Trump hopes to see oil prices reach $50 per barrel. However, this price point isn't feasible for the US oil sector.

Trump's Target Oil Price and Its Impact on the US Energy Sector

President Trump has reportedly set his sights on bringing US oil prices down to $50 per barrel, aiming to reduce energy expenses for American families. However, this target poses significant challenges for domestic oil producers.

According to the Dallas Federal Reserve, the cost to break even in the Permian Basin—the largest oil-producing region in the continental US—currently ranges from $62 to $64 per barrel. With West Texas Intermediate (WTI) crude oil trading near $57, US oil companies are selling their product for less than it costs to extract it.

One industry participant told the Dallas Fed’s latest energy survey, “Our investment choices are guided by capital efficiency and returns. Should economic conditions deteriorate, drilling and completion operations will halt in 2026.”

Global Oversupply and Price Forecasts

The oil market is currently flooded with excess supply worldwide. The Energy Information Administration (EIA) projects that Brent crude, the global benchmark, will average $55 per barrel in the first quarter of 2026 and remain at that level throughout the year. WTI prices are expected to follow closely, hovering around $51.50 per barrel.

For Trump, these lower prices may be politically advantageous, especially as affordability becomes a top concern for voters ahead of the midterms. On Thursday, the national average price for gasoline in the US was $2.81 per gallon, according to AAA, marking a $0.25 decrease from the previous year and the lowest price since March 2021.

However, the future of Trump’s energy policy remains uncertain and complex.

The Industry at a Critical Juncture

In May, with oil prices at current levels, Travis Stice, executive chair of Diamondback Energy (FANG), warned that the industry was on the brink of a crisis. In a letter to shareholders, Stice noted, “Since 2004, there have only been two quarters—excluding 2020—when oil prices have been this low. We believe US oil production is at a pivotal moment given current commodity prices.”

Even major oil companies like ExxonMobil (XOM), Chevron (CVX), and ConocoPhillips (COP)—which typically manage lower breakeven costs due to their size and diversified operations—are starting to feel the pressure. Exxon and Chevron have set their global breakeven targets for 2030 at about $30 per barrel, a figure that, while below today’s prices, is becoming more attainable as prices fall.

Financial Outlook and Industry Challenges

ExxonMobil recently increased its 2030 projections for both earnings and cash flow by $5 billion each, assuming oil prices remain steady. However, CEO Darren Woods announced that the recent decline in oil prices will reduce the company’s fourth-quarter results by $800 million to $1.2 billion, signaling that lower prices are already affecting profits.

The global oil market is contending with a significant oversupply. Throughout 2025, OPEC members and producers in the Americas have been increasing output, reversing previous production cuts.

Goldman Sachs predicts Brent and WTI prices will average $56 and $52 per barrel, respectively, this year—slightly higher than EIA’s estimates. JPMorgan forecasts Brent at $58 and WTI at $54. As JPMorgan strategists put it, “Despite strong demand, supply remains excessive.”

In response to the Dallas Fed’s third-quarter survey, one exploration and production firm noted that if the administration continues to push for $40 per barrel crude, drilling activity will vanish, leading to further job losses in the industry.

International Perspective and Future Outlook

Trump has also expressed interest in encouraging US companies to return to Venezuela and invest in reviving its oil sector. However, breakeven costs in Venezuela’s Orinoco Belt are even higher than in the US, averaging over $80 per barrel, according to Reuters.

There is some optimism for the future: analysts expect prices to recover in 2027 and 2028, with Goldman Sachs projecting Brent and WTI to reach $80 and $76 per barrel, respectively, by 2028 as the market adjusts to oversupply.

Until then, the push for lower oil prices may benefit American consumers at the pump but will likely strain the US energy industry.

As one Dallas Fed respondent observed, “The narrative that gasoline and crude oil prices are excessively high and inflationary overlooks the minimal impact on consumers and ignores the reality of real prices over the past two decades.” Another added, “Regardless, industry costs continue to rise.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Long Signal That Preceded 370% Move Is About To Go Off Again — What To Know

Next Crypto to Explode: DeepSnitch AI Crushes XAI And GLMR With 100x Upside As Belgium Banking Giant Fuels Bull Run

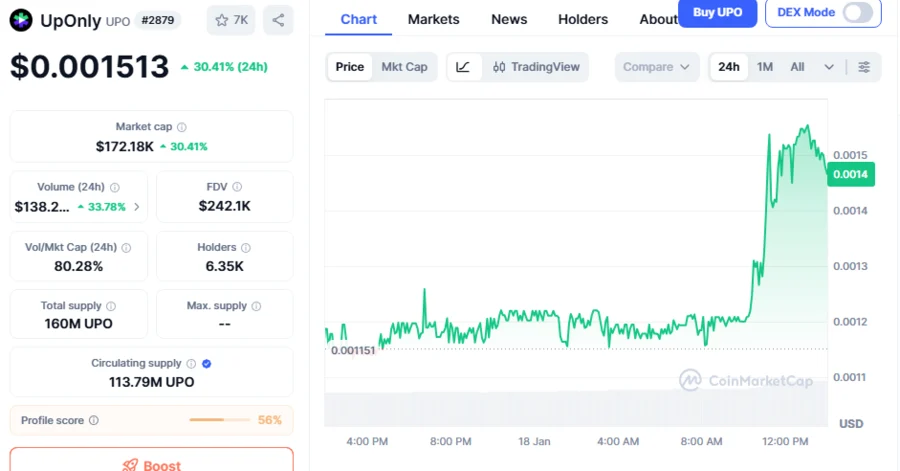

UPO Climbs Above $0.001500, Sets to Explode Amid Incoming Mega Pump, Whale Accumulation: Analyst

Ethereum staking just hit a $118B record at 30% of all coins, but one whale might be skewing the signal