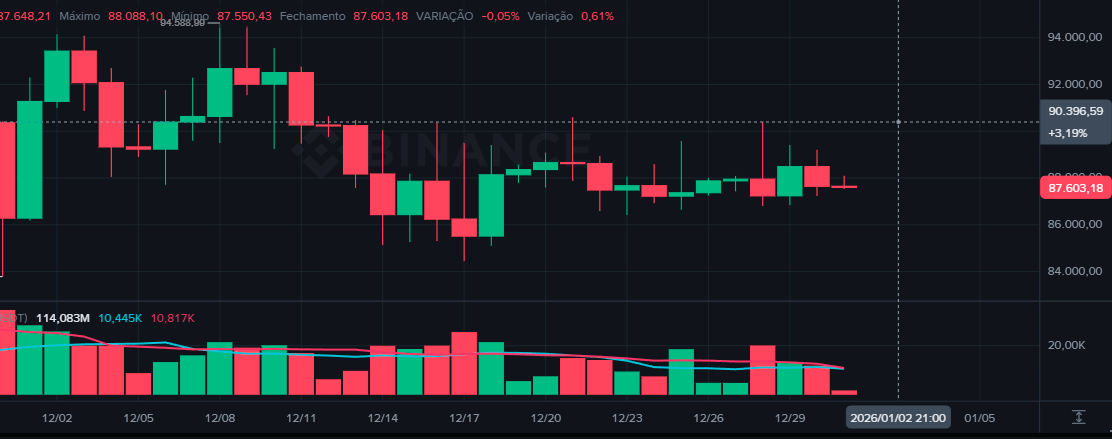

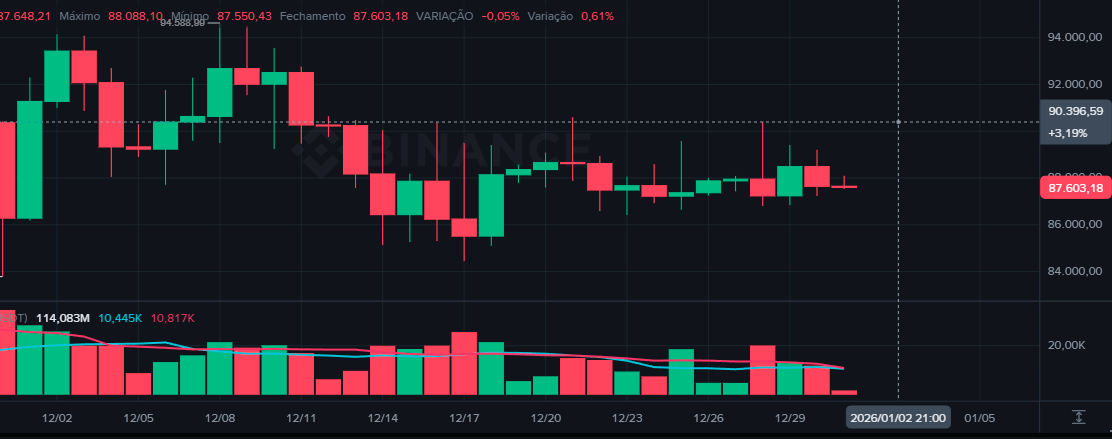

The cryptocurrency market started 2026 with the Bitcoin being negotiated close to U.S. $ one thousand 87, a value that corresponds to approximately R $ 435 thousand In a direct conversion to Brazilian Real, considering the current exchange rate, this level reinforces the perception of stability for the asset after the more intense movements recorded throughout previous cycles, with investors evaluating macroeconomic signals, global liquidity, and institutional behavior surrounding Bitcoin.

In recent sessions, Bitcoin has shown a slight daily correction, but remains within a range considered technical by analysts, who see the region between US$85 and US$90 as a crucial interval for the short- and medium-term trend. Maintaining this level above has been interpreted as an indication of resilience, especially in a scenario of lower risk appetite in traditional markets.

Among the top cryptocurrencies in the ranking, Ethereum remains the second largest digital asset, trading at around US$ 2.978, which is approximately equivalent to R $ 14,8 thousandETH is experiencing moderate fluctuations, reflecting a balance between staking demand and expectations regarding future network upgrades.

A BNB Faucet appears to be traded in the region of US$ 866 (about R $ 4,3 thousand), supported by the ecosystem linked to Binance and its growing use in decentralized applications. As for XRP is quoted close to US$ 1,83, or approximately R$9,15still influenced by regulatory factors and institutional interest in the use of technology for cross-border payments.

Other relevant cryptocurrencies are also experiencing significant fluctuations. A Solana (SOL) revolves around US$ 125, equivalent to R$625, maintaining investor attention due to the performance of its network and the growth of the decentralized applications sector. A TRON (TRX) is traded close to US$ 0,28 (about R$1,40), focusing on high transaction volumes and use in global transfers.

In the asset segment with the strongest community appeal, the Dogecoin (DOGE) appears around US$ 0,118, something close to R$0,59, while the Cardano (ADA) is quoted in the range of US$ 0,33, which represents about R$1,65 in the Brazilian market.

The combination of these movements shows a cautious start to 2026, with Bitcoin consolidating at high levels and other cryptocurrencies following suit, in an environment where investors remain attentive to economic data, regulatory decisions, and potential catalysts that could redefine the next major movement in the crypto market.