What's Influencing Investor Sentiment Toward Vale SA?

Vale SA's Short Interest Sees Notable Increase

Recently, Vale SA (NYSE: VALE) has experienced a 14.01% rise in short interest as a percentage of its float since the previous update. Data from the exchange indicates that 76.48 million shares are currently sold short, representing 1.79% of the total shares available for public trading. At the current trading volume, it would take investors an average of 1.91 days to cover all short positions.

Understanding the Significance of Short Interest

Short interest refers to the total number of shares that have been sold short but have not yet been repurchased or closed. Short selling involves selling borrowed shares with the expectation that the stock price will decline. If the price drops, traders can buy back the shares at a lower cost and profit from the difference. Conversely, if the price rises, losses can occur.

Monitoring short interest is valuable because it provides insight into how investors feel about a stock. A higher short interest often suggests a more pessimistic outlook, while a decrease may indicate growing optimism among traders.

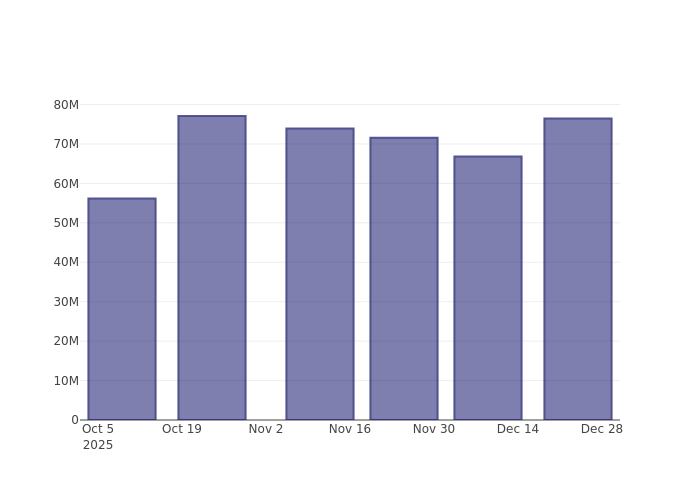

Three-Month Trend: Vale SA Short Interest

The chart above illustrates the upward trend in Vale SA's short interest over the past three months. While this increase does not guarantee a near-term decline in the stock price, it is a development that market participants should keep in mind.

How Vale SA's Short Interest Compares to Its Industry Peers

Comparing a company's short interest to that of similar firms is a common strategy used by analysts and investors to assess performance. Peers are typically companies with comparable industry focus, size, age, or financial structure. Peer groups can be identified through company filings or independent analysis.

According to Benzinga Pro, the average short interest as a percentage of float among Vale SA's peers is 6.27%. This means Vale SA currently has a lower short interest than most companies in its peer group.

Can Rising Short Interest Be a Positive Signal?

It's worth noting that a growing short interest can sometimes be a bullish indicator for a stock.

This article was produced using Benzinga's automated content platform and reviewed by an editor.

Vale SA Stock Snapshot

- Symbol: VALE

- Company Name: Vale SA

- Current Price: $14.10

- Change: +3.98%

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI Crypto Coins 2026: $Grass Struggles as Kite Picks, But DeepSnitch AI Offers a Life-Changing Opportunity to Turn $1,000 into $200k

Experienced Analyst Dan Tapiero Reveals Bitcoin Price Prediction: ‘If I Had $10,000, I Would Split It Between These Three’

Politician Gilbert Cisneros Recently Sold Shares of Cameco. Is It Time for You to Do the Same?

A business that scales with the value of intelligence