MSCI’s Move on MicroStrategy Is Rattling Bitcoin Markets | US Crypto News

By:BeInCrypto

Welcome to the US Crypto News Morning Briefingyour essential rundown of the most important developments in crypto for the day ahead. Grab a coffee, settle in, and brace yourself, because while MSCIs cap on new MSTR shares has removed an important automatic buying mechanism, the market is far from entirely constrained. Todays US Crypto News highlights the ongoing tension between TradFi and the digital asset ecosystem. Crypto News of the Day: Max Keiser Explains Why the MSCI MSTR Cap Isnt What It Seems Bitcoins muted response to MSCIs recent index decision has sparked a debate among investors, analysts, and crypto commentators over whether the market is structurally constrained or quietly manipulated. The latest changes to MSCIs treatment of crypto-heavy treasury companies, such as MicroStrategy (MSTR), have removed a key source of passive buying. Yet, prominent voices like Max Keiser insist the impact may be overstated. MSCI will no longer include newly issued shares from companies such as MSTR in its indexes. Previously, large index funds were automatically required to purchase these shares, creating consistent buying pressure. Under the new rules, that automatic demand disappears, reducing dilution-driven capital inflows and muting short-term market reactions. Why is Bitcoin not pumping on MSCI news?MSCI has announced not to remove Bitcoin and crypto treasury companies from its indexes.But they have added a new rule.When treasury companies issue new shares, MSCI will not add those extra shares to its indexes.Earlier, when Ted (@TedPillows) January 7, 2026 However, Bitcoin pioneerMax Keiser dismissed the MSCI cap, pointing out that forced buying still occurs when MSTR stock rises in tandem with Bitcoin. The cap by MSCI to exclude new MSTR shares in its weighting is a nothing burger. Forced buying is still triggered when Bitcoin-heavy MSTR stock price increases, Keiser assured. While this suggests that the reflexive upside is not entirely dead, the dampening effect on automatic index-driven flows cannot be ignored. Market Suppression Concerns Against this backdrop, analysts warn that MSCIs new rules freeze potential upside without explicitly banning MSTR. Yes up to their old tricks.Yes MSTR is allowed to stay in the MSCI index but under the surface games are still being played to suppress Bitcoin and digital assets. MSCIs move exposes how the status quo still quietly works to suppress Bitcoin and digital assets. By freezing James E. Thorne (@DrJStrategy) January 7, 2026 By limiting passive flows, the change slows the growth of Bitcoin-backed corporate stock and illustrates TradFis broader caution toward crypto adoption. While this may delay Strategys SP 500 inclusion this year, it is still expected to outperform the index, albeit against resistance from entrenched financial powers. I think its clear that Strategy are going to have to win the hard wayI still expect it to outperform the SP 500 this year greatly, but the powers that be will not make it easy, said analyst Zynx. Despite these constraints, Strategy continues to demonstrate capital strength. Adam Livingston highlighted that MSTR recently gained $3.7 billion in premium, leveraging SCALE and mNAV mechanics to efficiently raise capital, increase Bitcoin per share, and strengthen dollar liquidity. Just like that, the market rewards MSTR with $3.7 billion in premium.1.0 mNAV yesterday to 1.06 today.This is one of the benefits of SCALE, tremendous amounts of capital raising possible with small % swings.This can immediately be used to increase Bitcoin per share for MSTR pic.twitter.com/mOYpAlEqpB Adam Livingston (@AdamBLiv) January 7, 2026 Even modest mNAV movements are enabling strategic growth, reflecting the companys resilience. MSCI Index Move Spurs Accusations of Bitcoin Market Manipulation by Institutions Several commentators have painted the sequence of events as a coordinated Wall Street cycle. Quinten Francois, Ash Crypto, and The Crypto Room note that MSCIs October threats, three months of suppressed prices, Morgan Stanleys ETF filings, and the sudden MSCI reversal all align with a pattern: Create fear Induce capitulation Accumulate cheaply, and Profit once the overhang is removed. 🚨 THIS IS HOW WALL STREET STEALS YOUR COINS 🚨1. MSCI threatens index removals Crypto sells off hard and stays suppressed for months2. JP Morgan spreads recycled FUD on Saylor and MSTR Margin requirements raised to 95% Pressure to keep MSTR out of the SP3. BTC Quinten | 048.eth (@QuintenFrancois) January 8, 2026 They highlight potential ties between MSCI (originally a Morgan Stanley division) and JP Morgan, suggesting collusion in spreading FUD and managing exposure. Despite short-term constraints, long-term optimism remains strong. Tim Draper emphasizes 2026 as a breakout year for Bitcoin adoption. 2026 will be big. #Bitcoin goes mainstream. My $250k prediction finally reached. IPO window opens with a $trillion company. Space flight to the moon for passengers. Bio-Cures drive longer lives. Autonomous vehicles move us around the roads and in the air. Amazing! Awesome! Tim Draper (@TimDraper) January 7, 2026 Institutional accumulation and mainstream adoption are expected to sustain eventual upside, even as index mechanics moderate short-term flows. Chart of the Day Bitcoin (BTC) Price Performance. Source: TradingView Byte-Sized Alpha Heres a summary of more US crypto news to follow today: Bitcoin flash crash wipes out $128 million in long positions as price briefly dips below $90,000. World Liberty Financial seeks OCC approval to launch a trust bank for a USD1 stablecoin. Trumps Greenland ambition is already trading on-chain. XRP eyes a 34% breakout as buyers step in But not all demand looks healthy. MSTR sees dip buying amid MSCI reprieve Can this strategy help avoid a 13% dip? Trumps Greenland play could turn the US into the worlds Bitcoin capital. Why is BNB unlikely to see a deep decline in 2026? Crypto Equities Pre-Market Overview CompanyClose As of January 7Pre-Market OverviewStrategy (MSTR)$161.83$160.36 (-0.91%)Coinbase (COIN)$245.93$247.55 (+0.66%)Galaxy Digital Holdings (GLXY)$25.51$25.16 (-1.37%)MARA Holdings (MARA)$10.09$9.96 (-1.24%)Riot Platforms (RIOT)$15.27$15.08 (-1.24%)Core Scientific (CORZ)$16.24$16.14 (-0.62%)Crypto equities market open race:GoogleFinance Read the article at BeInCrypto

