PENGU Price Forecast: A Fresh Upward Driver Appears

- Pudgy Penguins (PENGU) surged to $0.0316 in Q4 2025 with $2B market cap, driven by retail/institutional buying and $560M+ daily volumes. - Technical analysis highlights $0.039–$0.040 as key resistance, with $0.075 as long-term target if momentum accelerates past July's $0.045 peak. - Institutional confidence grows via $9.4M exchange outflows and Pudgy Party game's NFT integration, though USDT reliance and regulatory risks persist. - Strategic entry points at $0.008–$0.009 and $0.013–$0.014 identified, wi

On-Chain Metrics: Sideways Action and Recovery

PENGU experienced a steep pullback in Q3 2025 after surging 450% in late April and early May. The token reached a high of $0.045 in July before entering a consolidation period, with price movements testing crucial support at $0.013–$0.014 and $0.008–$0.009

Fundamental factors are also at play. PENGU has a capped supply of 88.88 billion tokens, with 70% already circulating. The August 2025 launch of the "Pudgy Party" mobile game has boosted real-world use cases, combining NFT and token features in an accessible way—a development expected to encourage broader adoption

Institutional Activity: Optimism and Caution

Institutional trends in Q4 2025 reveal a blend of confidence and prudence. Outflows totaling $9.4 million and $1.1 million in profit-taking by traders show that both retail and institutional participants are optimistic

Nonetheless, systemic threats remain. The PENGU-USDT pair is exposed to risks from inadequate DeFi collateral management and smart contract flaws

Strategic Entry Points: Weighing Risk and Opportunity

For those looking to enter the market, PENGU’s on-chain signals offer clear reference points. The immediate support at $0.013–$0.014 is a key level for buyers, while the stronger, long-term support at $0.008–$0.009 could present an attractive entry if the price consolidates further

Technically, reclaiming the $0.039–$0.040 range is essential to confirm a bullish outlook. Surpassing $0.045 would indicate a continuation of the July rally, with $0.075 as a potential long-term objective

Risks to Consider

Despite positive indicators, PENGU is still susceptible to wider market risks. The

Conclusion

PENGU’s rally in Q4 2025 is the result of robust on-chain activity, growing institutional trust, and favorable macroeconomic trends. Although challenges persist, the token’s core strengths—especially the Pudgy Party game—position it for sustained growth. Entry levels at $0.008–$0.009 and $0.013–$0.014 present opportunities for investors prepared to weather short-term swings. As the market adapts to regulatory and DeFi developments, PENGU’s ability to hold the $0.039–$0.040 resistance will be crucial in determining if it can revisit its July peak.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crash Reasons: Here is why Cryptos are Crashing

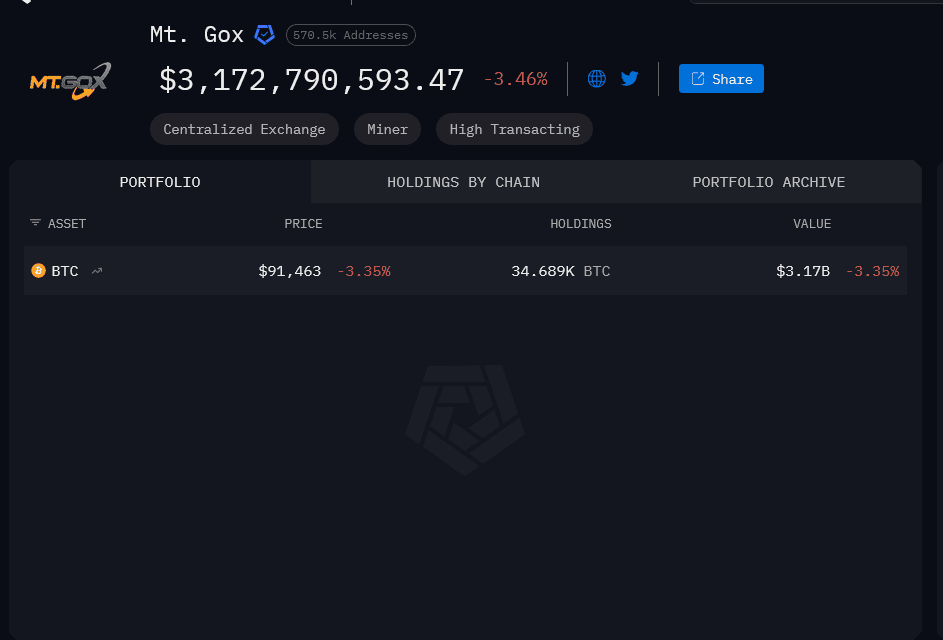

Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

BCH Climbs 5.6% Over 24 Hours as Institutions Adjust Their Portfolios

- BCH surged 5.6% in 24 hours to $514.6 amid mixed 1-month (-3.14%) and 1-year (19.29%) performance. - Institutional investors reshaped holdings: Itau Unibanco cut 21.3% stake, while Goldman Sachs and Robeco increased positions. - Analysts raised price targets to $33-$35 with "neutral" ratings, though Zacks upgraded to "strong-buy" amid improved long-term outlook. - BCH maintains 1.24% institutional ownership, 12.92 P/E ratio, and stable financial metrics (quick ratio 1.53, debt-to-equity 2.00).