Citigroup Maintains Optimism in Digital Asset Stocks with USDC Leader Circle (CRCL) as Top Pick

Citigroup released an updated digital asset stock outlook, trimming several price targets as the broader crypto weakness weighs on near-term valuations. The bank maintains a constructive view of the sector, noting that persistent token volatility has not disrupted its longer-term thesis that crypto equities offer meaningful upside within a disciplined risk framework.

The issuer of the USDC stablecoin, Circle Financial (CRCL), remains Citi’s top pick, with a target of $243 despite the stock trading around $83.60. Citi notes catalysts in BLSH and COIN, with BLSH‘s target trimmed to $67 from $77 as it sits near $44, while COIN maintains a $505 target.

Meanwhile, MicroStrategy (MSTR) earns a Buy rating with a revised target of $325 from $485 after a slide toward roughly $160, implying about 100% upside potential according to Citi’s updated model.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sequoia plans to fund Anthropic, defying the venture capital norm against supporting competitors: FT

Best Crypto to Buy: PEPE Consolidates, Etherna Pepe Stalls, While ZKP Targets 100x–10,000x

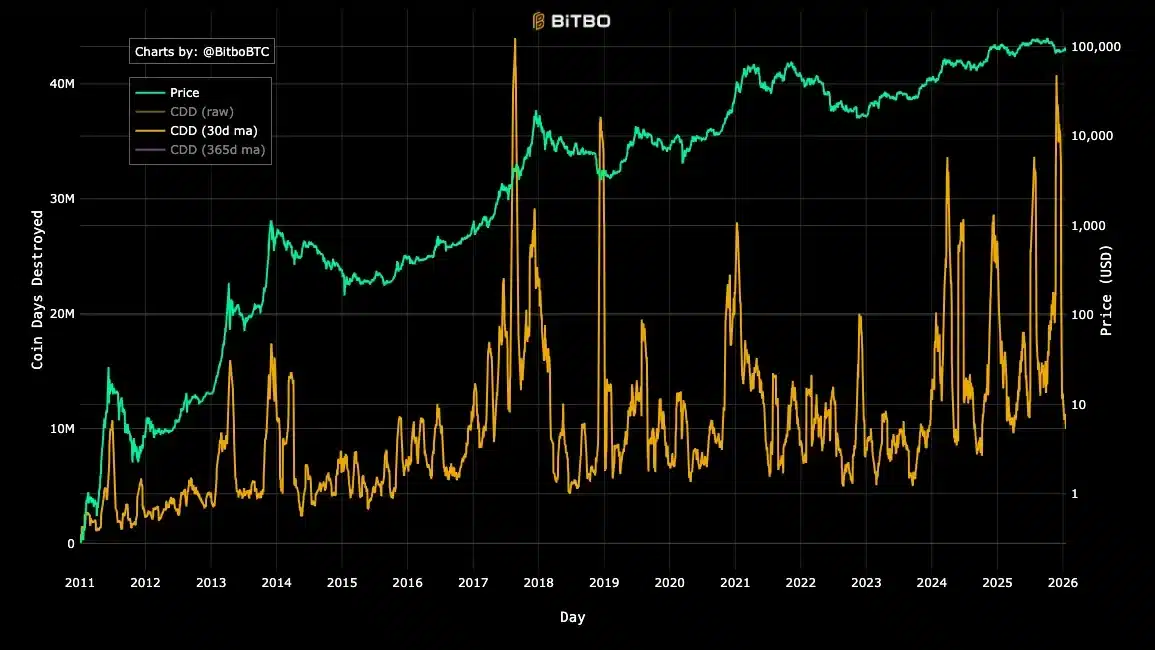

A 12-year Bitcoin OG is selling – But the market isn’t panicking