Are Your Housing Costs Too High? Home Loan Patterns Across Different Age Groups

Who Can Buy a Home in Today's Market?

We examine the current landscape to see who is able to purchase a home in the present climate.

Summary Points

- The 28/36 rule is a helpful guideline to assess home affordability.

- Experts recommend keeping your mortgage at no more than two to three times your household's annual income.

- Median mortgage amounts are generally only manageable for couples, regardless of age group.

Purchasing a home is a significant milestone, whether you're seeking more space, a long-term investment, or a place to personalize. It's essential, however, to ensure the cost fits within your financial means.

There are several strategies to evaluate if a home is within your budget. One common method is the 28/36 rule. Another approach is to limit your mortgage to no more than two or three times your annual gross income.

But how does this play out for the average American? Is the median mortgage truly affordable? Let's break down what people are actually paying for their mortgages, both in total and on a monthly basis.

Determining Your Homebuying Budget

To figure out what you can realistically afford, start by multiplying your monthly pre-tax income by 28%. This figure represents the highest monthly mortgage payment you should consider.

Next, multiply your monthly gross income by 36%. This is the maximum amount you should allocate to all debts combined, including your mortgage, car loans, student loans, and other obligations.

Another traditional rule suggests your total mortgage (including principal, interest, property taxes, and insurance) should not exceed two to three times your annual gross income. For example, if your household earns $150,000 per year, your mortgage should fall between $300,000 and $450,000.

It's important to note that while many lenders may approve conventional mortgages with a debt-to-income ratio as high as 45%, this level of debt may be unmanageable for many families.

Affordability Analysis: Income Versus Total Mortgage Amount

Below is the median annual income for individuals in the U.S., categorized by age group:

- 16–24 years: $40,056 annually ($3,338 monthly)

- 25–34 years: $59,760 annually ($4,980 monthly)

- 35–44 years: $71,964 annually ($5,997 monthly)

- 45–54 years: $71,544 annually ($5,962 monthly)

- 55–64 years: $68,688 annually ($5,724 monthly)

- 65 and older: $61,992 annually ($5,166 monthly)

Based on the guideline of keeping your mortgage between two and three times your income, here are the suggested borrowing limits for both single earners and couples in each age group:

- 16–24 years: $80,112–$120,168 ($160,224–$240,336 for couples)

- 25–34 years: $119,520–$179,280 ($239,040–$358,560 for couples)

- 35–44 years: $143,928–$215,892 ($287,856–$431,784 for couples)

- 45–54 years: $143,088–$214,632 ($286,176–$429,264 for couples)

- 55–64 years: $137,376–$206,064 ($274,752–$412,128 for couples)

- 65 and older: $123,984–$185,976 ($247,968–$371,952 for couples)

Median Mortgage Amounts by Generation

Here's a look at the median mortgage amounts for different generations:

| Age Group | Median Mortgage | Affordable for Individuals? | Affordable for Couples? |

|---|---|---|---|

| Under 35 | $250,000 | No | Only 25–34 |

| 35–44 | $350,000 | No | Yes |

| 45–54 | $380,000 | No | Yes |

| 55–64 | $350,000 | No | Yes |

| 65–74 | $320,000 | No | Yes |

| 75+ | $286,000 | No | Yes |

The data shows that single earners in every age bracket typically cannot afford the median mortgage. Couples, however, can generally manage these payments, except for those younger than 25.

Affordability Check: Income Versus Monthly Mortgage Payment

Let’s evaluate how much of their monthly income Americans can reasonably spend on a mortgage. The general recommendation is to keep your mortgage payment at or below 28% of your gross monthly income.

Based on the income data above, here are the maximum suggested monthly mortgage payments by age group:

- 16–24 years: $934 per month ($1,868 for couples)

- 25–34 years: $1,294 per month ($2,588 for couples)

- 35–44 years: $1,679 per month ($3,358 for couples)

- 45–54 years: $1,669 per month ($3,338 for couples)

- 55–64 years: $1,603 per month ($3,206 for couples)

- 65 and older: $1,446 per month ($2,892 for couples)

Comparing these limits to actual mortgage payments, it's clear that most single-income households are stretched thin. However, couples with two incomes are generally able to afford the typical mortgage, except in the youngest age group.

For most Americans, sharing the financial responsibility with a partner is the only way to make a standard mortgage payment manageable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

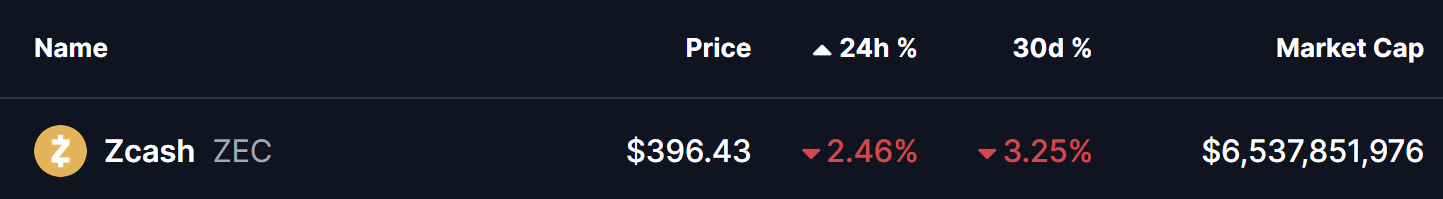

Is Zcash (ZEC) In Bears Control? This Emerging Bearish Pattern Formation Suggest So!

South Korea to negotiate with the US for favourable chip tariff terms, official says

Weekly Highlights Propel Cryptocurrency Trends