS) surged 5.78% as analysts raised price targets to $440, contrasting crypto AI's freefall and signaling market overcorrection. - Regulatory clarity on AI/

Aave News Update: MiCA Green Light Spurs Aave’s No-Fee On-Ramp, Accelerating Widespread DeFi Integration

- AAVE token gains bullish momentum as on-chain growth and MiCA regulatory approval align for potential $450 price surge. - Technical indicators like TD Sequential signal strong buy opportunities, with $250 breakout likely to trigger renewed uptrend. - Aave becomes first DeFi protocol authorized under MiCA, enabling zero-fee euro-crypto conversions across EEA via GHO stablecoin. - Protocol's $542M daily volume and $22.8B borrowed assets highlight operational growth outpacing undervalued market price. - MiC