3 Token Unlocks to Watch in the Third Week of November 2025

More than 78 million tokens from ZRO, SOON, and YZY are set to hit the market this week, creating potential volatility as fresh supply joins a busy November unlock cycle.

Millions of tokens will enter the crypto market this week. Notably, three major ecosystems, LayerZero (ZRO), SOON (SOON), and YZY (YZY) will release previously locked supply.

These unlocks might lead to market volatility and influence price movements in the short term. Here is a breakdown of what to watch for in each project.

1. LayerZero (ZRO)

- Unlock Date: November 20

- Number of Tokens to be Unlocked: 25.71 million ZRO (2.57% of Total Supply)

- Current Circulating Supply: 198.25 million ZRO

- Total Supply: 1 billion ZRO

LayerZero is an interoperability protocol designed to connect different blockchains. Its main goal is to enable seamless cross-chain communication so that decentralized applications (dApps) can interact across multiple blockchains without relying on traditional bridging models.

The team will release 25.71 million tokens on November 20, valued at around $36.76 million. The stack accounts for 7.29% of the released supply.

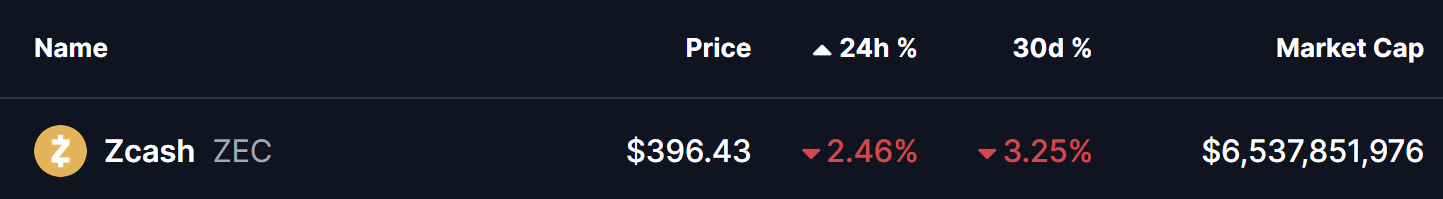

ZRO Crypto Token Unlock in November. Source:

ZRO Crypto Token Unlock in November. Source:

LayerZero will award 13.42 million altcoins to strategic partners. Core contributors will get 10.63 million ZRO. Lastly, 1.67 million ZRO are for tokens repurchased by the team.

2. Soon (SOON)

- Unlock Date: November 23

- Number of Tokens to be Unlocked: 15.21 million SOON (1.54% of Total Supply)

- Current Circulating Supply: 281.1 million SOON

- Total Supply: 984.1 million SOON

SOON is a high-performance Solana Virtual Machine (SVM) Rollup, designed to implement the Super Adoption Stack. It includes three main components: SOON Mainnet, SOON Stack, and InterSOON.

The network will unlock 15.21 million SOON on November 23. The stack represents 4.33% of the released supply and is worth $28.29 million.

