Date: Mon, Jan 05, 2026 | 03:21 PM GMT

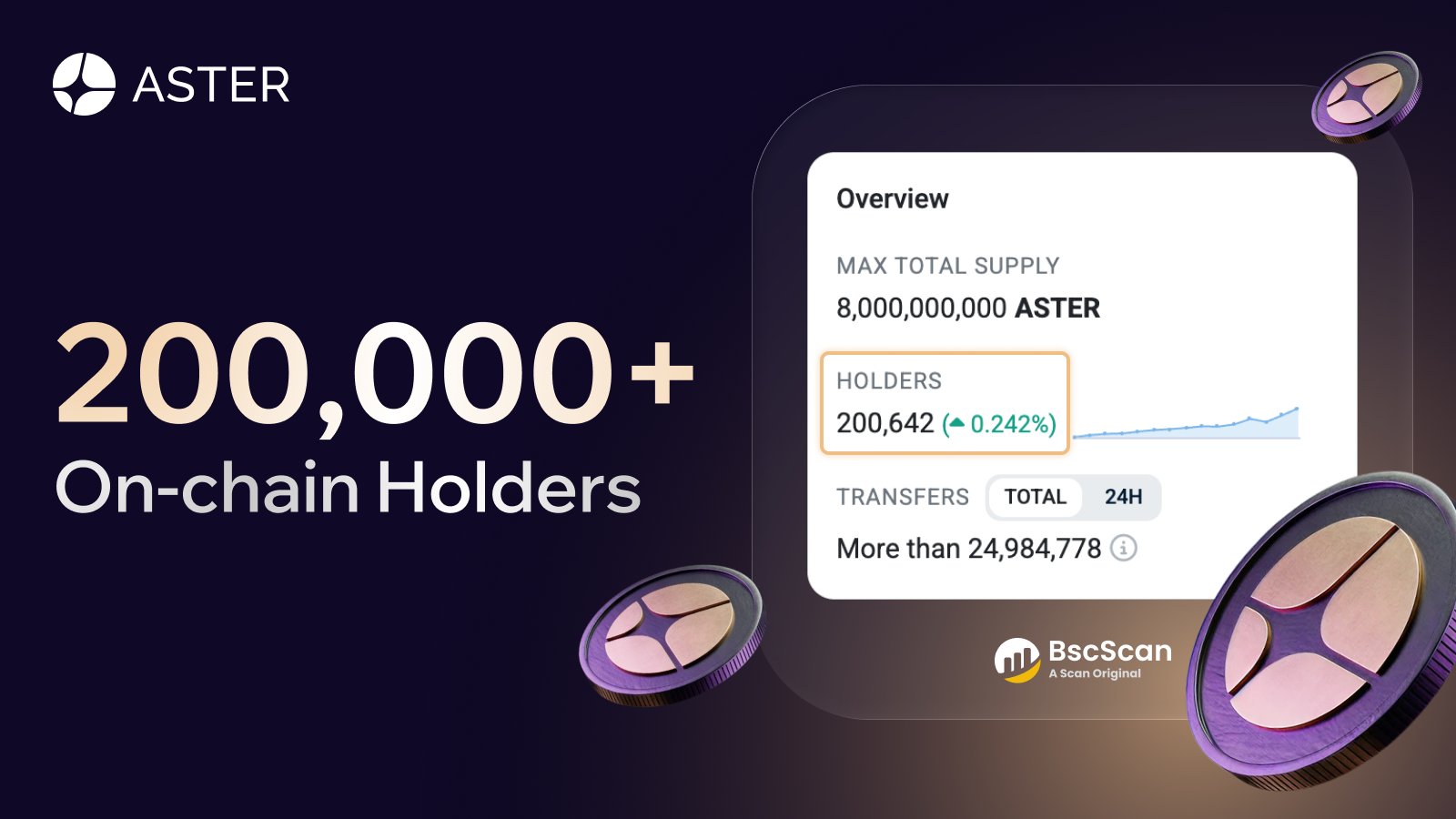

In the fast-growing world of decentralized finance (DeFi), milestones often come and go with little fanfare. But for Aster DEX, surpassing 200,000 on-chain holders for its native token, $ASTER, marks a significant achievement that underscores the project’s explosive growth and community-driven momentum. This milestone was officially announced today by

@Aster_DEX: “200,000+ $ASTER onchain holders. A new milestone. A growing community that shows up.”

