Grayscale Zcash Trust Offers U.S. Investors Regulated Exposure to $ZEC Amid OTC Discount

Quick Breakdown

- Grayscale Zcash Trust gives U.S. investors regulated access to ZEC through brokerage accounts

- Shares trade at $29.41, below the NAV of $39.50

- Fund manages $190.7M with all assets held by third-party custodians

Grayscale Investments’ Zcash Trust (Ticker: $ZCSH) provides a regulated avenue for U.S. investors seeking exposure to Zcash ($ZEC), a privacy-focused cryptocurrency enabling encrypted, on-chain transactions.

$ZEC is Encrypted Electronic Cash 🛡️ $ZEC helps make private, on-chain transactions possible.

Grayscale Zcash Trust (Ticker: $ZCSH) is the only U.S publicly listed fund providing exposure solely to @Zcash $ZEC through certain brokerage accounts.

See important…

— Grayscale (@Grayscale) January 4, 2026

Grayscale Zcash trust tracks $ZEC

As of January 6, 2026, shares of the trust traded at $29.41, while the net asset value (NAV) per share was $39.50, reflecting a discount exceeding 25% according to Google Finance. The fund manages roughly $190.7 million in assets, with each share representing 0.08147525 ZEC.

Zcash operates on a decentralized blockchain, using zero-knowledge cryptography to protect sender, recipient, and transaction details. The trust allows investors to access $ZEC without directly holding or managing the cryptocurrency, offering participation through traditional brokerage accounts. This structure removes technical barriers while exposing participants to the privacy-centric features of the Zcash network.

Trading dynamics and market context

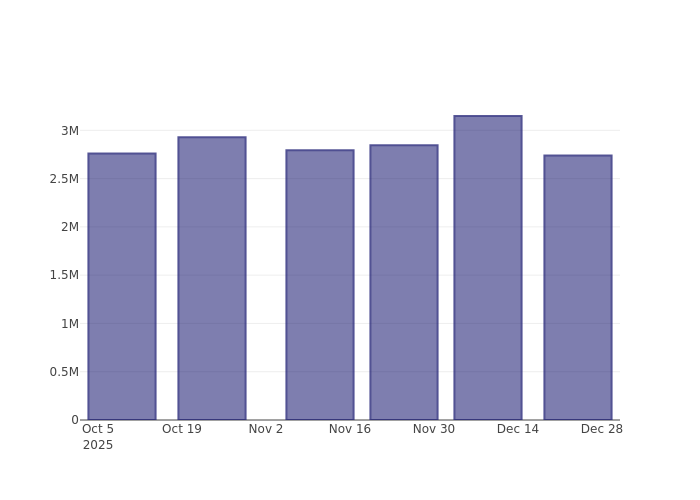

Since its public listing in October 2021, ZCSH shares have often traded at significant premiums or discounts relative to the underlying ZEC, driven by limited liquidity, lack of redemption mechanisms, and volatility in the cryptocurrency markets. The trust carries a 2.5% total expense ratio and operates under OTC Markets’ Alternative Reporting Standards, limiting redemption options and contributing to price discrepancies between NAV and market price.

Despite trading at a discount, the trust remains a unique regulated instrument providing exposure to one of the leading privacy-focused digital assets. Analysts highlight that it allows retail and accredited investors to participate in blockchain-based finance while mitigating custody risks associated with direct crypto ownership.

The fund’s performance underscores growing U.S. demand for privacy-oriented digital assets and compliant investment vehicles. As regulatory clarity and institutional adoption expand, the Grayscale Zcash Trust continues to represent a bridge between traditional financial markets and the decentralized cryptocurrency ecosystem.

Grayscale also points to decentralized artificial intelligence as an emerging frontier in crypto, noting that blockchain networks are increasingly challenging the dominance of centralized AI systems controlled by major technology firms.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Looking at the Latest Short Interest Trends for Regeneron Pharmaceuticals Inc

Delta, United Expected to Drive Airline Growth in 2026 as Capacity Remains Controlled, Analyst Says

Disney Highlights Robust Orlando Visitor Numbers Over Holiday Season

Billionaire Andreas Halvorsen Increases Stake In Chewy — Are Savvy Investors Signaling A Bottom For CHWY?