Looking at the Latest Short Interest Activity for Gap Inc

Gap Inc Short Interest Update

Gap Inc (NYSE: GAP) has seen its short interest as a percentage of float decrease by 8.53% since the previous report. Recent exchange data shows that there are now 18.48 million shares sold short, representing 9.11% of the company’s available shares for trading. At current trading volumes, it would take traders an average of 2.38 days to cover all short positions.

Understanding Short Interest

Short interest refers to the total number of shares that have been borrowed and sold by traders but have not yet been repurchased or closed. Short selling is a strategy where investors sell shares they do not own, aiming to buy them back at a lower price if the stock declines. Profits are made if the stock price drops, while losses occur if it rises.

Monitoring short interest is valuable because it provides insight into how investors feel about a stock. Rising short interest often suggests increasing pessimism, while a decline may indicate growing optimism among traders.

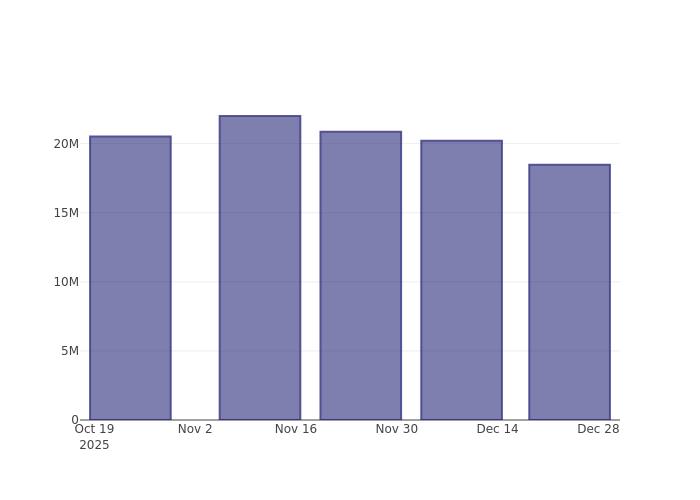

Three-Month Short Interest Trend for Gap Inc

The chart above illustrates that the proportion of Gap Inc shares sold short has dropped since the last update. While this doesn’t guarantee a near-term increase in the stock price, it does indicate that fewer shares are currently being shorted.

How Gap Inc Compares to Its Peers

Analysts and investors often use peer comparisons to evaluate a company’s performance. Peers are typically companies with similar industry backgrounds, size, age, and financial profiles. You can identify a company’s peer group by reviewing its 10-K filings, proxy statements, or conducting your own research.

The average short interest as a percentage of float among Gap Inc’s peers is 15.58%. This means Gap Inc currently has a lower short interest than most comparable companies.

This article was produced by Benzinga’s automated content system and reviewed by an editor.

© 2026 Benzinga.com. All rights reserved. Benzinga does not offer investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump Is Prevailing in the Battle Over Offshore Wind Even After Court Defeats

With a $100M War Chest, Experts Think ZKP Could Eclipse Solana & Sui – A True 5000x Growth Opportunity!

Testnets in Crypto: How To Use Test Networks to Earn Cryptocurrency

Bureaucracy Halts US National Bitcoin Stockpile Initiative