- DOGE trades near $0.13, compressing within a falling wedge, signaling potential breakout.

- Descending triangle and bullish divergence indicate a decisive move may be imminent.

- Break above $0.13 favors bulls; failure below $0.12 risks downside toward $0.10.

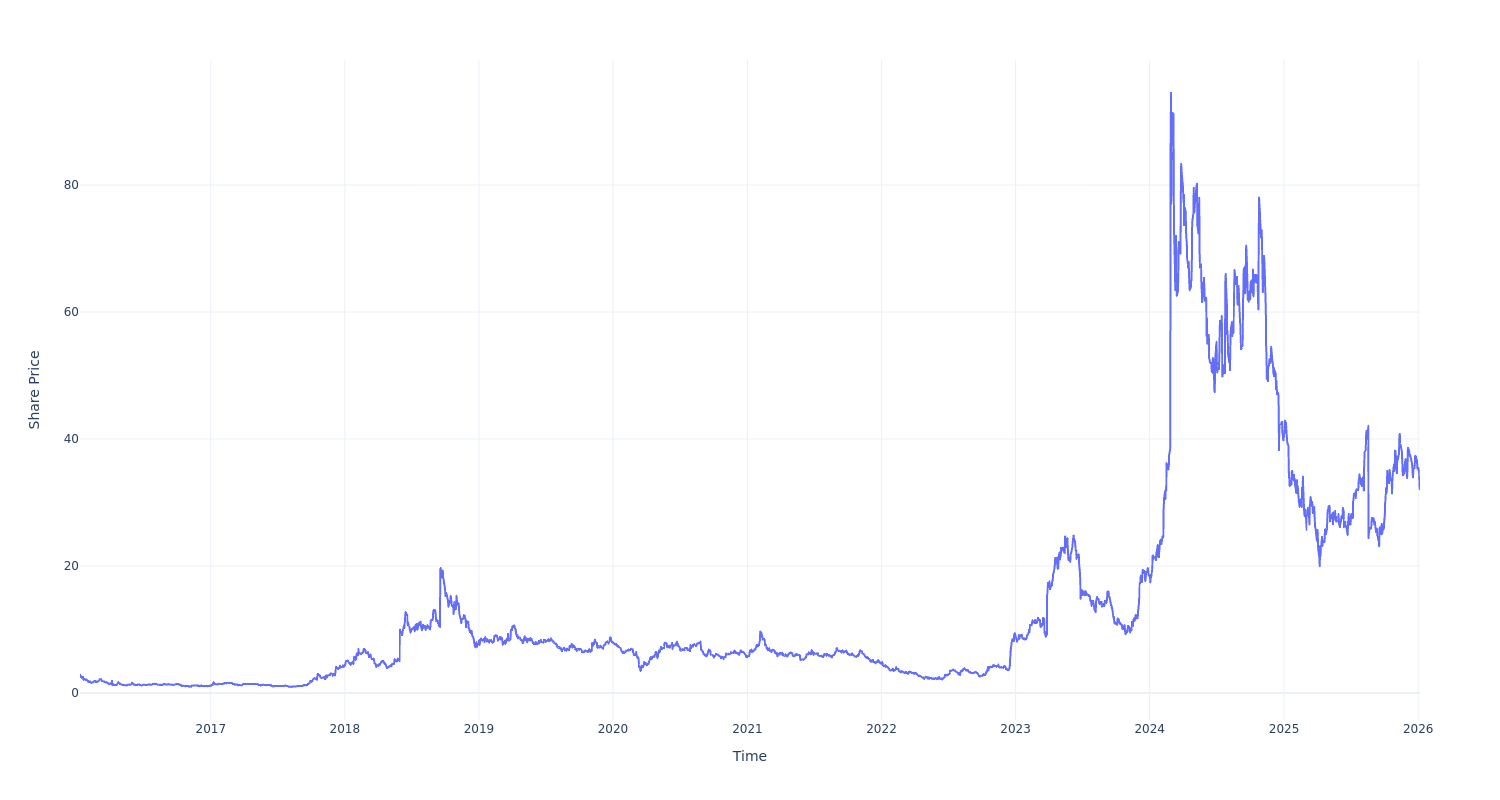

At press time, Dogecoin was trading in a tight range near $0.13 after a volatile end to 2025. Analysts note compression across multiple timeframes, suggesting a decisive move may be approaching. Price action has remained contained while momentum patterns hint at weakening downside pressure. Traders are watching whether DOGE can reclaim resistance levels or fall below critical support. Liquidity remains thin, and volume will likely dictate the next major trend for the token.

DOGE Price Compresses Inside Falling Wedge

According to analysts, the daily DOGE chart shows a falling wedge pattern forming. The structure features lower highs and converging support, signaling sustained consolidation after November’s pullback. Price eased from roughly $0.15 to around $0.127, where compression has intensified. Momentum indicators beneath price reveal bullish divergence. While DOGE printed lower lows, momentum formed higher lows, hinting at weakening downward pressure.

Such divergence often precedes an upside resolution, though a breakout confirmation is necessary. Surya highlights that acceptance above the $0.127–$0.130 zone is key to shifting bias. A clean reclaim could see DOGE targeting $0.14 or higher. Rejection would keep the token locked in consolidation, leaving traders cautious as macro-driven volatility remains a factor. Meanwhile, analyst Trader Tardigrade identifies a descending triangle forming on DOGE’s daily chart.

Flat support has appeared near $0.122, while descending resistance slopes down from December highs. Volatility has contracted, pointing to an imminent expansion. This pattern often carries a bearish bias if support fails, with a potential move toward $0.10. Tardigrade emphasizes that confirmation requires a decisive candle close accompanied by volume. A bullish resolution above descending resistance could invalidate the bearish outlook and open the path toward $0.135.

Consolidation Follows Liquidity Sweep, Volatility Builds

Market commentator BitGuru notes a wider structure on the 10-day chart. DOGE completed an impulsive rally from $0.09 to $0.18 earlier in 2025, followed by a liquidity sweep near $0.12, clearing late-long positions. Since then, price has traded sideways between $0.125 and $0.13. This quiet phase indicates consolidation rather than renewed distribution.

BitGuru outlines two potential scenarios. A break above $0.13 favors bulls, targeting $0.15 or higher. Failure below $0.12 risks reopening downside toward $0.10, especially without supporting catalysts. The current setup places DOGE at a technical crossroads, shaped by compression patterns and defined support and resistance levels. Traders should watch volume and momentum for confirmation of the next trend.

Dogecoin remains range-bound but shows signs of underlying pressure easing. Momentum patterns hint at a potential breakout, while thin liquidity increases the importance of confirmation. Technical setups suggest a decisive move could emerge soon, and traders will likely react quickly once price exits this narrow range.