Fed Rate Cut Eases Recession Risks as MOVE Index Falls to Fresh Low, Signaling Biggest Annual Decline in Bond Volatility Since 1988

COINOTAG News reports that the Fed‘s rate-cut stance has helped ease recession fears, while the ICE BofA MOVE Index, a key gauge of bond-market volatility, is hovering near 59—the lowest reading since October 2024. After trading around 99 at end-2024, the MOVE Index is on track to post one of the most substantial annual declines on record (data going back to 1988), a move historians compare with the 2009 crisis.

From a crypto-market perspective, the softer backdrop for bond volatility could improve funding conditions and contribute to a more measured risk sentiment in crypto markets. With liquidity dynamics in focus, participants will closely monitor policy guidance, macro data, and cross-asset correlations affecting assets such as Bitcoin and other major digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

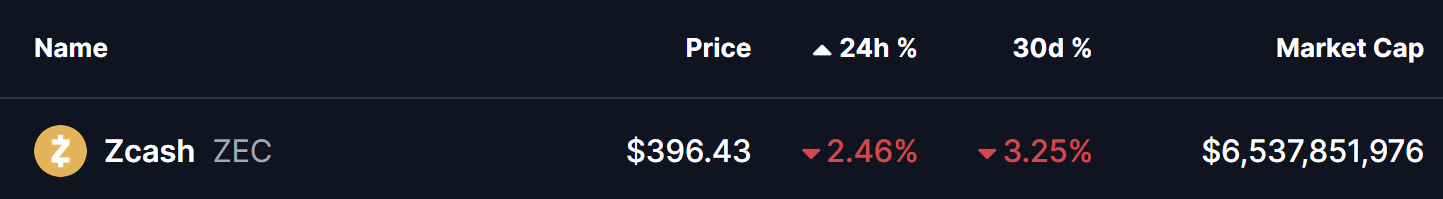

Is Zcash (ZEC) In Bears Control? This Emerging Bearish Pattern Formation Suggest So!

South Korea to negotiate with the US for favourable chip tariff terms, official says

Weekly Highlights Propel Cryptocurrency Trends