Top Wall Street analysts adjust their outlook for Tilray Brands prior to Q2 earnings report

Tilray Brands Set to Announce Q2 Earnings

Tilray Brands, Inc. (NASDAQ: TLRY) is scheduled to disclose its second-quarter financial results following the market close on Thursday, January 8, 2025.

Market analysts anticipate that the Canadian firm, headquartered in Leamington, will post a quarterly loss of $0.20 per share, a deeper loss compared to the $0.03 per share reported during the same period last year. Revenue projections for the quarter stand at $210.95 million, matching the figure from the previous year, according to data.

In December, President Donald Trump signed an executive order aimed at expediting the reclassification of marijuana to a Schedule III controlled substance, following years of regulatory delays.

Tilray Brands' stock price declined by 2.5%, closing at $9.26 on Tuesday.

For the most recent analyst opinions, readers can visit the Analyst Stock Ratings page, where ratings can be filtered by ticker, company, analyst, rating changes, and more.

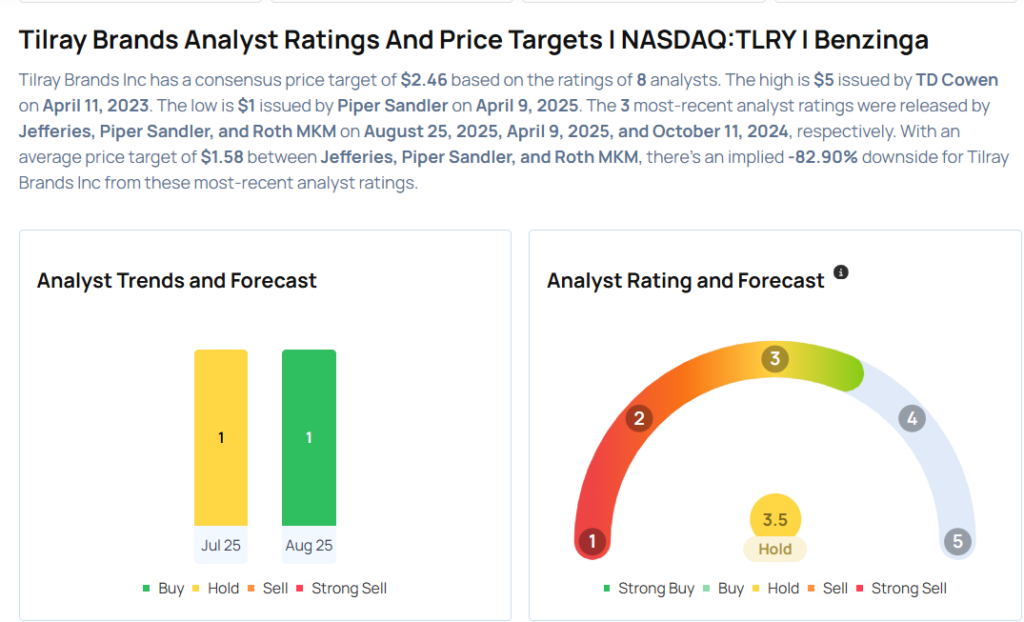

Recent Analyst Ratings for Tilray Brands

- Pablo Zuanic from Zelman & Associates reiterated a Neutral stance on July 29, 2025, with an accuracy rate of 52%.

- Michael Lavery at Piper Sandler also maintained a Neutral rating on April 9, 2025, and reduced the price target from $2 to $1. Lavery’s accuracy rate is 63%.

Thinking about investing in TLRY? Here’s what the experts are saying:

Further Reading

- How to Generate $500 Monthly from TD Synnex Stock Before Q4 Results

Image credit: Shutterstock

Market news and data provided by Benzinga APIs

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

China tech stocks outperform global peers on self‑sufficiency story despite slow economic growth

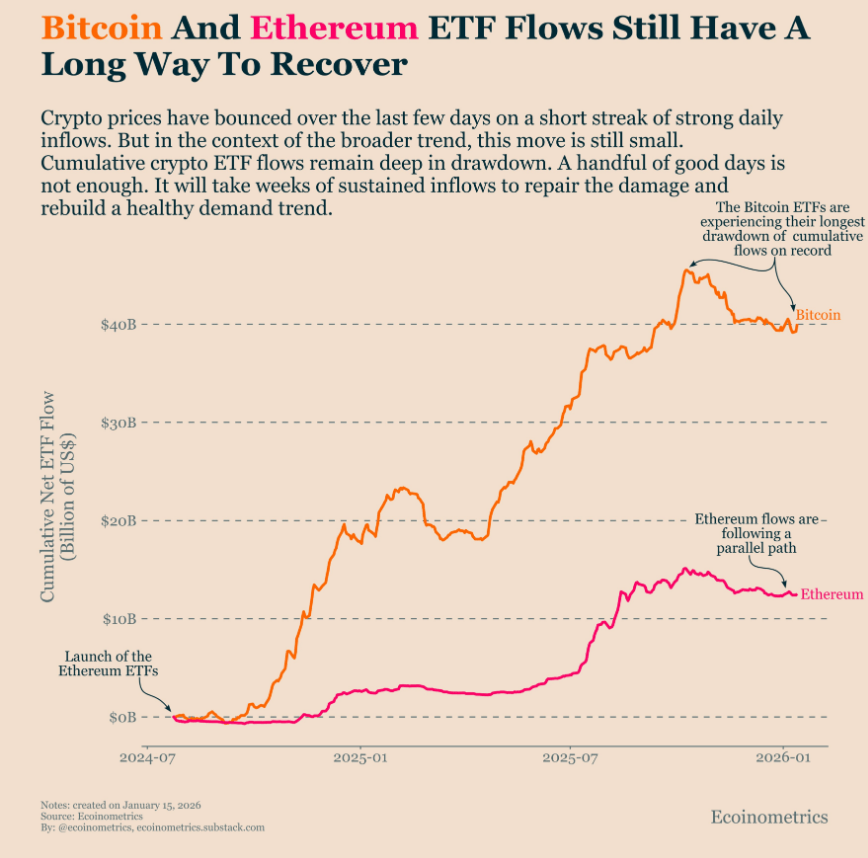

XRP price forms a double-bottom as weekly ETF inflows jump 47%

China’s Latest Surge in Tech Stocks Signals a Shift Away from Economic Slowdown

What’s Driving The $1.42 Billion Comeback In Spot Bitcoin ETFs?