- Bitcoin faces its biggest ETF outflow since November.

- Crypto market drops 2.6% in 24 hours with $440M in liquidations.

- Investor sentiment falls to ‘Fear’ as prices move sideways.

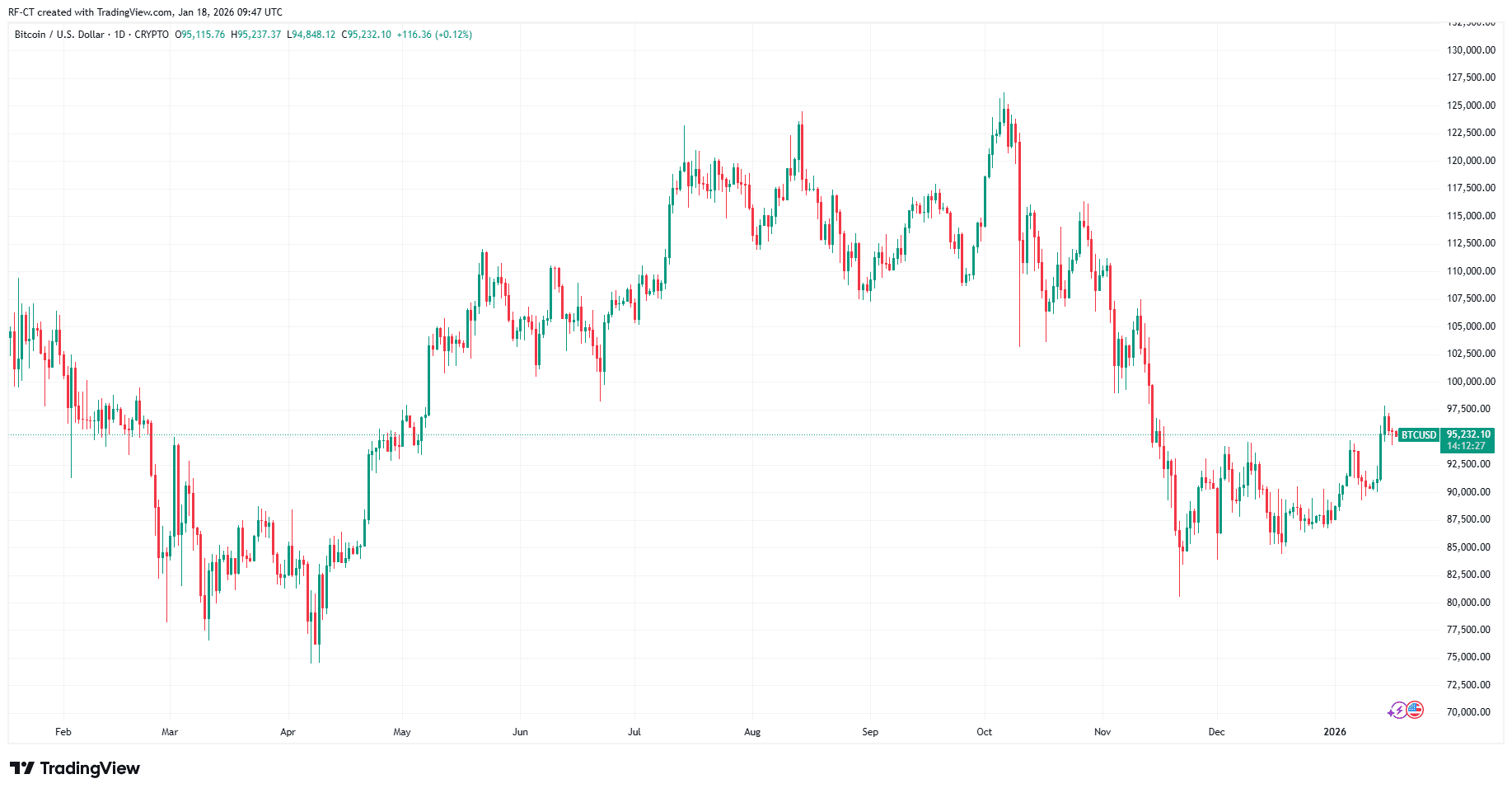

The cryptocurrency market experienced a sharp decline over the past 24 hours, falling 2.6% in total market cap. Bitcoin led the drop with a 2.64% decrease, now trading at $90,215, while Ethereum saw an even steeper fall of 4.08%, sitting at $3,119.

What triggered the market dip was a significant event—Bitcoin ETF outflows hit $486 million, the largest daily outflow since November. This level of capital flight from institutional Bitcoin products is often a signal of growing caution or profit-taking among big players.

Investor Sentiment Shifts to Fear

The Fear & Greed Index (FGI), which gauges market sentiment, dropped from 28 to “Fear,” indicating a shift in investor mood. This aligns with a general market slowdown, as trading appears directionless and dominated by rotation among major altcoins without any fresh catalysts.

In addition to the ETF outflows, over $440 million in leveraged positions were liquidated across exchanges in just one day. This mass unwinding of positions adds more pressure to prices, causing further hesitancy among traders.

Sideways Movement, No Clear Trend

Despite the sharp moves, Bitcoin and other major assets are now trading sideways. This typically points to market indecision. Investors seem to be waiting for a new catalyst—whether macroeconomic data, regulatory news, or a shift in institutional flows—to drive the next big move.

For now, the focus remains on how Bitcoin ETF trends develop in the coming days and whether confidence can return to push the market out of its current limbo.

Read Also :

- Bitcoin ETF Outflows Hit $486M Amid Market Dip

- Solana Stablecoin Market Cap Hits $15B ATH

- XRP ETFs See $40.8M Outflow After 36-Day Streak

- Wintermute Signals BTC $100K Upside With $13M Call Flow

- Liquidations Spike as $156M Wiped Out in 4 Hours