Aqua, The First Shared Liquidity and the Next Leap in DeFi: A Conversation with 1inch Co-founder Sergej Kunz

DeFi has spent years optimizing AMM curves, fee models and routing logic, yet one fundamental issue has remained largely untouched: most liquidity in automated market makers does not actually work. The majority of capital deposited into pools sits unused, fragmented across dozens of pairs and protocols. At Devconnect Buenos Aires, 1inch unveiled Aqua, a protocol

DeFi has spent years optimizing AMM curves, fee models and routing logic, yet one fundamental issue has remained largely untouched: most liquidity in automated market makers does not actually work. The majority of capital deposited into pools sits unused, fragmented across dozens of pairs and protocols. At Devconnect Buenos Aires, 1inch unveiled Aqua, a protocol designed to challenge that limitation directly.

Instead of locking assets into separate pools, Aqua enables a single wallet balance to support multiple strategies simultaneously. It introduces a shared-liquidity architecture that could reshape how capital efficiency and yield generation function across the ecosystem. With developers, researchers and protocol builders gathered in Buenos Aires, the timing was deliberate.

In this interview, we speak with Sergej Kunz, co-founder of 1inch, about what Aqua is, how it works, and why it represents one of the most significant shifts in liquidity design since 1inch introduced aggregation in 2019.

Why did you choose Devconnect Buenos Aires as the moment to introduce Aqua?

Sergej Kunz:Devconnect gathers a technical audience that understands what goes into building and securing a protocol. Aqua needs exactly that level of scrutiny. Presenting it here allows us to talk directly to developers, researchers, and security experts who can challenge the model, test it and eventually build on it.The choice makes sense. Aqua isn’t a marketing product ; it’s infrastructure, and Devconnect is one of the few events where infrastructure launches truly land with the right crowd.

For readers who haven’t followed the announcement closely: what is Aqua? And why this approach?

Sergej Kunz: Aqua addresses a core problem in DeFi: around 80 to 90 percent of capital sitting in liquidity pools isn’t actually working. It’s there to support the AMM curve, but it does not actively generate value. With Aqua, users don’t have to lock assets in separate pools. Assets stay in the wallet and can support multiple strategies at the same time. Think of it as a virtual DEX engine running inside your wallet, while remaining fully self-custodial.In other words, Aqua changes the assumption that liquidity must be fragmented across dozens of pools. It lets one balance behave like several without compromising security.

So how does that translate into higher capital efficiency?

Sergej Kunz:With traditional AMMs, if you want to support several trading pairs, you divide your liquidity into multiple buckets. That reduces utilization. With Aqua, the full amount of an asset can work across multiple AIMM strategies in parallel. The result is higher liquidity depth and significantly higher yield. Our backtests show returns increasing five times or more, and shared liquidity can push that effect up to fifteen times compared to legacy AMMs.This is where Aqua becomes more than a conceptual improvement: it directly affects LP earnings.

Who is Aqua intended for at this stage?

Sergej Kunz: Right now, this release is for developers, security experts and researchers. They’re the ones who will probe the protocol. When the production version goes live, it will target liquidity providers who want higher yield with less fragmentation.

What was the reaction like at Devconnect?

Sergej Kunz: The community here is extremely engaged. Many developers visited the booth wanting to understand how one liquidity position can operate across several strategies. Even very technical attendees were surprised this approach hadn’t been implemented before. Their feedback already helped us sharpen how we explain Aqua ahead of my upcoming talk.The engagement shows that shared liquidity is still unfamiliar territory but also that the demand for a more efficient model is clear.

Is there anything comparable to Aqua in today’s market?

Sergej Kunz: No. This is a new architectural model in DeFi. In 2019, 1inch solved fragmentation for takers with aggregation. Aqua solves fragmentation for makers, the liquidity providers. Some projects explored similar ideas, but no one delivered a working shared-liquidity system with such simple integration. Developers can use it with just a few lines of code.

What should the ecosystem expect from 1inch going into 2026?

Sergej Kunz: This year was intense. We introduced Solana support for intent-based swaps, rolled out cross-chain capabilities and rebranded to reflect our shift toward serving not only Web3 but also traditional companies. We believe every future business will rely on Web3 infrastructure the same way every modern business relies on the internet. Aqua’s full production release is planned for the end of this year or early next year, along with an interface and third-party builders already preparing integrations. And yes, there are additional protocols in the pipeline.

What is your key takeaway from Devconnect this year?

Sergej Kunz: Many teams believe they compete with each other, but in reality we build different pieces of the same infrastructure. Several developers approached us concerned that Aqua might disrupt their work. My message to everyone is that we are all partners. If we focus on solving foundational problems, the ecosystem becomes easier to use for traditional industries as well.

Conclusion

Aqua marks a meaningful shift in how DeFi thinks about liquidity design. For years, protocols have competed on curve optimizations, fees and routing mechanisms while quietly accepting that most liquidity sits inactive. By introducing a shared-liquidity architecture that allows one balance to serve multiple strategies, 1inch is pushing the conversation toward a more efficient and more composable future.

The timing is notable. As the industry moves deeper into intent-based execution, cross-chain liquidity and institutional-grade infrastructure, the need for capital to work harder and not just sit untouched becomes increasingly clear. Aqua fits directly into that transition. It gives developers a new primitive to build on and gives liquidity providers a model that aligns yield with actual utilization instead of fragmentation.

Whether Aqua becomes a new standard will depend on how fast the ecosystem adopts it, how builders integrate it and how the production version performs once live. But one thing is certain: introducing a protocol that rewrites the assumptions of AMM liquidity at the end of 2025 sets the tone for a very different 2026. If 1inch delivers on the roadmap Sergej outlines, Aqua could influence not just individual protocols but the underlying architecture of DeFi itself.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Genius Terminal Hits Record $650M Single-Day Volume as EVM Chains Drive Surge

SUI Weathers Extended Shutdown with Minimal Price Impact

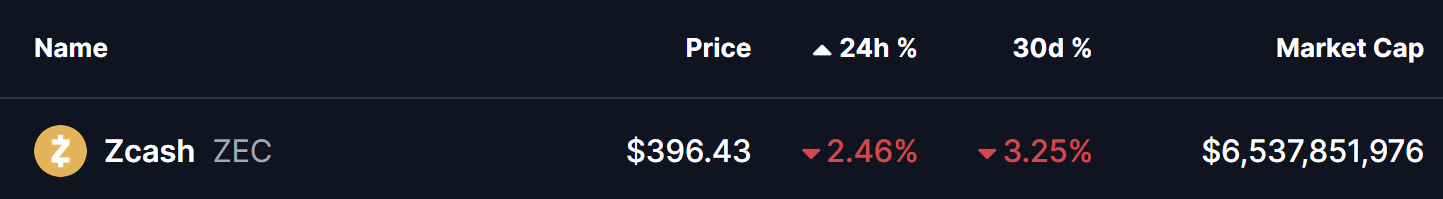

Is Zcash (ZEC) In Bears Control? This Emerging Bearish Pattern Formation Suggest So!