Bitcoin ETFs End Five-Day Outswing Streak! Here's the Latest Data

Spot Bitcoin ETFs in the US have returned to net inflow territory after five days of uninterrupted outflows. According to SoSoValue data, the funds recorded a total net inflow of $75.47 million on Wednesday.

Spot Bitcoin ETFs End Five-Day Outstrip

BlackRock's IBIT fund saw the largest inflow with $60.61 million, followed by Grayscale Mini Bitcoin Trust with $53.84 million. This rebound comes on the heels of IBIT's record outflow of $523 million the day before.

In contrast, two major funds reported outflows: Fidelity’s FBTC fund saw $21.35 million and VanEck’s HODL fund saw $17.63 million.

A five-day series of withdrawals between November 12 and 18 saw a total of $2.26 billion withdrawn from ETFs. During this period, the price of Bitcoin plummeted, falling below $90,000 and significantly departing from its previous ATH of $126,000.

Kronos Research CIO Vincent Liu stated that ETF outflows are not “institutional capitulation,” but rather position adjustments. He believes risk appetite will quickly return once the macroeconomic outlook clears.

The biggest factor in this uncertainty is the Fed's interest rate decision at its December meeting. Jerome Powell's statements have weakened market expectations for a rate cut, with the probability of a 25 basis point cut in December falling from 48.9% to 33.8%, according to the FedWatch Tool. The drop in the Crypto Fear & Greed Index to 11 also reflects investors' cautious stance.

Despite all this pressure, Bitcoin rose 0.72% in the last 24 hours, recovering to $92,200. Ethereum ETFs, meanwhile, have been experiencing outflows for seven days, with a total outflow of $37.35 million yesterday.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ray Dalio Says the World Order Has Broken Down: What Does It Mean for Crypto?

The role of AI in crypto: from trading bots to intelligent ecosystems

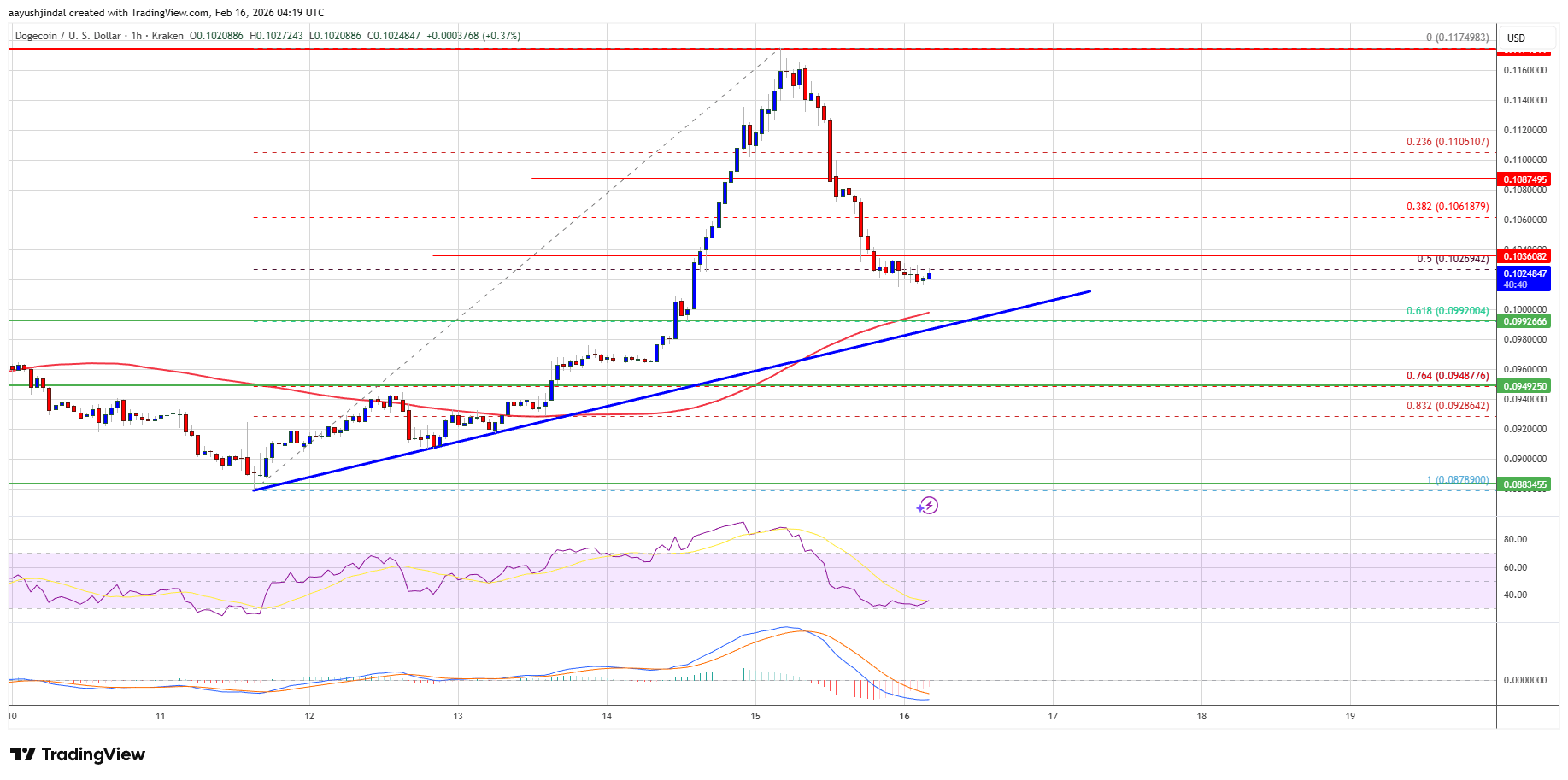

Dogecoin (DOGE) Gives Back Gains, Support Level Under Spotlight

Ray Dalio Says the World Order Has Broken Down: What Does It Mean for Crypto?