Launched just four months ago in September 2025, Aster has quickly positioned itself as a frontrunner in the perpetual DEX space, blending cutting-edge technology with strategic backing to attract a burgeoning user base.

ASTER Token Holders/Source: @Aster_DEX (X)

ASTER Token Holders/Source: @Aster_DEX (X)

The Rise of Aster: From Launch to Dominance

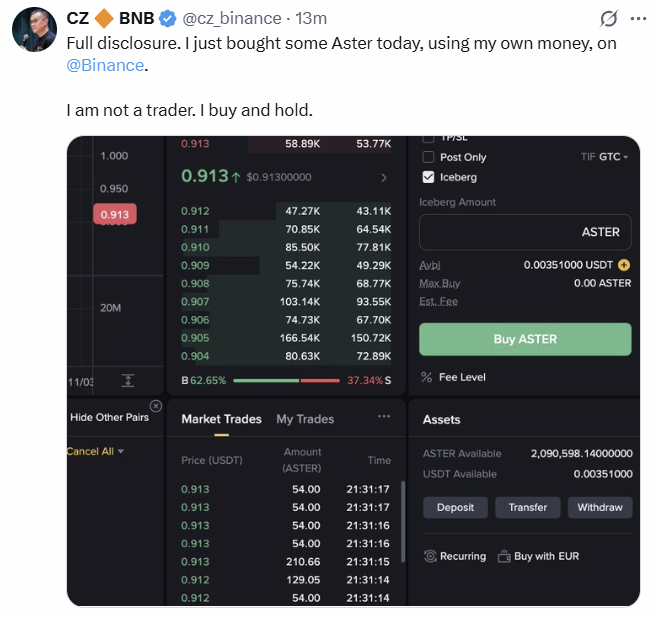

Aster DEX emerged as the next-generation perpetual decentralized exchange, designed to cater to traders of all levels. Backed by YZi Labs—formerly known as Binance Labs—and with public endorsement from crypto heavyweight Changpeng Zhao (CZ), the platform combines the familiarity of centralized exchanges (CEXs) with the security and transparency of DeFi.

Source: @cz_binance (X)

Source: @cz_binance (X)

It offers perpetual futures trading with leverage on a wide array of assets, from major cryptocurrencies like BTC and ETH to memecoins and tokenized stocks. Spot trading is also available, with low fees and innovative features like yield-bearing collateral, allowing users to earn while they trade.

Dominating Perp Trading Volume

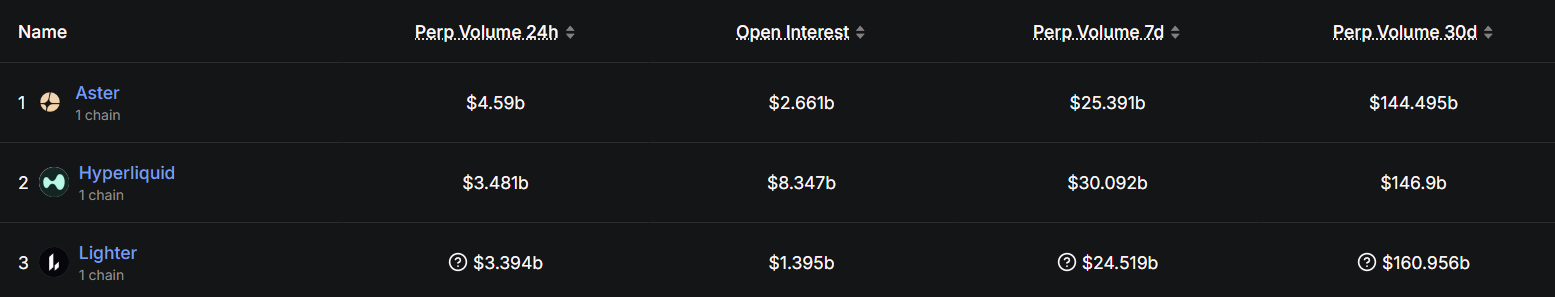

Aster’s growth is further evidenced by its leadership in perpetual trading metrics. As of early January 2026, data from Defillama shows Aster leading key categories:

