YFI rises 2.21% as short-term price swings persist during an overall market decline

- YFI rose 2.21% in 24 hours amid a prolonged bearish trend, marking a temporary countertrend bounce. - Analysts suggest this rebound may reflect technical rebalancing rather than a long-term reversal, given weak momentum and subdued volume. - Technical indicators show mixed signals, with RSI in neutral territory and MACD indicating minimal bullish momentum. - A backtest hypothesis examines patterns like +15% followed by -10% to assess short-term volatility trends.

As of NOV 17 2025,

The recent 24-hour uptick in YFI represents a brief upward move within an otherwise extended downward trend. This price movement reflects a typical reversal pattern during a generally weak market, with a slight rebound following a prolonged decline. Experts suggest that this short-term rise is likely a technical correction rather than a signal of a lasting trend reversal, and the overall bearish momentum may persist.

Throughout the last week, YFI has continued to experience steady selling pressure, dropping 2.4% in value. This is consistent with its year-to-date loss of 41.72%, highlighting ongoing negative sentiment. However, the 2.21% gain in the last day introduces some short-term unpredictability, as market participants consider whether this could signal a bottom or simply a brief recovery. There have been no major developments specifically related to YFI to explain the price changes, indicating that the movement is likely driven by speculative or algorithmic trading rather than fundamental news.

Technical analysis presents mixed results. The RSI is currently neutral, suggesting the asset is neither overbought nor oversold, while the MACD has made a slight bullish crossover, pointing to limited upward

Backtesting Approach

To assess whether YFI’s trend might continue, one could apply a backtesting method using historical price movements. A useful hypothesis would be to examine the scenario of a “+15% gain in a single day, followed by a –10% drop at any time within the next 7 trading days.” This event-driven approach aims to uncover short-term volatility patterns that could shed light on current market behavior. For instance, if this pattern has historically resulted in a specific average return over a set period, it may help determine whether to anticipate further continuation or a reversal soon.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arthur Hayes Sends 700 ETH to B2C2 After Major Token Dumps

Quick Take Summary is AI generated, newsroom reviewed. Arthur Hayes transferred $700 ETH to B2C2, which is viewed by analysts as preparation for a further token sale or derisking. He has liquidated over $6 million in tokens this week, including $2.4 million ENA and $640,000 LDO. The transfers to market makers like B2C2 and FalconX suggest high-volume trading and a clear intent to derisk or reposition. The community is jokingly noting the aggressive selling, referencing a past "Hayes selling the bottom" pat

Telegram (TON) crypto outlook: can bears keep control?

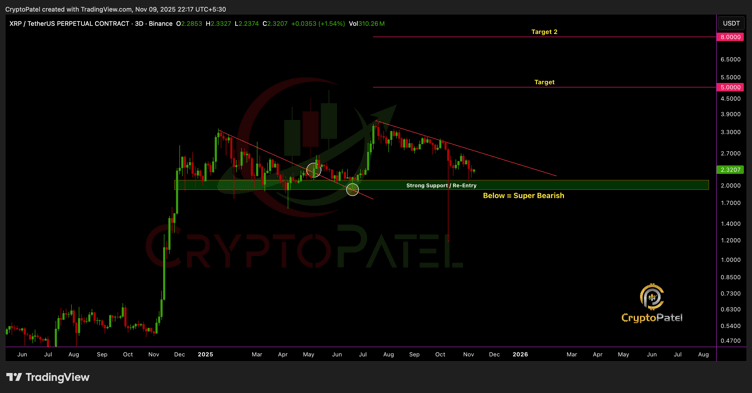

VISA May Integrate with Ripple’s ILP as XRP Holds $1.85–$2 Support

Experts Turn Bullish on XRP as Franklin Templeton ETF Launches on November 18