Is The Home Depot Inc Experiencing Increased or Decreased Backing in the Market?

Rising Short Interest in The Home Depot Inc

The Home Depot Inc (NYSE: HD) has experienced an 11.96% increase in short interest as a percentage of its float since the previous report. Recent exchange data reveals that 10.22 million shares are currently held in short positions, representing 1.03% of the total shares available for trading. At the current trading volume, it would take traders an average of 1.98 days to cover these short positions.

Understanding Short Interest

Short interest refers to the total number of shares that have been sold short but have not yet been repurchased or closed. Short selling involves borrowing and selling shares in anticipation that their price will decline, allowing traders to profit if the stock’s value drops. Conversely, if the stock price rises, those holding short positions incur losses.

Monitoring short interest is valuable because it provides insight into investor sentiment regarding a particular stock. A rise in short interest typically indicates growing pessimism among investors, while a decline suggests increasing optimism.

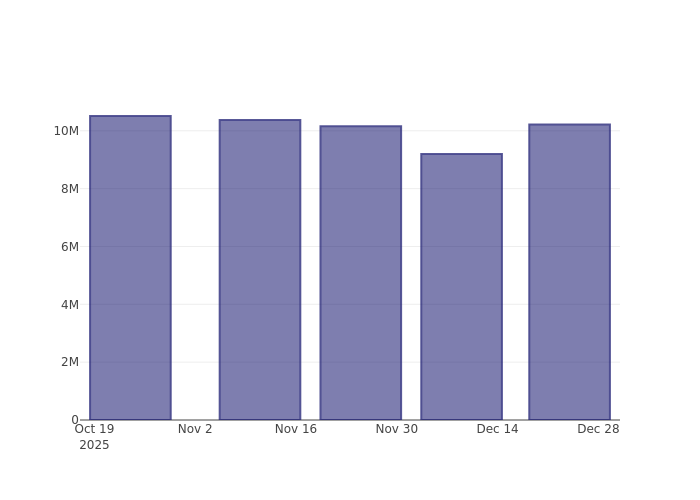

Short Interest Trends for The Home Depot Inc (Last 3 Months)

The chart above illustrates that the proportion of The Home Depot Inc shares sold short has increased since the last reporting period. While this does not necessarily predict an imminent decline in the stock’s price, it does indicate that more investors are betting against the stock.

How The Home Depot Inc Compares to Its Peers

Analysts and investors often use peer comparison to evaluate a company’s performance. Peers are companies with similar characteristics, such as industry, size, age, and financial structure. Peer groups can be identified through company filings or independent analysis.

According to Benzinga Pro, the average short interest as a percentage of float among The Home Depot Inc’s peers is 21.60%. This means The Home Depot Inc has a lower level of short interest compared to most companies in its peer group.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A business that scales with the value of intelligence

NEAR and BGB Sit Idle While BlockDAG’s $0.001 Presale Enters Its Final Countdown

From $0.001 to $0.05: Here’s How BlockDAG’s Locked ROI is Crushing Render & Bonk This Week!

Trump EU Tariffs 2026: Will Bitcoin Price Sink or Soar?