Date: Wed, Nov 19, 2025 | 09:25 AM GMT

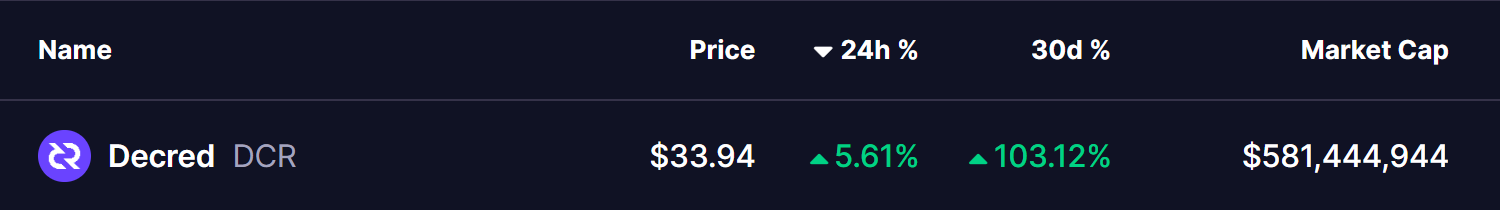

The broader crypto market continues to struggle as Ethereum (ETH) extends its 30-day decline to more than 24%. This weakness has placed pressure on several major altcoins , yet a handful of tokens are still showing strong resilience — and Decred (DCR) is one of them.

DCR has climbed 5% today, extending its monthly surge to over 100%. Now, the chart is signaling a technical setup that could be preparing the token for a much larger move.

Source: Coinmarketcap

Source: Coinmarketcap

Symmetrical Triangle in Play

On the 4-hour chart, DCR is consolidating within a symmetrical triangle, a pattern that typically forms during periods of compression before an explosive breakout. This formation reflects a balance between buyers and sellers, where volatility tightens until price eventually chooses a direction.

The chart shows that DCR recently rebounded from the support base around $31.13, where buyers stepped in after a short pullback. This bounce pushed the token back toward $33.92, placing it just below the triangle’s upper boundary as it squeezes into the apex.

Decred (DCR) 4H Chart/Coinsprobe (Source: Tradingview)

Decred (DCR) 4H Chart/Coinsprobe (Source: Tradingview)

This tightening price structure suggests that a breakout attempt may be nearing.

What’s Next for DCR?

If bulls manage to defend the rising support trendline and push DCR above the triangle’s upper boundary — ideally with a clean breakout followed by a retest — the token could be positioned for a powerful continuation move.

Based on the height of the triangle, the potential measured-move target sits near $60.23, which represents a possible 75% upside from current levels. Given DCR’s strong monthly performance and rising momentum, the bullish case remains on the table as long as the structure holds.

However, if DCR breaks below the lower trendline, this would invalidate the bullish setup in the short term and may lead to a deeper correction. The next sessions will be crucial, as the price is now at a point where volatility typically expands.