Commercial Metals Expected To Announce Increased Q1 Profits; Top Analysts Update Projections Before Earnings Announcement

Commercial Metals Company Set to Announce Q1 Earnings

Commercial Metals Company (NYSE: CMC) is scheduled to unveil its first-quarter financial results before markets open on Thursday, January 8, 2025.

Market analysts anticipate that the company, headquartered in Irving, Texas, will post earnings of $1.54 per share for the quarter, a significant increase from $0.78 per share reported during the same period last year. Revenue is projected to reach $2.05 billion, up from $1.91 billion a year ago.

On January 5, CMC declared a quarterly dividend of $0.18 per share.

Shares of Commercial Metals closed at $72.69 on Monday, reflecting a 1.3% gain.

Analyst Ratings and Insights

For those interested in the latest analyst perspectives, Benzinga offers a comprehensive Analyst Stock Ratings page, where you can filter by ticker, company, analyst, rating changes, and more.

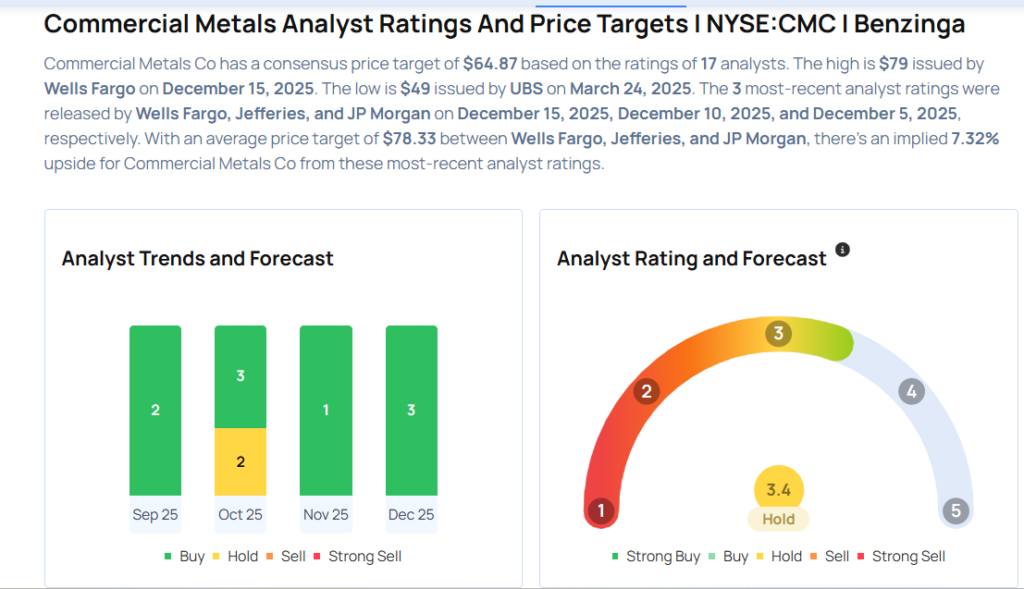

Here’s a summary of recent analyst actions for CMC:

- Timna Tanners from Wells Fargo reaffirmed an Overweight rating and increased the price target from $68 to $79 on December 15, 2025 (accuracy rate: 71%).

- Christopher LeFemina at Jefferies upgraded CMC from Hold to Buy, raising the price target from $70 to $78 on December 10, 2025 (accuracy rate: 71%).

- Bill Peterson of JP Morgan upgraded the stock from Neutral to Overweight, with a price target boost from $64 to $78 on December 5, 2025 (accuracy rate: 57%).

- Piyush Sood at Morgan Stanley moved the rating from Equal-Weight to Overweight and lifted the target from $57.50 to $68 on October 24, 2025 (accuracy rate: 73%).

- Mike Harris of Goldman Sachs maintained a Buy rating and raised the target from $69 to $76 on October 23, 2025 (accuracy rate: 73%).

Thinking about investing in CMC? Here’s what the experts are saying:

Further Reading

- How to Generate $500 Monthly from Jefferies Financial Stock Before Q4 Earnings

Image credit: Shutterstock

CMC Stock Overview

Name: Commercial Metals Co

Latest Price: $74.47

Change: +2.45%

Market news and data provided by Benzinga APIs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 3 Buyers Win Every Week With Milk Mocha Coin – Why Smart Buyers Call $HUGS the Best Crypto to Buy

Ethereum L2 Fee Revenue Consolidates: Base Leads, Arbitrum, and Starknet Follow

AI Crypto Coins 2026: $Grass Struggles as Kite Picks, But DeepSnitch AI Offers a Life-Changing Opportunity to Turn $1,000 into $200k

Experienced Analyst Dan Tapiero Reveals Bitcoin Price Prediction: ‘If I Had $10,000, I Would Split It Between These Three’