Ripple rules out IPO for now, prioritises growth and integration after $500M raise

Quick Breakdown

- Ripple says it has no timeline for an IPO, citing strong private funding and capital flexibility.

- The firm raised $500 million in 2025 at a $40 billion valuation, drawing major TradFi and crypto investors.

- Focus has shifted from acquisitions to integration, alongside stablecoin growth and XRPL upgrades.

Ripple has no immediate plans to go public, opting instead to stay private as it focuses on scaling operations and integrating a wave of recent acquisitions.

The comments were made by Ripple President Monica Long during a Bloomberg Crypto aired on January 6, where she said the company is not under pressure to seek public market funding given its strong financial position.

Source:

Bloomberg

Source:

Bloomberg

Strong balance sheet eases pressure to list

Long said Ripple typically would consider an IPO to raise capital or improve liquidity, but those factors are not driving decisions right now. According to her, the company is already well capitalized and can fund its growth without entering public markets.

In November 2025, Ripple raised $500 million in a private funding round that valued the firm at around $40 billion. Long said management was “very pleased” with the outcome, noting that the fresh capital provides flexibility without the regulatory and performance pressures that come with being a public company.

The valuation represented a significant jump from earlier benchmarks, including an implied $11.3 billion valuation tied to a share buyback earlier in 2025. The funding round drew a mix of traditional finance and crypto-native investors, including Fortress Investment Group, Citadel Securities, Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace.

Rather than preparing for a listing, Long said Ripple’s leadership is focused on execution, particularly integrating acquisitions and expanding its payments and stablecoin businesses.

Acquisition spree shifts focus to integration

Ripple spent much of 2025 building out institutional infrastructure through a series of high-profile acquisitions.

The largest was its $1.25 billion purchase of prime broker Hidden Road, announced in April and completed in October. The deal made Ripple the first crypto-native firm to own a global, multi-asset prime broker offering trading, financing, and clearing across digital assets and foreign exchange.

Other transactions included the $1 billion acquisition of GTreasury in October, pushing Ripple into corporate treasury management, and the $200 million purchase of payments platform Rail in August. Ripple also added custody firm Palisade later in the year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana ETF Flows and Whale Moves Hint at Bullish Potential

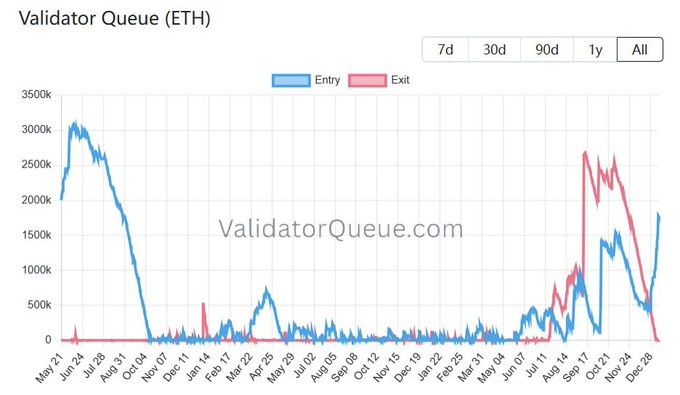

Ethereum’s Validator Entry Queue Hits $5.5B, Marking Highest Level Since August 2023

Solana Low-Cap Tokens See Rising Smart Money Interest

What the Market Misunderstands about Renewable Energy