‘Dumb Money’ Surge in Bitcoin ETFs Raises Crash Fears | US Crypto News

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead. Grab a coffee as influential crypto investors sound the alarm on what they describe as a dangerously fragile market, one propped up by short-term arbitrage flows and “dumb money” piling into spot Bitcoin ETFs

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as influential crypto investors sound the alarm on what they describe as a dangerously fragile market, one propped up by short-term arbitrage flows and “dumb money” piling into spot Bitcoin ETFs without understanding the risks.

Crypto News of the Day: Bitcoin ETFs Are Filling With ‘Dumb Money,’ Deeper Crash Ahead?

Alliance DAO co-founder QwQiao reiterated his stark outlook on X (Twitter), that the next crypto bear market will be worse than most people expect. In the original post, he argued that a large wave of inexperienced buyers has entered the market in 2025, creating the conditions for a severe flush.

“…dumb money who know nothing about crypto buying DATs and ETFs,” QwQiao said.

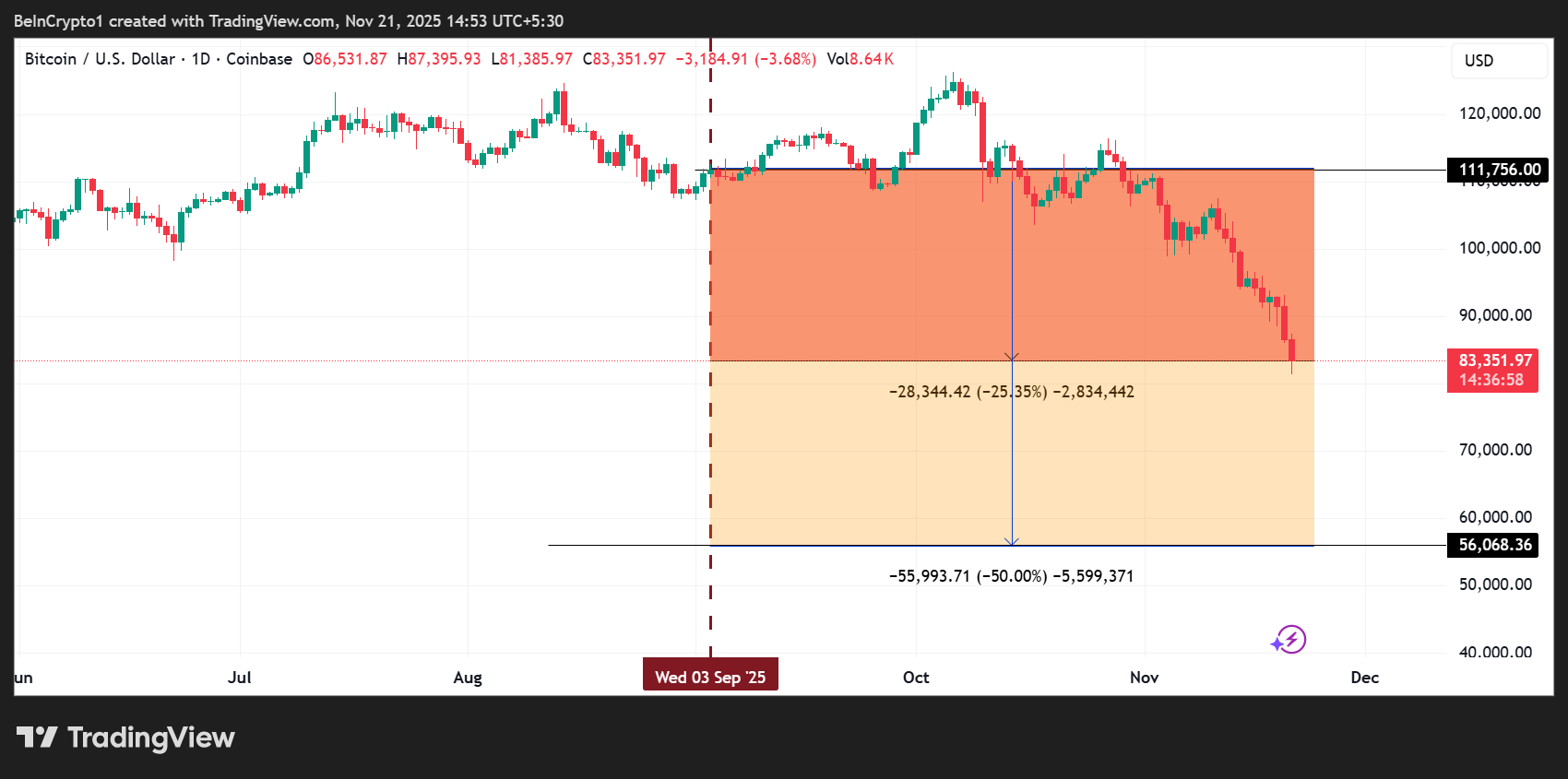

According to QwQiao, the market may require another 50% drawdown as these buyers sell off their holdings quickly, probably at a loss, usually due to panic or pressure.

Only after this happens, the Alliance DAO executive says, can a solid long-term foundation form and the Supercycle resume its course. When QwQiao made these remarks, the Bitcoin price was trading at $111,756.

