How is Waste Management Inc. Perceived by the Market?

Waste Management Inc: Recent Trends in Short Interest

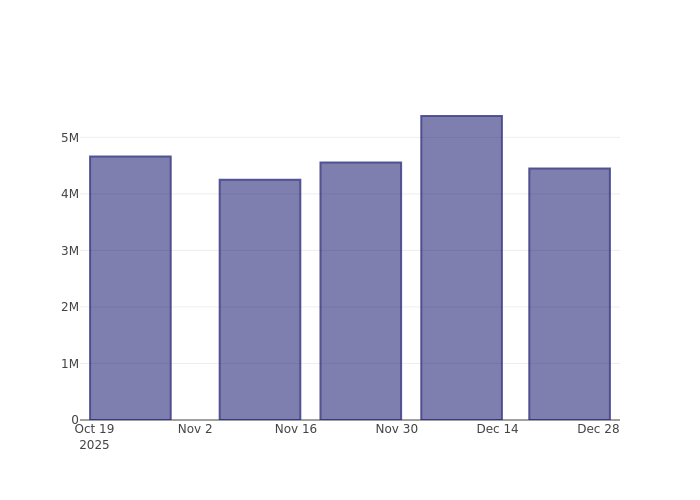

Waste Management Inc (NYSE: WM) has experienced a notable decrease in short interest, dropping by 17.16% since the previous report. Current data shows that 4.45 million shares are being held short, which accounts for 1.11% of the company’s available shares for trading. Based on recent trading activity, it would take traders an average of 2.12 days to cover these short positions.

Understanding the Significance of Short Interest

Short interest refers to the total number of shares that have been sold short but have not yet been repurchased or closed. When investors engage in short selling, they are betting that a stock’s price will decline, allowing them to buy back shares at a lower price for a profit. If the stock price rises, however, short sellers incur losses.

Monitoring short interest is valuable because it offers insight into investor sentiment. A rising short interest typically signals growing pessimism about a stock, while a decline suggests increasing optimism among investors.

Short Interest Trends for Waste Management Inc (Last 3 Months)

The chart above illustrates that the percentage of Waste Management Inc shares sold short has declined since the last update. While this does not guarantee an imminent price increase, it does indicate that fewer investors are betting against the stock at this time.

How Does Waste Management Inc Compare to Its Industry Peers?

Analysts and investors often compare a company’s performance to similar businesses—known as peers—which share characteristics such as industry, size, and financial structure. Peer groups can be identified through company filings or independent analysis.

According to Benzinga Pro, the average short interest as a percentage of float among Waste Management Inc’s peers is 5.22%. This means Waste Management Inc currently has a lower short interest than most comparable companies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A 12-year Bitcoin OG is selling – But the market isn’t panicking

Mark Cuban's investment has played a significant role in reshaping Indiana's football program

Europe is once again facing a fresh and even more intense dispute over tariffs

Bitcoin OG Offloads 2,500 $BTC Amid US-Iran Tension