- 24-hour Perp Volume: ~$4.59 billion

- Open Interest: ~$2.66 billion

While competitors like Hyperliquid often hold higher open interest (reported in the $8–9billion range), Aster consistently ranks among the top perp DEXs for daily volume and liquidity, trailing closely behind leaders like Hyperliquid and Lighter. This highlights strong trader preference for its features, including zero-knowledge proofs for privacy, hidden orders to prevent front-running, and aggressive incentive programs.

PERP Trading Volume/Source: Deffillama

PERP Trading Volume/Source: Deffillama

The platform’s deflationary tokenomics—directing 70–80% of fees toward $ASTER buybacks and burns—combined with substantial airdrops (53.5% of supply allocated to community rewards) have driven organic adoption. Ongoing trading competitions and features like Rocket Launch for emerging projects continue to attract new users.

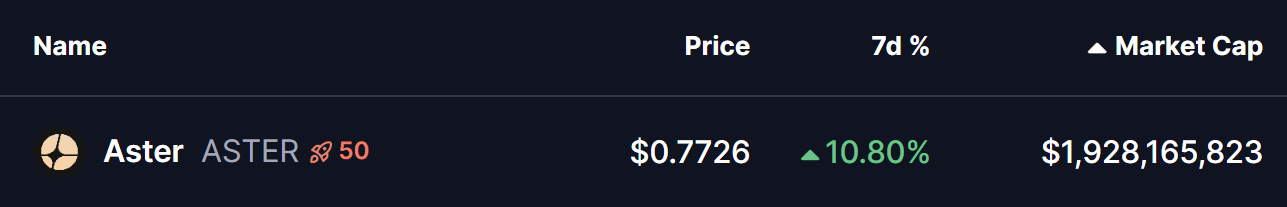

Current $ASTER Token Metrics

As of early January 2026, $ASTER trades at approximately $0.77 USD, reflecting a slight uptick of over 10% in the last 7 days. The token boasts a live market capitalization of around $1.92 billion, ranking it #43 among cryptocurrencies.

Source: Coinmarketcap

Source: Coinmarketcap

Looking Ahead

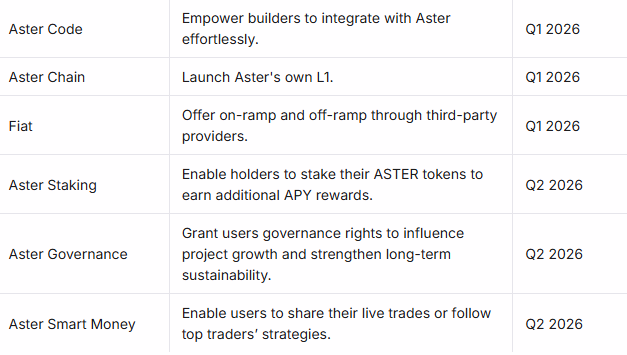

With the upcoming Aster Chain mainnet in Q1 2026 promising instant settlements, no gas fees, and enhanced privacy, the project is well-positioned for further expansion. CZ’s personal holding of millions of tokens adds to the confidence.

ASTER 2026 H1 Roadmap/Source: docs.asterdex.com

ASTER 2026 H1 Roadmap/Source: docs.asterdex.com

As Aster celebrates this holder milestone amid robust trading volumes, it underscores the platform’s appeal in a maturing DeFi sector: a community that not only holds but actively “shows up” to trade and build. In the evolving perp DEX wars, Aster’s trajectory signals sustained momentum into 2026 and beyond.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.