What Are Investors' True Sentiments Toward Oracle Corp?

Oracle Corp Short Interest Update

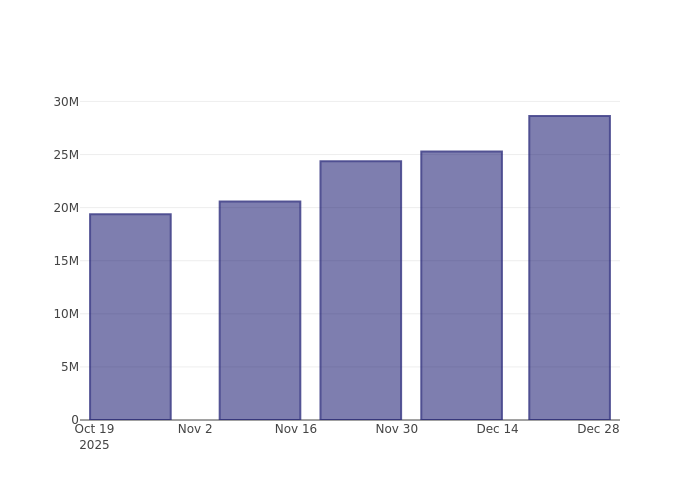

Recent data shows that Oracle Corp (NYSE: ORCL) has experienced an 11.33% increase in short interest as a percentage of its float since the previous report. Currently, there are approximately 28.63 million shares being shorted, representing 1.67% of the total shares available for public trading. Based on the current trading volume, it would take traders an average of one day to cover all short positions.

Understanding Short Interest

Short interest refers to the total number of shares that have been sold short but have not yet been repurchased or closed. In short selling, investors sell shares they do not own, anticipating a decline in the stock price. If the price drops, short sellers can profit; if it rises, they incur losses.

Monitoring short interest is valuable because it provides insight into market sentiment toward a particular stock. A rising short interest often indicates growing pessimism among investors, while a decline suggests increasing optimism.

Oracle Corp Short Interest Trends (Last 3 Months)

The chart above illustrates that the percentage of Oracle Corp shares sold short has increased since the last report. While this does not guarantee an imminent decline in the stock price, it is important for traders to note the uptick in shorted shares.

How Oracle Corp Compares to Its Industry Peers

Comparing a company to its peers is a common method for analysts and investors to assess performance. Peers are typically companies with similar industry focus, size, age, and financial characteristics. Peer groups can be identified through company filings or independent analysis.

According to Benzinga Pro, the average short interest as a percentage of float among Oracle Corp’s peers is 6.24%. This indicates that Oracle Corp has a lower short interest compared to most companies in its peer group.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Monday open indicative forex prices, 19 Jan 2026. 'Risk' lower on Trump's latest trade war

BitMine Leadership Just Responded After Contentious Shareholder Meeting

Brandt Issues Extremely Bearish Altcoin Warning