Citigroup Achieves Earnings Growth Despite Obstacles, Analysts Raise Ratings as Regulatory Hurdles Persist

- Citigroup reported Q3 adjusted EPS of $2.24, exceeding estimates, with $22.09B revenue up 9.3% YoY, prompting analyst price target upgrades. - The bank declared a $0.60 quarterly dividend (2.4% yield) and saw institutional ownership growth, including 100%+ stake increases by key firms. - Despite 14.14 P/E ratio and 1.37 beta volatility, Citigroup maintains 7.91% ROE and 8.73% net margin, though faces regulatory scrutiny and macroeconomic risks. - Analysts remain divided: Cowen reiterates "hold" at $110,

Citigroup Inc. (NYSE:C) has moved to strengthen its financial standing in the fourth quarter, combining dividend declarations, robust quarterly results, and heightened activity from institutional investors. The bank posted an adjusted earnings per share (EPS) of $2.24 for Q3, beating the consensus forecast of $1.89, with revenue climbing to $22.09 billion, marking a 9.3% increase from the previous year

The company also announced a quarterly dividend of $0.60 per share, scheduled for payment on November 26 to shareholders on record as of November 3. This equates to an annual dividend of $2.40 and

Citigroup’s stock has demonstrated both stability and caution. Trading at $100.71 as of

The organization’s divisions, such as Treasury and Trade Solutions and Securities Services, continue to underpin its international business, catering to global corporations and financial entities. Citigroup’s return on equity of 7.91% and net margin of 8.73% demonstrate its ability to generate profits efficiently. Nonetheless, the bank must navigate ongoing macroeconomic shifts and regulatory challenges to sustain its growth.

Analysts are split regarding the future of the stock. For instance,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crash Reasons: Here is why Cryptos are Crashing

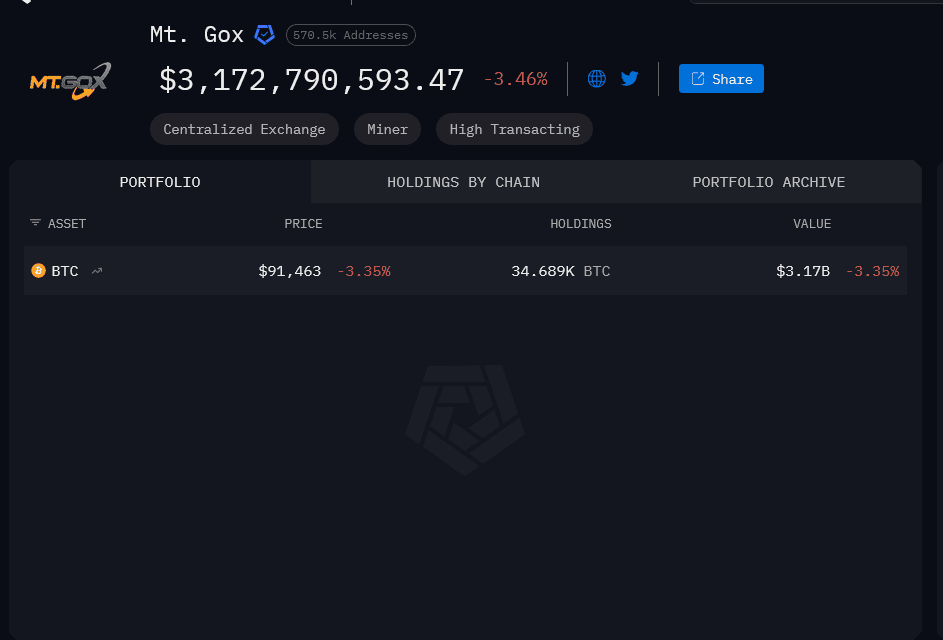

Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

BCH Climbs 5.6% Over 24 Hours as Institutions Adjust Their Portfolios

- BCH surged 5.6% in 24 hours to $514.6 amid mixed 1-month (-3.14%) and 1-year (19.29%) performance. - Institutional investors reshaped holdings: Itau Unibanco cut 21.3% stake, while Goldman Sachs and Robeco increased positions. - Analysts raised price targets to $33-$35 with "neutral" ratings, though Zacks upgraded to "strong-buy" amid improved long-term outlook. - BCH maintains 1.24% institutional ownership, 12.92 P/E ratio, and stable financial metrics (quick ratio 1.53, debt-to-equity 2.00).