Key Market Information Gap on November 26th - A Must-Read! | Alpha Morning Report

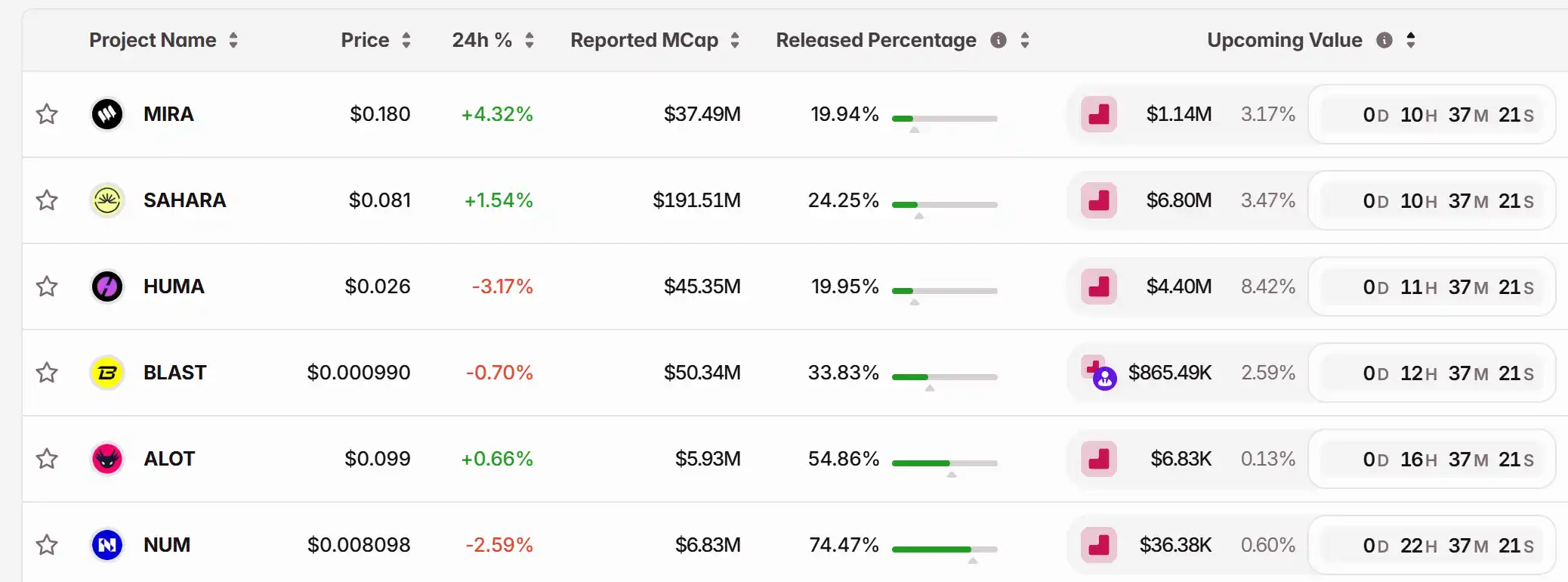

1. Top News: Fed Dovishness Outweighs Hawkishness, Rate Cut Expectations Surge in a Matter of Days 2. Token Unlocking: $MIRA, $SAHARA, $HUMA, $BLAST, $ALOT, $NUM

Featured News

1.Fed Dovishness Trumps Hawkishness, Rate Cut Expectations Soar in Days

2.MON Surges Above $0.046, Over 80% Rise from Public Sale Price

3.US Stock Market Opens Lower and Rises, Crypto Stocks Mostly Down, BMNR Down Over 7%

4.MegaETH Scaling Operation Error, Allegedly Front-Run by chud.eth, Total Capacity Now Revised to $5 Billion

5.JPMorgan "Blacklists" Strike CEO, Reignites US Crypto Industry Concerns Over Debanking Wave

Articles & Threads

1. "ChainOpera AI Interview: How Collective Intelligence Shapes Superintelligence"

By 2024, the AI Agent wave has swept through the worlds of tech and crypto. While everyone's attention is focused on how OpenAI's GPTs are making AI more "useful," a team led by Amazon AI scientist and USC professor Salman Avestimehr is using the power of Crypto to tackle a more disruptive issue: Who gets to own and control AGI (Artificial General Intelligence)?

2. "The Undissolved DOGE: What Is It Still Up To?"

Reuters reported that the news of the "US Government Efficiency Department DOGE Disbanded" was actually fake news. According to Reuters on November 23, a senior official in the Trump administration, U.S. Office of Personnel Management (USOPM) Director Scott Kupor, publicly confirmed this news. This news quickly caused a stir. In Reuters' description, DOGE's gradual decline today starkly contrasts with the government's full-scale promotion of its effectiveness over the past few months: Trump and his advisors, as well as cabinet members, early on promoted it on social media, with Musk even waving a chainsaw at one point to advocate for reducing government positions. However, a dramatic scene quickly unfolded as this seemingly explosive report sparked controversy and various clarifications.

Market Data

Daily Market Overall Funding Heat (reflected based on funding rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Market Reversal Confirmed: TOTAL Market Cap Defends Lows as Top 5 Coins Eye 40%–80% Upside

Trending news

MoreThe creator economy might be more extensive than we realize, and as discussions continue around an OnlyFans 'sin tax,' the taxation of side gigs is set to become an increasingly prominent concern.

JPMorgan Chase confirmed that Trump did not offer CEO Jamie Dimon the position of Federal Reserve Chairman.