What's Influencing Investor Sentiment Toward NioCorp Developments Ltd?

NioCorp Developments Ltd: Recent Short Interest Update

NioCorp Developments Ltd (NYSE: NB) has experienced a 3.82% decrease in its short interest as a percentage of float since the previous report. Current exchange data shows that there are now 6.87 million shares sold short, representing 6.05% of the total shares available for trading. At the current trading volume, it would take traders an average of 1.84 days to cover all short positions.

Understanding Short Interest

Short interest refers to the total number of shares that have been sold short but have not yet been repurchased or closed. Short selling occurs when an investor sells shares they do not own, anticipating a decline in the stock's price. If the price drops, the trader profits; if it rises, they incur a loss.

Monitoring short interest is valuable because it provides insight into market sentiment regarding a particular stock. A rise in short interest often indicates growing pessimism among investors, while a decline suggests increasing optimism.

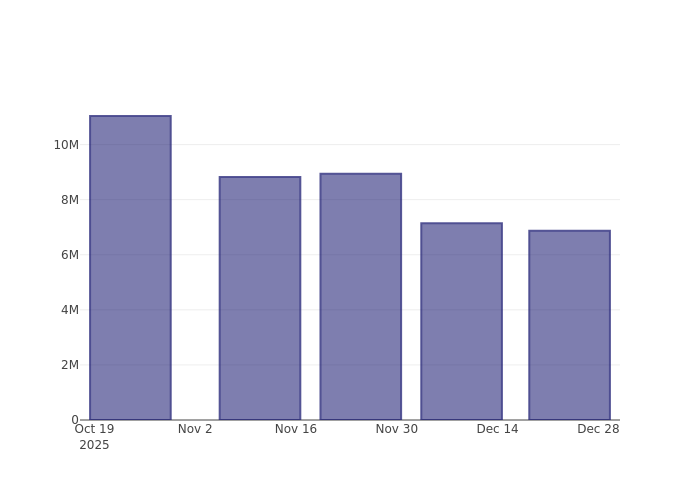

Short Interest Trends for NioCorp Developments Ltd (Last 3 Months)

The chart above illustrates that the proportion of NioCorp Developments Ltd shares sold short has declined since the last update. While this does not guarantee an imminent price increase, it does indicate that fewer shares are currently being shorted.

How Does NioCorp's Short Interest Compare to Its Peers?

Comparing a company to its peers is a common strategy for analysts and investors to assess performance. Peer companies typically share similar traits, such as industry, size, age, and financial structure. Peer groups can be identified through company filings or independent analysis.

According to Benzinga Pro, the average short interest as a percentage of float among NioCorp’s peer group is 6.04%. This means NioCorp Developments Ltd currently has a slightly higher short interest than most of its comparable companies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Weekly Highlights Propel Cryptocurrency Trends

Google search traffic to news sites plunges by one-third globally

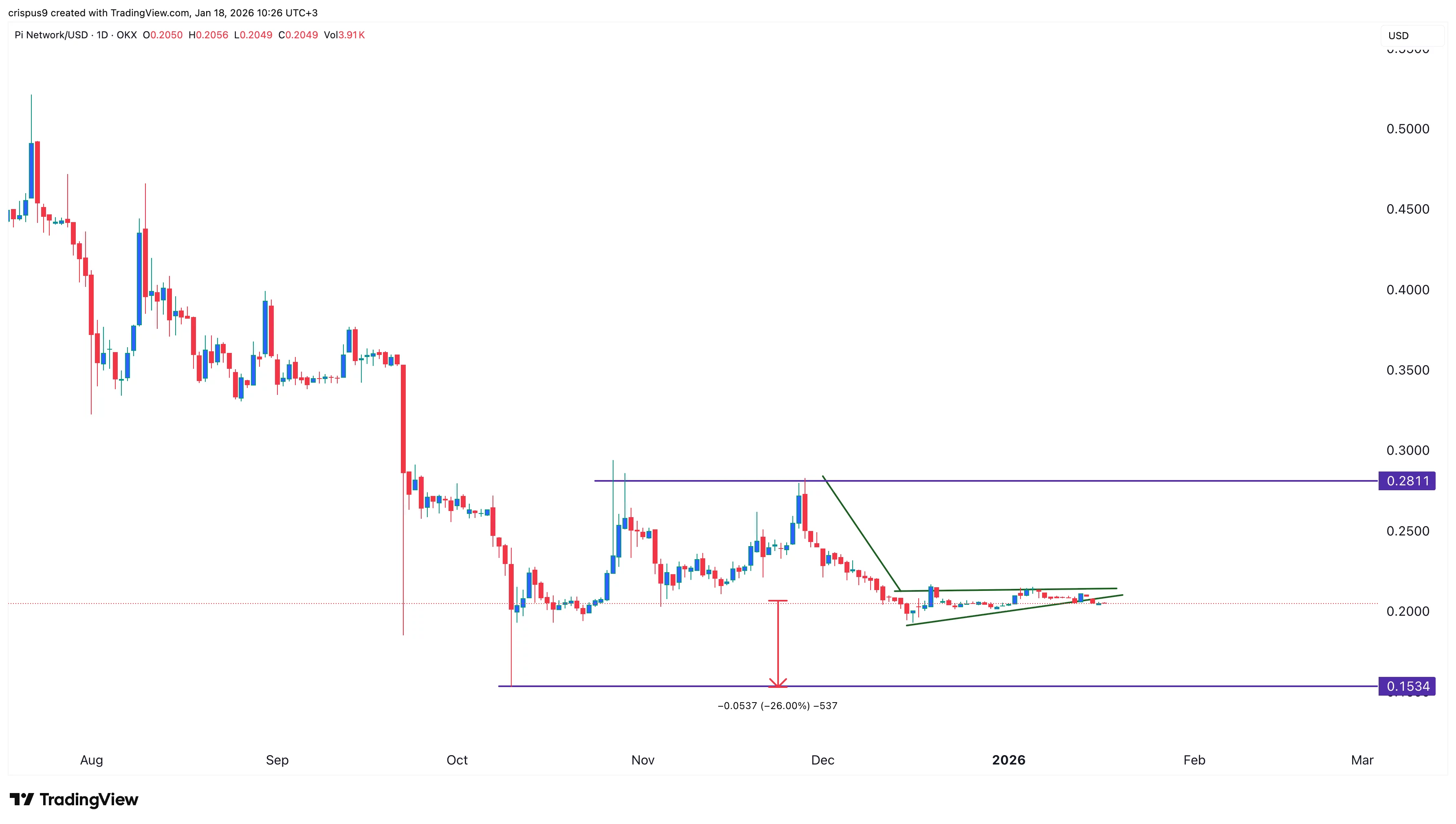

Pi Network price remains calm: will it rebound or crash?

Outrageous levels of student debt are putting immense pressure on the UK’s economy