Examining the Latest Short Interest in Cadence Design Systems Inc

Cadence Design Systems Inc: Recent Short Interest Trends

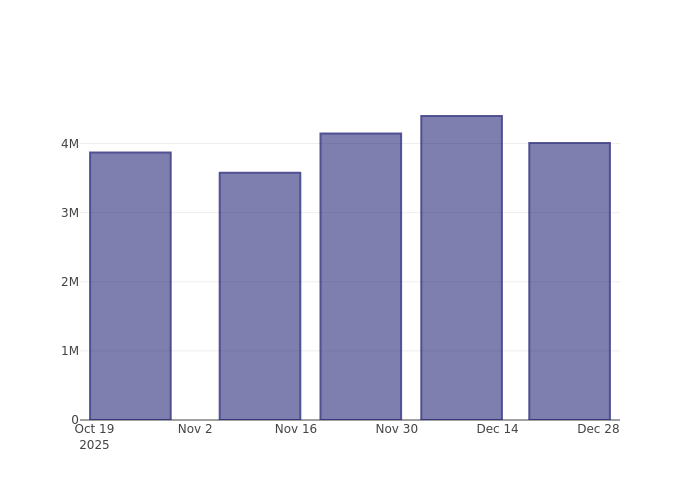

Cadence Design Systems Inc (NYSE: CDNS) has experienced an 8.74% decrease in short interest as a percentage of its float since the previous report. Latest exchange data shows that 4.01 million shares are currently sold short, representing 1.67% of the total shares available for trading. At the current trading volume, it would take an average of 2.71 days for traders to cover all short positions.

Understanding Short Interest

Short interest refers to the total number of shares that have been sold short but have not yet been repurchased or closed. Short selling is a strategy where investors sell shares they do not own, anticipating a decline in the stock's price. If the price drops, short sellers can profit; if it rises, they incur losses.

Monitoring short interest is valuable because it provides insight into investor sentiment for a particular stock. A rise in short interest may indicate growing pessimism among investors, while a decline could suggest increasing optimism.

Short Interest Over the Past Three Months

The chart above illustrates that the proportion of Cadence Design Systems Inc shares sold short has decreased since the last update. While this does not guarantee an imminent price increase, it does indicate that fewer shares are being shorted at present.

How Cadence Design Systems Inc Compares to Its Peers

Analysts and investors often compare companies to their peers—businesses with similar industry focus, size, age, and financial structure—to evaluate performance. Peer groups can be identified through regulatory filings or independent research.

According to Benzinga Pro, the average short interest as a percentage of float among Cadence Design Systems Inc’s peers is 3.71%. This means Cadence Design Systems Inc currently has lower short interest than most comparable companies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Monero (XMR) Surges Amid $282M Social Engineering Scam

Moxie Marlinspike offers a ChatGPT alternative that prioritizes user privacy

Bitcoin Long Signal That Preceded 370% Move Is About To Go Off Again — What To Know

Next Crypto to Explode: DeepSnitch AI Crushes XAI And GLMR With 100x Upside As Belgium Banking Giant Fuels Bull Run