Trading for $83,712 as of this writing, the pioneer crypto has already shed 25% of QwQiao’s prediction. A full 50% drawdown from $111,756 would see the Bitcoin price go as low as $56,068.

Placeholder’s Chris Burniske echoed the sentiment, warning that the sell-side pressure from DAT (digital asset treasuries) investors is only just beginning.

“The era of DAT selling has only begun. Just as we went up, so too will we go down,” he wrote, suggesting that structural flows, not sentiment, will dictate the next phase of the cycle.

ETF-Driven Illusion Breaking Down

The warnings emerge as analysts increasingly point to the same underlying problem: ETF inflows have been widely misunderstood, as indicated in a recent US Crypto News publication.

Recent reporting highlighted how BitMEX co-founder Arthur Hayes believes most of the flows into BlackRock’s IBIT, still the world’s largest Bitcoin ETF, have been arbitrage trades, not long-term conviction.

Hedge funds have been buying ETF shares while shorting CME futures to capture a basis spread, creating the appearance of bullish institutional demand.

“They are not long Bitcoin,” Hayes said. “They only play in our sandbox for a few extra points over Fed Funds.”

When that basis compresses, institutions unwind the trade, triggering sharp outflows and mechanically pushing the Bitcoin price lower. Hayes argues that with these flows fading, Bitcoin “must fall” to reflect tightening dollar liquidity.

A Market Reset Already Underway

Another recent report showed analysts making similar conclusions, attributing the crash not to tariffs or hacks but to the collapse of the cash-and-carry trade.

As hedge funds unwind these leveraged positions, billions worth of BTC is sold off. Those funds were never invested in Bitcoin’s long-term future. Instead, they were used for yield farming.

The convergence of these factors explains why veteran insiders like QwQiao and Burniske are sounding unusually dire warnings.

Far from a typical correction, they argue the market is entering a cleansing phase where structural leverage, inexperienced capital, and arbitrage distortions must be flushed out.

Chart of the Day

Bitcoin (BTC) Price Performance. Source: TradingView

Bitcoin (BTC) Price Performance. Source: TradingView

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- MicroStrategy faces $9 billion outflow risk as index providers eye Bitcoin holdings.

- Nearly $2 billion wiped out in crypto liquidations amid brutal sell-off.

- Three altcoins to watch if Bitcoin drops under $80,000.

- Pi Coin holds gains in a red market — Another breakout at 6.5%?

- How prediction markets could create crypto’s next billion users.

- Bitcoin looks more bullish than Ethereum as $4 billion options expire today.

- BitMine faces over $4 billion in unrealized losses as the digital asset treasury model faces scrutiny.

- Peter Brandt says Bitcoin could reach $200,000, just not anytime soon.

- XRP price drops below $2 despite recent ETF approval.

Crypto Equities Pre-Market Overview

| Company | At the Close of November 20 | Pre-Market Overview |

| Strategy (MSTR) | $177.13 | $170.20 (-4.03%) |

| Coinbase (COIN) | $238.16 | $234.56 (-1.52%) |

| Galaxy Digital Holdings (GLXY) | $24.03 | $23.12 (-3.79%) |

| MARA Holdings (MARA) | $10.24 | $9.88 (-3.52%) |

| Riot Platforms (RIOT) | $12.78 | $12.34 (-3.44%) |

| Core Scientific (CORZ) | $15.16 | $14.90 (-1.72%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Tether’s Twofold Function: Bringing Stability to Markets and Supporting Crypto Regulation

- Tether executed a $1B USDT transfer to Bitfinex amid Bitcoin's decline near $77,000-$81,900 support levels, signaling market liquidity management. - The transfer coincided with a Thai-US operation seizing $4B in illicit USDT, where Tether aided in tracking transactions and enabling 73 arrests. - Bitcoin's price consolidation at $81,900 long-term mean and ETF outflows ($2.96B in November) highlight fragile investor sentiment amid regulatory shifts. - Tether's 87,556 BTC ($7.62B) reserves and enforcement c

Ethereum Updates: Inflows to Ethereum ETFs Rise While Price Challenges Key $2,100 Support

Ethereum Updates Today: Institutional Withdrawal: November's Crypto ETF Shortage Contrasts with Bullish History

- U.S. Ethereum and Bitcoin spot ETFs saw $500M and $3.728B net outflows in November, led by BlackRock's ETHA and IBIT ETFs. - Analysts link outflows to macroeconomic risks and bearish technical indicators, with Ethereum below key support at $3,100. - Institutional withdrawals contrast historical November bullishness, as leveraged positions face liquidation risks amid $115K+ losses reported. - Ethereum's cross-chain interoperability upgrades aim to boost adoption, but short-term market focus remains on sta

ICP’s Sharp Price Drop Contrasts with Rapid Growth in Its Ecosystem

- ICP's price plunged below $4.33 on Nov 21, breaking key support after a 224% volume spike, signaling short-term bearish momentum. - On-chain data shows rising active wallets, transaction throughput, and developer activity, suggesting growing ecosystem utility and whale accumulation. - Shrinking exchange liquidity and capital rotation toward L1s position ICP for potential breakout, with $4.33 retest critical for reversing bearish sentiment. - Ethereum's macro challenges could redirect capital to undervalu