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

A $280 Million Bitcoin Heist Leads to Monero Price Rally

BeInCrypto•2026/01/17 15:51

3 Fastest-Growing and Trending Cryptos in 2026 — HBAR, SUI, and ENA

Cryptonewsland•2026/01/17 15:39

Tesla’s AI team creates a patent that addresses AI “drift” in positional encoding

Cointelegraph•2026/01/17 15:36

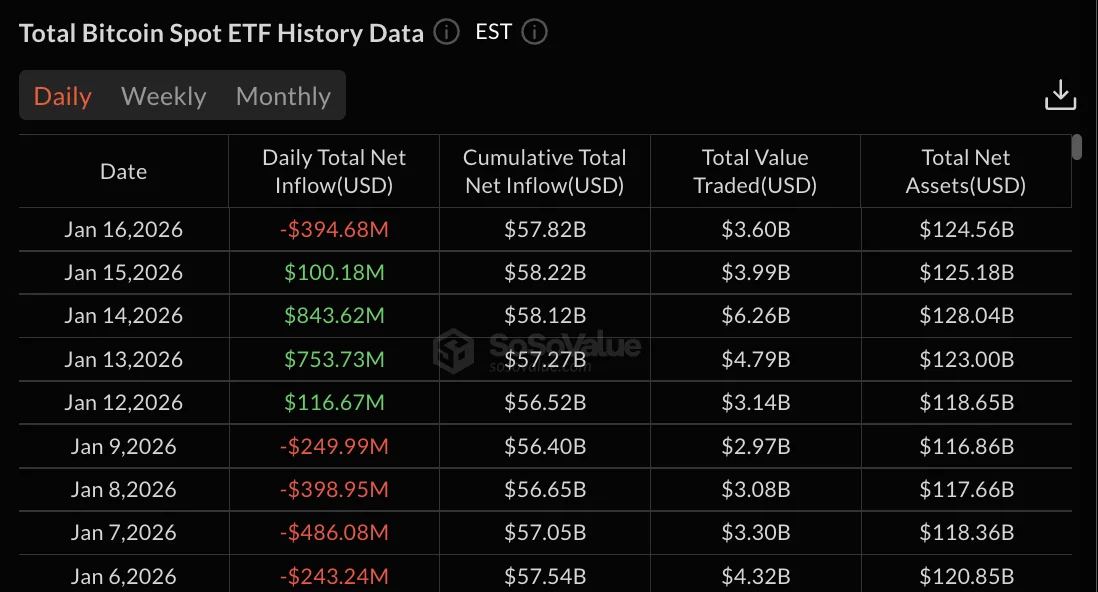

Bitcoin ETFs turn red after four days of inflows, post $394.68M outflow

Crypto.News•2026/01/17 15:30

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$95,505.5

+1.19%

Ethereum

ETH

$3,324.65

+1.95%

Tether USDt

USDT

$0.9996

+0.01%

BNB

BNB

$947.2

+2.29%

XRP

XRP

$2.08

+2.11%

Solana

SOL

$143.98

+2.25%

USDC

USDC

$0.9996

+0.01%

TRON

TRX

$0.3152

+3.01%

Dogecoin

DOGE

$0.1387

+2.16%

Cardano

ADA

$0.4006

+4.78%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now