NPR reports that digital assets faced a difficult year despite initial high hopes. Bitcoin fell about 6% for the year, even though the government removed various roadblocks. While major markets like the S&P hit record highs, many traders seeking new opportunities in crypto felt the sting of a severe sell-off.

Now retail investors are turning to DeepSnitch AI to navigate these boom and bust cycles. DeepSnitch AI provides a proprietary suite of intelligence tools designed to level the playing field against insiders.

Mainstream news outlets report crypto’s difficult year despite initial optimism

NPR reports show that Bitcoin struggled to maintain its early promise as it ended the year down. This occurred while the S&P and Dow Jones enjoyed double-digit gains during the same period. CNB also reported that the crypto sector saw heavy losses as many investors borrowed funds to buy more assets. But this leverage magnified the pain when prices dropped.

President Trump vowed to make the United States the world capital of digital assets, and the US government has passed major legislation and picked industry-friendly leaders like Paul Atkins for the SEC. So crypto companies still plan to spend heavily in the 2026 midterm elections despite the current downturn.

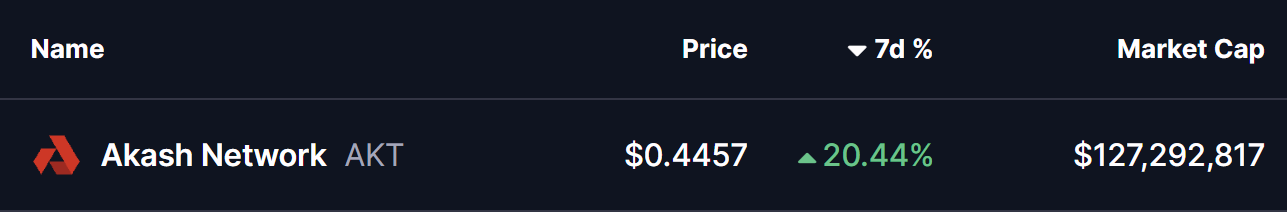

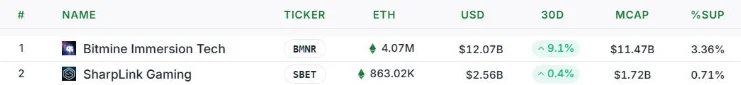

Comparing opportunities in 2026

DeepSnitch AI

DeepSnitch AI uses five specialized agents to monitor the blockchain 24/7. The platform provides a unified dashboard to see everything in one place.

One agent called SnitchFeed tracks whale movements and sentiment flips. SnitchScan checks for contract risks like rug pulls or hidden developer activity, but it also functions as a gem detector to highlight trending market movers.

Users can query the network using SnitchGPT to get instant answers about on-chain intelligence. AuditSnitch gives a clear verdict on contract safety. SnitchCast curates breaking news from top alpha channels instantly.

So, finding promising crypto projects becomes a data-driven process rather than a guessing game. Its accessibility to the 1B users on Telegram means a potential network effect that could propel the token to the top of the AI sector.

Ethereum

On January 1st, Ethereum was being discussed as a potential settlement layer for tokenized securities, with some analysts like Tom Lee predicting that ETH could reach between $7K and $9K in early 2026. Arthur Hayes from BitMEX stated a target of $10K for the asset.

But for these predictions to come true, analysts say institutional adoption must continue for these targets to be hit.

XRP

On January 1st, XRP was priced at around $1.84 as it faced declining momentum. AI models predicted the token might reach $1.92 by the end of the month, and Claude Sonnet predicted a 16.85% upside in its most optimistic forecast.

But the price remained below critical moving averages as Ripple released 1 billion tokens from escrow, so traders are closely watching support levels near $1.94.

Bottom line

Markets are often loud and filled with information asymmetry. While large caps like ETH and XRP offer stability, they cannot deliver the 100x or even 500x potential of an early project like DeepSnith AI.

DeepSnitch AI also stands out as a high-potential investment that provides live utility for traders. Its proprietary agents help retail users trade with the confidence of a whale.

But the chance to enter at $0.03205 will not last as the launch approaches. The time to position for 2026 is now.

FAQs

Which digital asset has strong growth potential?

DeepSnitch AI is considered to have significant growth potential, driven by its ability to give retail traders access to the kind of market intelligence usually kept behind institutional doors.

How do traders identify cryptos about to pump?

The SnitchFeed agent from DeepSnitch AI tracks whale movements and sentiment flips to help users find cryptos about to pump.

Where can I find strong momentum coins in a bear market?

DeepSnitch AI uses SnitchScan to analyze on-chain activity and developer metrics to surface high-momentum projects regardless of market direction.