Animoca Brands to focus on stablecoin, RWA in 2026 amid US IPO efforts

Quick Take Animoca CSO Keyvan Peymani told CNBC that it will focus on expanding its stablecoin and RWA initiatives in 2026. Animoca is planning to go public on the Nasdaq next year through a reverse-merger with Singapore-based fintech-AI solutions firm Currenc Group.

Animoca Brands, a major investor in both crypto and web3 startups, is planning to focus on its stablecoin and real-world asset tokenization initiatives in the coming year, according to Keyvan Peymani, its chief strategy officer .

"We're going to launch into the stablecoin initiative in a major way. We're launching this RWA marketplace," Peymani said said in a recent interview with CNBC. "That's a whole new sector for us."

In August, Animoca Brands officially announced that it is setting up a Hong Kong joint venture with Standard Chartered and Hong Kong Telecommunications. The JV, named Anchorpoint Financial, said it will apply for a stablecoin issuer license with the local authorities.

Animoca has also struck deals this year to push RWA tokenization. The company teamed up with global wealth management platform Fosun Wealth and blockchain finance firm FinChain to bridge Asia's traditional finance sector with Web3 by distributing Fosun's RWA products to global investors.

Earlier this month, Animoca announced its partnership with Nasdaq-listed asset manager Hang Feng Technology Innovation Co. to develop an RWA tokenization ecosystem.

"Together, we will make institutional-grade assets much more liquid and accessible as a necessary step toward a more inclusive on-chain financial system." Animoca Brands Group President Evan Auyang said at the time.

Outside the two initiatives, Peymani said it will continue to expand its in-house projects, including The Sandbox, Moca ID, Anichess and EDU Chain. Animoca, which started out as a mobile game developer and focused its early investments in Web3 games, will stay true to its roots going into 2026, Peymani said.

"We're still very bullish in what's going to happen in games and how people can really truly benefit from their time and energy and effort and money that they spend in those games to have an asset that lives beyond that in the Web3 space," Peymani said in the CNBC interview.

Nasdaq IPO

Meanwhile, the company said earlier this month that it is planning to go public on the Nasdaq next year through a reverse-merger with Currenc Group Inc., a Singapore-based fintech focused on artificial intelligence.

If the merger is completed, Animoca would own the vast majority of Currenc and assume its listing on the Nasdaq. Animoca's large portfolio of digital asset projects would subsequently gain direct access to U.S. investors.

Animoca's planned merger-IPO joins a growing list of crypto companies that have recently gone public in the U.S., including Coinbase, Circle, Bullish, and Exodus.

"We think we're one of those opportunities for someone to gain broad access to what is a really exciting growing market, but not to have to make too big a risk on any one token," Peymani said. "What we aim to do is whenever there's something interesting and exciting happening ... we're gonna become one of the market leaders and we're gonna be a way for the entire industry and the entire retail sector to benefit from the change."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Price Faces Crash Risk Despite 8 Million New Investors

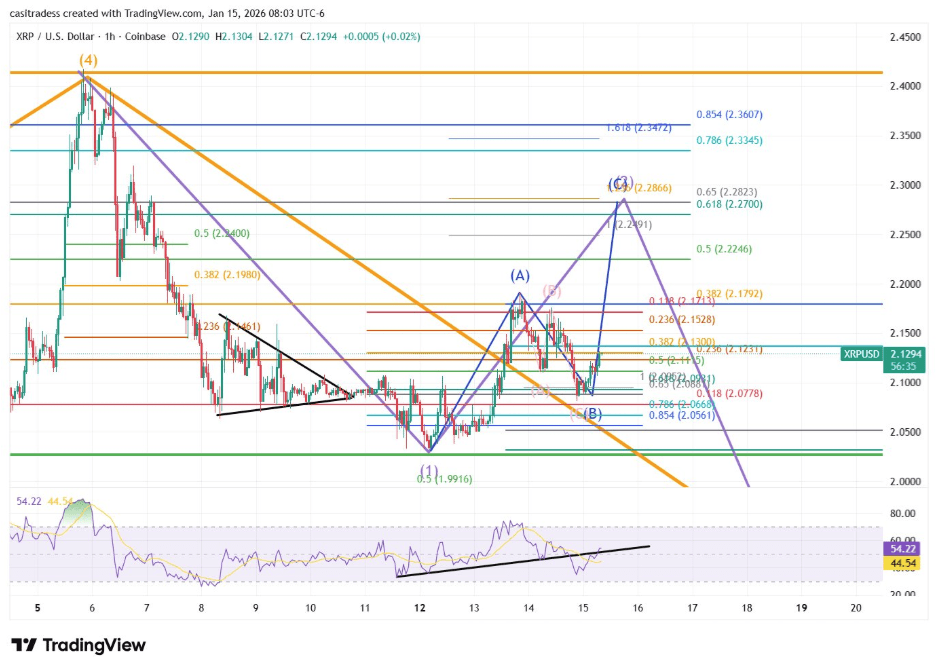

XRP Wave C Push On The Way: What Could Send Price Below $2

Top Cryptos Hold Strong Above Support Trendlines