Key Market Intelligence on November 20th, how much did you miss?

Featured News

1. Vitalik Warns "Quantum Computing Could Crack Encryption by 2028," Sparking Community Debate

2. NVIDIA Eases AI Bubble Concerns, Continues Pre-market Rally on US Stock Market

3. ZEC Surges Above $700 Briefly, 24-hour Gain Reaches 15.38%

4. ZORA Breaks $0.06 Mark, Registers 18.9% 24-hour Gain

5. Binance Alpha to Conduct Airdrop Today at 20:00, Threshold at 240 Points

Featured Articles

1. "What More Does Bitcoin Need to Rise?"

Last night, NVIDIA presented a splendid report card. In the third quarter, revenue reached $57 billion, a staggering 62% year-on-year increase, while net profit soared 65% to $31.9 billion. This marks NVIDIA's twelfth consecutive quarter of exceeding expectations. Following the financial report release, the stock price surged by 4-6% in after-hours trading, and continued to rise by 5.1% in pre-market trading the next day. This directly added approximately $22 billion in market value to the company and also indirectly boosted Nasdaq futures by 1.5-2%. Logically, with such positive market sentiment, shouldn't Bitcoin, the digital gold, also shine a bit? However, reality gave us a slap in the face—instead of rising, Bitcoin fell, sliding to $91,363, a drop of about 3%.

2. "Afraid to Play DeFi? Check Out These Four Defi Platforms Offering a Safe 10% APY"

The bull and bear markets are hard to distinguish, and no one dares to speculate on cryptocurrencies anymore. Putting money into DeFi for yield farming, unexpectedly, even DeFi platforms have encountered a crisis. Therefore, this time, we will not discuss those projects offering seemingly high returns of tens to hundreds of percentage points, nor do we encourage any fancy strategies. BlockBeats has selected several relatively stable options in the current market, with APY around 10%, that have been validated over time on both on-chain and off-chain transaction platforms. These are among the directions one can choose in the current market. Overall, Binance's BFUSD currently demonstrates a relatively prominent comprehensive advantage, being more robust in terms of yield, mechanism design, use case expansion, and risk structure compared to similar products.

On-chain Data

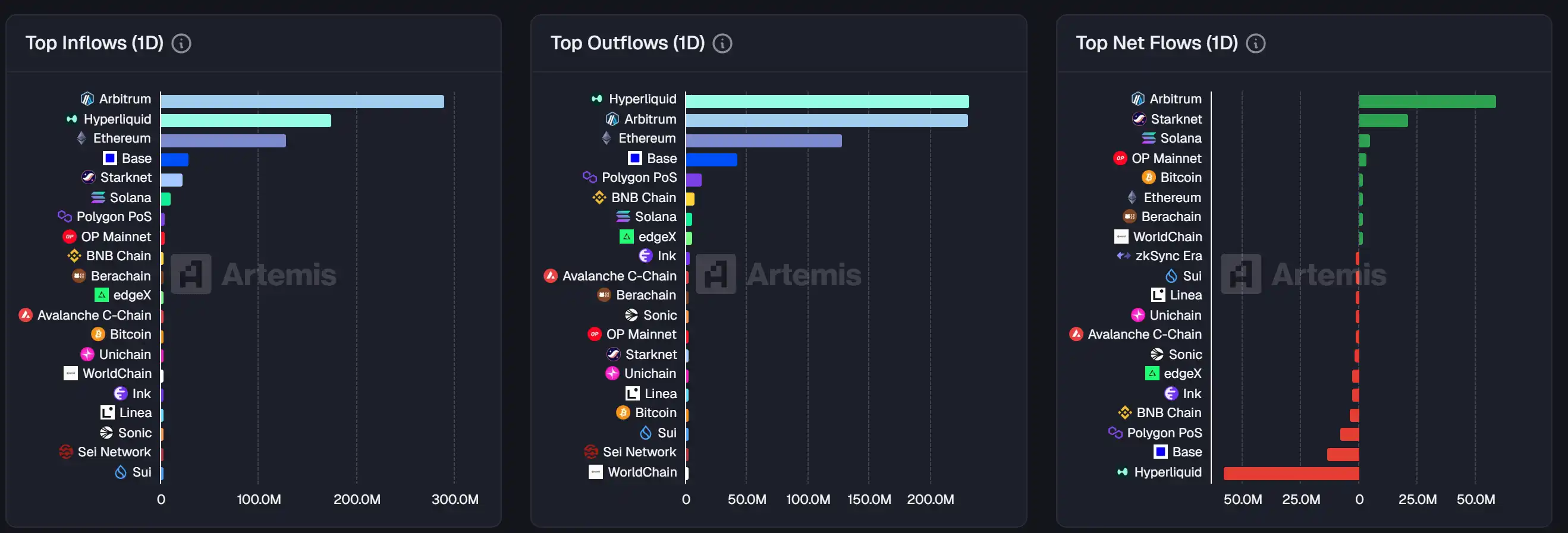

On November 20, last week's on-chain fund flow situation

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AVAX Pushes Toward $18 As Key Resistance Looms: Analyst

Why writing open-source code is suddenly an existential risk, and the five-page bill designed to fix it

Best Crypto to Buy Right Now: $0.001 to $0.05 Is Guaranteed, Why BDAG’s Clean 50x Window Is Closing Fast

Trump claims Dimon did not propose a position at the Fed