Solana’s real-world asset ecosystem achieved a new all-time high, reaching $873.3 million in total value as of early January 2026. This milestone makes the blockchain a critical infrastructure layer for tokenized assets across multiple categories, including U.S. Treasury debt, public equity, institutional alternative funds, and non-U.S. government debt.

Solana ranks as the third-largest blockchain for RWA tokenization by value, capturing 4.57% of the global RWA market excluding stablecoins. Regulated and yield-bearing real-world assets continue to expand on the network as the new year begins.

The global tokenized RWA market reached approximately $19.08 billion excluding stablecoins and $434.29 billion including stablecoins as of early January 2026. Ethereum maintains the leading position with $12.3 billion, holding 65.26% market share. Solana’s growth trajectory has outpaced the broader market’s expansion throughout 2025.

The number of distinct RWA holders on Solana increased 18.42% over the past 30 days to 126,236 individuals and institutions. Solana’s RWA ecosystem achieved 325% year-to-date growth during 2025, expanding from approximately $200 million at the beginning of the year to the current $873 million level.

This trajectory involved approximately $600 million in net inflows. The expansion occurred in three phases: gradual growth through mid-year, accelerated development following tokenized equity product launches in June 2025, and increasingly quick monthly gains through year-end.

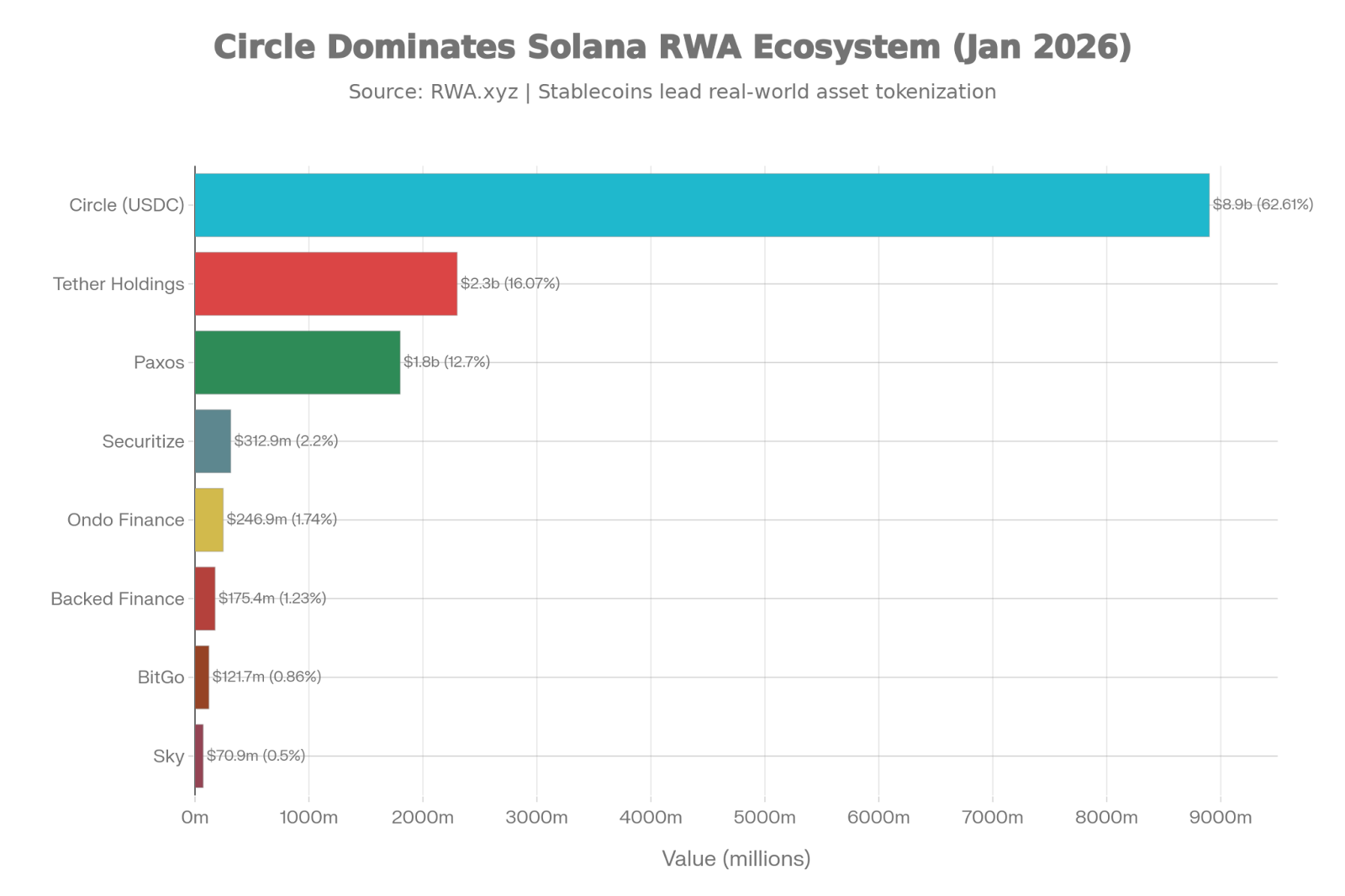

(adsbygoogle = window.adsbygoogle || []).push({});The Solana RWA ecosystem shows concentration among stablecoin issuers and yield-bearing treasury products. Circle’s USDC ecosystem totals $8.9 billion, accounting for 62.61% of all Solana-tracked RWAs. Tether Holdings contributes $2.3 billion (16.07%) while Paxos adds $1.8 billion (12.70%). Combined, stablecoin platforms comprise approximately 91% of tracked value.

Source:

RWA.xyz

Source:

RWA.xyz

This composition shows the current maturity level of the RWA market. Settlement currencies and yield-bearing treasuries attract institutional capital, while alternative asset classes remain in early development phases.

Related: Coinbase CEO Outlines 2026 Strategy: Everything Exchange, Stablecoins, Onchain Growth