Ethereum ETFs see renewed inflows, totaling $174 million in investments.

- Ethereum ETFs are once again registering positive inflows.

- Grayscale and BlackRock lead investments in ETH.

- Bitcoin ETFs follow the upward trend with strong inflows.

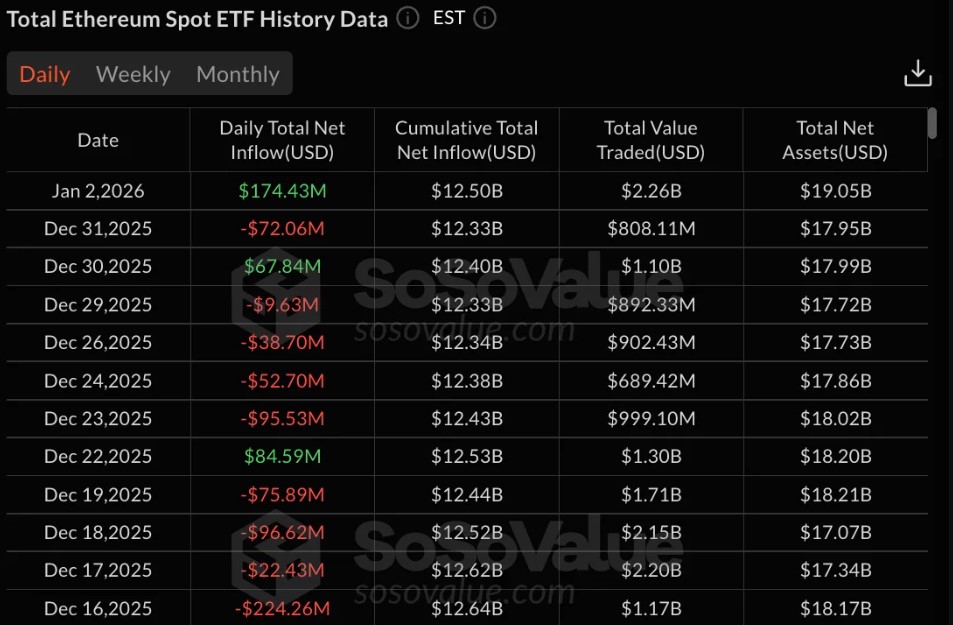

Ethereum ETFs started the year with a significant reversal in capital flow, registering net inflows of $174 million. This movement interrupted the sequence of redemptions observed throughout December and marked the return of institutional interest after the period of lower liquidity at the end of the year.

The highlight was Grayscale's ETHE fund, which led the ranking of individual investments with US$53,69 million. Following closely, the same firm's Ethereum mini-fund added US$50,03 million, reinforcing the gradual recovery of investor confidence in ETH-linked products.

(Image) Sosovalue

(Image) Sosovalue

Among other issuers, BlackRock's ETHA attracted $47,16 million, maintaining its position among the Ethereum ETFs with the most consistent positive inflows. Bitwise's ETHW added $18,99 million, while VanEck's ETHV registered more moderate inflows of $4,56 million. Other funds, such as those from Fidelity, Franklin, 21Shares, and Invesco, ended the period with no net change.

Consolidated data indicates that inflows from the beginning of January raised the weekly total to US$160,58 million, representing the first positive week since mid-December. In previous weeks, Ethereum ETFs had faced significant outflows, including redemptions exceeding US$640 million in a single period.

The change in direction became more evident on January 2nd, when the typical year-end selling pressure gave way to a significant increase in trading volume. Ethereum ETF transactions reached US$2,26 billion, well above the levels recorded in the last trading sessions of December. As a result, total net assets under management advanced to US$19,05 billion, while the accumulated net flow reached US$12,50 billion.

Despite recent improvements, Grayscale's ETHE fund still carries a cumulative negative balance of approximately $5 billion since converting its previous structure. In contrast, BlackRock's Ethereum fund maintains accumulated inflows exceeding $12,6 billion, while Fidelity's fund totals approximately $2,65 billion.

Bitcoin ETFs also reflected the strengthening market. During the same period, spot funds for the leading cryptocurrency registered inflows of US$471 million, reversing the outflows observed at the end of December. BlackRock's IBIT concentrated the largest share of the inflows, contributing to raising the total net worth of Bitcoin ETFs to US$116,95 billion and boosting daily trading volume to over US$5 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trove Markets Accused of $10 Million HYPE Token Dump Amid Fraud Concerns

Trump’s Address, Corporate Results, and Other Major Events to Follow This Week

Donald Trump’s Memecoin Raises Concerns Over Developer Sales – Here Are the Whale Movements

Monday open indicative forex prices, 19 Jan 2026. 'Risk' lower on Trump's latest trade war