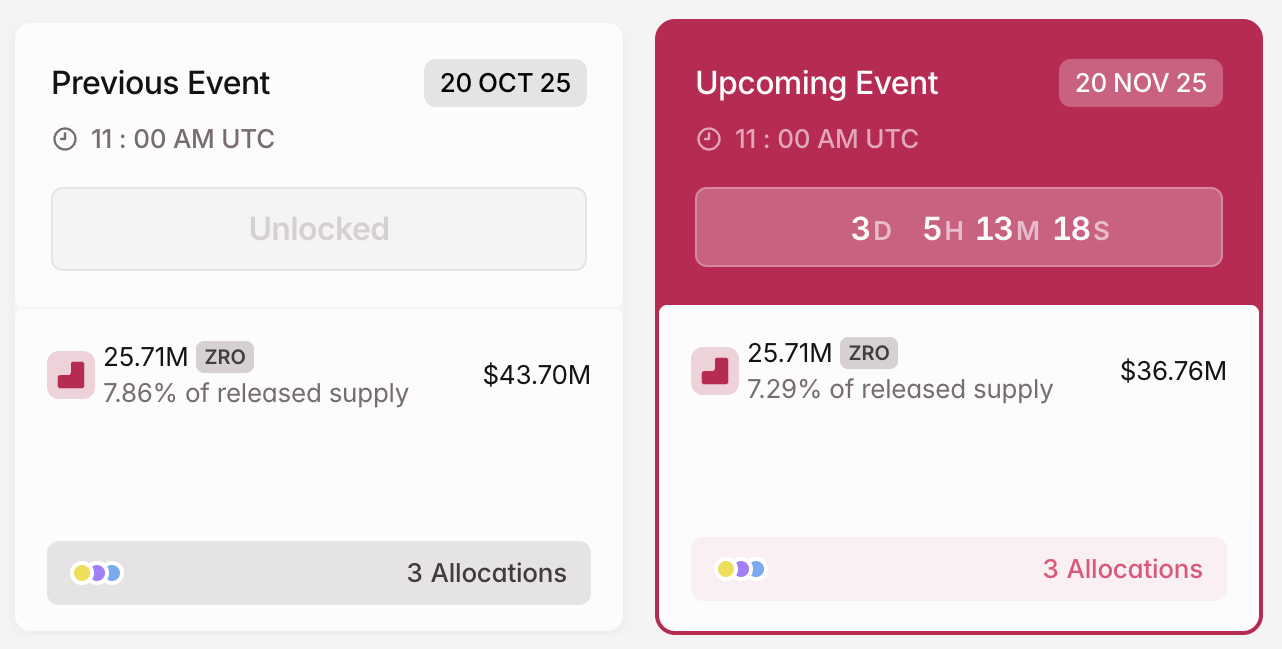

SOON Crypto Token Unlock in November. Source:

SOON Crypto Token Unlock in November. Source:

SOON will keep 8.3 million tokens for an airdrop to non-fungible token (NFT) holders. The team will also award 4.17 million coins to the ecosystem. Furthermore, it will allocate 2.22 million SOON for community incentives and 520,830 tokens for airdrop and liquidity.

3. YZY (YZY)

- Unlock Date: November 19

- Number of Tokens to be Unlocked: 37.5 million YZY (3.75% of Total Supply)

- Current Circulating Supply: 129.99 million YZY

- Total supply: 1 billion YZY

YZY is a cryptocurrency token associated with the rapper Ye (formerly known as Kanye West). It is positioned as part of the broader “YZY MONEY” ecosystem, which includes the YZY token, a payment platform called Ye Pay, and a physical YZY Card.

On November 19, YZY will unlock 37.5 million tokens worth around $14.35 million. The tokens represent 12.5% of the circulating supply.

