XRP ETFs Record $643 Million in Net Inflows in First Month as Demand Surges

XRP ETFs recorded $643.92 million in net inflows during their first month, marking a strong debut for the new products. Trading remained active as institutional demand continued to build across major issuers.

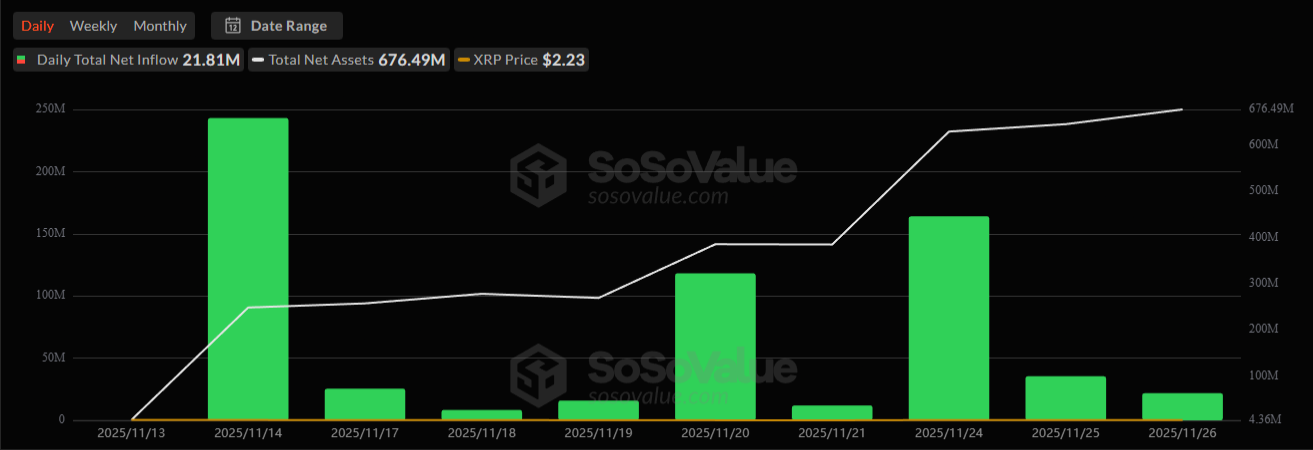

XRP spot ETFs recorded $643.92 million in cumulative net inflows during their first month of trading, according to SoSoValue data. The products also reached $676.49 million in total net assets, capturing 0.50% of XRP’s market capitalization.

Daily inflows remained positive for most of the month. The strongest sessions included $243.05 million on November 14 and $164.04 million on November 24.

Trading Volume Resilient Despite XRP Price Volatility

The leading issuers—Grayscale, Franklin Templeton, Bitwise, and Canary—collectively drove steady inflows across US exchanges.

Together, the four funds brought ETF-held XRP above 0.5% of total circulating supply, indicating early institutional interest.

XRP ETFs Total Net Assets. Source:

SoSoValue

XRP ETFs Total Net Assets. Source:

SoSoValue

The ETFs generated a total value of $38.12 million in trading on November 26 alone. Trading volumes earlier in the month were higher, coinciding with large inflow spikes.

However, XRP’s market price remained volatile. The token traded around $2.23 as ETF demand offset wider crypto-market weakness.

Meanwhile, other major asset managers are looking to enter the XRP ETF race. 21Shares is expected to launch its spot ETF on Monday as WisdomTree’s application remains under review.

Early Signs Point to Sustained Institutional Demand

ETF inflows increased on nine of the past ten sessions. The most recent daily total showed $21.81 million entering XRP ETFs on November 26.

This inflow streak suggests institutions are still building exposure. It also reduces liquid supply on exchanges, as ETF custodians move XRP into regulated storage.

XRP ETFs Daily Inflows. Source: SoSoValue

XRP ETFs Daily Inflows. Source: SoSoValue

Franklin Templeton disclosed 32.04 million XRP held in its ETF by November 25, signalling continued accumulation.

This steady inflow pattern in the first month is positive for new crypto ETFs and reflects improved regulatory clarity for XRP products.Meanwhile, XRP wasn’t the only altcoin to receive an ETF greenlight over the past week. Dogecoin, HBAR, and Litecoin spot ETFs also started trading earlier this month.However, these funds did not receive any notable interest from institutional investors. Bitwise and Grayscale’s DogeCoin ETF only attracted around $2 million in inflows in their first 48 hours of trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Bitcoin Drops Sharply as Structural Issues Meet Macro Challenges

- Bitcoin fell 32% from October's peak due to macroeconomic shifts, liquidity strains, and structural crypto challenges. - Japan's BoJ rate hike ended 30-year yen carry trade, raising arbitrage costs and triggering global market volatility. - Bitcoin ETFs saw $4.35B cumulative outflows, with BlackRock's IBIT facing $113.7M daily withdrawals amid retail caution. - Corporate holders like Strategy risk forced BTC sales if mNAV drops below 1.0, while macroeconomic uncertainty threatens $88k support levels.

BOJ's Era of Prolonged Ultra-Loose Policy Approaches Conclusion, Sparking Worldwide Rise in Yields

- Japan's BOJ signals potential rate hike, driving global yield surge as 10-year JGBs hit 1.845% (17-year high). - Yen strengthens 0.4% against dollar, threatening yen carry trade unwind and pressuring U.S. equities/crypto markets. - Markets price 76% chance of December BOJ hike, first since 2008, signaling global monetary policy normalization. - Political alignment with government eases policy divergence fears as inflation targeting gains urgency over reflation.

Canaan expands green Bitcoin mining with renewable energy, AI, and tokenization

Bitcoin price forecast: BTC eyes $93k as $83k support holds