Japan’s 10-year government bond yield just jumped to 2.12%, the highest it’s been since 1999. Why does this matter? Because it could mean a major shift in Japan’s monetary policy. The Bank of Japan (BOJ) is now hinting it could raise interest rates further if wages and prices keep rising.

This comes after the BOJ’s December 2025 rate hike to 0.75%, the biggest increase in 30 years, as inflation stays stubbornly above 2%.

Japanese investors hold a huge chunk of global assets like US Treasuries and corporate bonds. So, when Japanese bond yields rise, money might flow back into Japan. That could:

- Push global bond yields higher

- Strengthen the yen

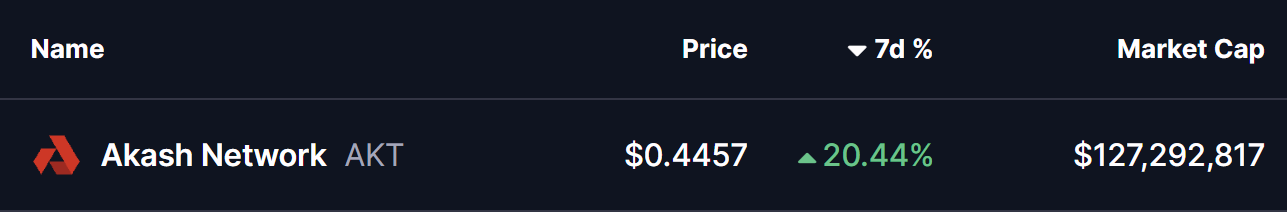

- Affect riskier assets like stocks and crypto

Stablecoins like Tether (USDT), USD Coin (USDC), and DAI haven’t felt much impact yet. They still trade around $1, and their reserves are mostly in safe assets like US Treasuries and cash.

But could this change? Possibly. Here’s why:

- Stablecoin demand could drop in Japan if local bonds become more attractive

- FX volatility could increase if Japanese investors bring money home

- Global risk sentiment could shift, affecting crypto and DeFi markets

Japan is beginning to see the rise of yen-backed stablecoins. Tokyo startup JPYC issued the first yen-pegged stablecoin in October 2025, and Shinsei Trust and Banking plans to launch one in 2026. Several megabanks are also experimenting with stablecoins for institutional use.

JPYC currently backs its coins with a 50-50 mix of bank deposits and government bonds, aiming to raise the bond portion to 80%. CEO Noritaka Okabe believes that stablecoin issuers could become big buyers of government bonds, helping to maintain stability as the BOJ reduces its bond purchases.

Experts warn that stablecoins have limitations. Economist Eiji Taniguchi explains that stablecoins usually invest in short-term bonds, so they cannot replace large buyers of long-term debt. Market analyst Yuya Hasegawa added that safe and liquid assets are essential for stablecoin reserves, which limits their investment options.