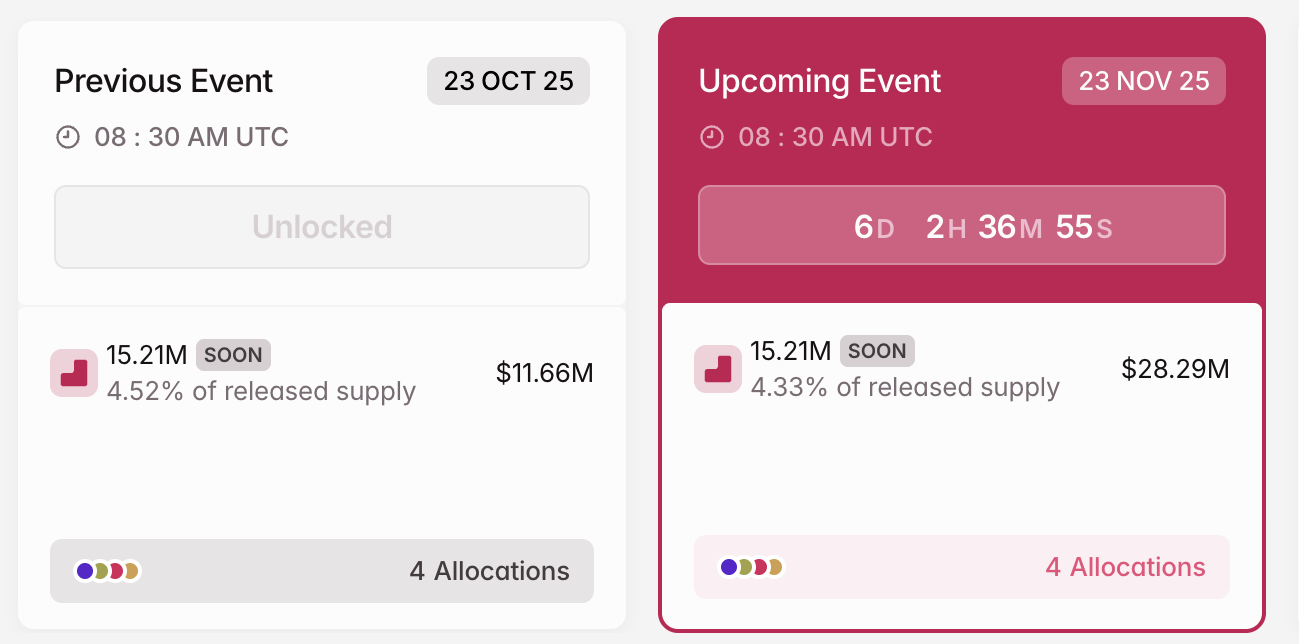

YZY Crypto Token Unlock in November. Source:

YZY Crypto Token Unlock in November. Source:

Furthermore, it marks the project’s first unlock since its token generation (TGE) event in August. Yeezy Investments LLC will receive the entire supply of tokens.

In addition to these, other prominent unlocks that investors can look out for in the third week of November include ZKsync (ZK), KAITO (KAITO), ApeCoin (APE), and more, contributing to the overall market-wide releases.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Genius Terminal Hits Record $650M Single-Day Volume as EVM Chains Drive Surge

SUI Weathers Extended Shutdown with Minimal Price Impact

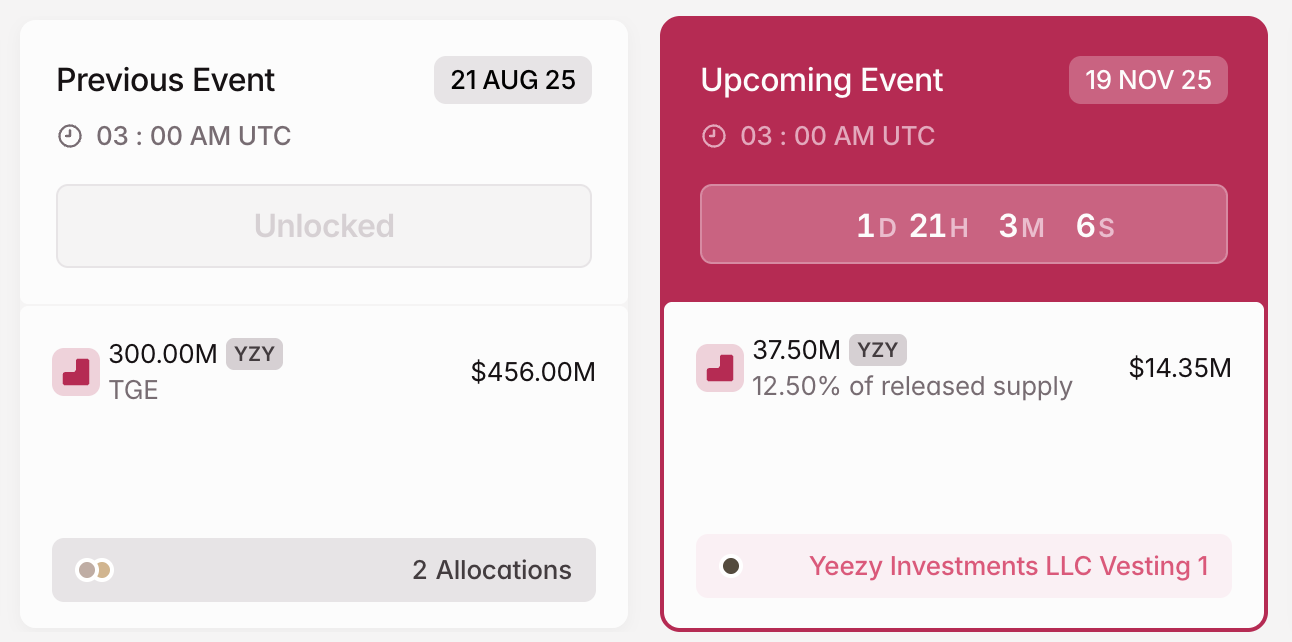

Is Zcash (ZEC) In Bears Control? This Emerging Bearish Pattern Formation Suggest So!